Understanding Your MLP's Financially-Engineered Equity Value

For background on this topic, please read “5 Reasons Why Kinder Morgan Will Collapse,” and “5 More Reasons Why Kinder Morgan Will Collapse.”

In this article, we will synthetically create the equivalent of a master limited partnership (MLP), called iNewCorp with Kinder Morgan’s financial profile, from scratch with effectively no capital at all, with only a strong credit rating.

In such an example, we’ll also explain how valuation techniques cannot ignore growth capital in the valuation equation of MLPs or other midstream corporates by pricing them on a multiple of “distributable cash flow” or on the dividend/distribution that follows it.

We’ll do so by contemplating the value of a company that has a “distributable cash flow” stream requiring maintenance (and/or growth) capex versus one with the same “distributable cash flow” stream not requiring any maintenance (and/or growth) capex.

First, however, we’ll address the rumor mill by showing how the oil and gas pipeline industry is not covering its dividend and distribution payments with traditional free cash flow, a valuation term, which differs from the industry’s definition of ‘distributable cash flow,’ a contractual term--not one to be used in valuing equities, or at least in the context of how some are using it.

The primary goal of this piece, however, is to reveal how warped the financial engineering has become with respect to MLPs, especially in the context of the “valuations” placed on them. When one sees how easily other corporates such as Apple (AAPL), Microsoft (MSFT), Cisco (CSCO), or Qualcomm (QCOM) or any other entity with excess cash and a strong credit rating can create a shell conduit that is priced on a contractual pass-through to shareholders, or the substance of the distribution pass-through to unitholders of an MLP, for example, either one of two things may happen: 1) every capable company will or should create cash-flow-backed shell companies to artificially generate value at the parent, consequences unknown or 2) the MLP business model will be restrained, or dissolved in time.

In the example to follow, we’ll show how an investment-grade company, with essentially no investment or ongoing commitment at all, can generate $120 billion in incremental equity value, to the tune of the equivalent of the entire enterprise value of Kinder Morgan (KMI), at the time the example was originally developed. Given the recent controversial, contractual pass-through structure of Alibaba (BABA), for example, we wouldn’t be surprised that, if board rooms in other sectors, namely technology, knew how easily value could be generated in the following way, we’d see cash-flow-backed shell companies expand in number just the same as the MLP model has proliferated across the energy complex in the US.

But first, let’s clear the air.

The Shocking Truth About the Free Cash Flow Shortfall and Debt Bubble

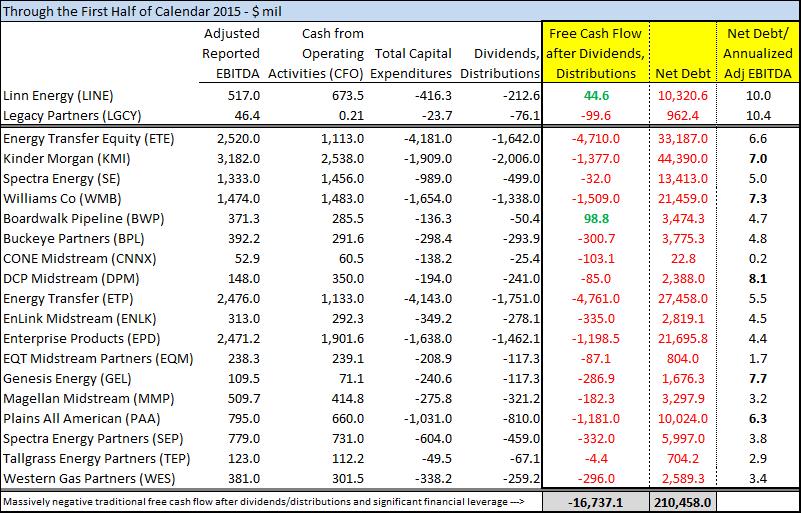

Most master limited partnerships and midstream corporates do not generate enough traditional free cash flow to cover their cash distributions and dividends. Anything to the contrary is categorically false. A look at traditional free cash flow generation, as measured by cash flow from operations less all capital spending, after distributions/dividends for a select, but large and representative group of upstream and pipeline MLP plays, shows a massive shortfall.

The select group of entities in the table at the top of this article, both upstream and midstream, had an aggregate $16.7 billion free cash flow shortfall relative to cash dividends paid during the first half of 2015 as they collectively held a staggering $210 billion in net debt at the end of the second quarter of 2015; that’s nearly a quarter trillion dollars! The idea that such financial profiles can possibly translate into a view that their dividends/distributions are “safe” is hard to believe. What’s more, how some of the debt from entities in this group can be considered investment-grade by the rating agencies when such entities have been unable to generate operating cash flow in excess of total capital spending and the dividend/distribution, and in light of their “junk-equivalent” net debt to adjusted EBITDA levels, is even harder to believe.

It may be the nature of the MLP business model that is causing this ominous dynamic, but it may not be, but it may not matter either. A corporate, not MLP, Kinder Morgan (KMI), for one, has the choice to finance all of its capital expenditures with internally-generated cash flow from operations and forgo the current level of its dividend, as most corporates do, but it doesn’t. Instead, Kinder Morgan accesses the debt and equity markets, not for funds related to capex because we argue it already has them (the firm has already generated them in cash flow from operations), but because it wants to keep paying and growing a dividend. There’s nothing wrong with this, per se, unless of course, investors are led to believe that the dividend is organically-derived like those of other corporates, which pay out their dividends as a percentage of earnings and/or traditional free cash flow. In 2015, Kinder Morgan will pay out twice as much in cash dividends than it will generate in earnings and possibly four times as much in dividends as it will generate in traditional free cash flow.

From our perspective, and Kinder Morgan’s activity sheds light on this, executive teams across the MLP space are also, in substance, accessing the equity and debt markets as a way to fund distributions, and in our view, conveniently using the MLP structure as a way to do so, helping to facilitate a debt-infused dividend-based equity pricing paradigm. It doesn’t matter if this is “how MLPs work” or not, this is what’s happening at the core. Internally-generated capital is always the lowest cost of capital – and that it is not being used as the primary source of investment for growth, even for a corporate pipeline operator, which has as much flexibility as any other corporate, is a significant red flag, at the very least. Investors should continue to be concerned about debt-infused dividends/distributions and the equity pricing structure that surrounds them.

Understanding the Financial Engineering of MLPs and Why Traditional MLP Valuation Techniques Should Not Omit Growth Capex

This example appeared on www.valuentum.com August 19, 2015.

The following example is purely hypothetical and for educational purposes only, but let’s explain, for example, how Apple--a balance-sheet cash-rich entity--can effectively financially engineer a completely new entity that has “Kinder Morgan’s” current financial profile, or create ~$75 billion in incremental equity value or more, using less than 5% of Apple’s current balance sheet, or arguably with nothing at all.

(Note: Kinder Morgan had been trading at a higher price level when this example was first developed, so its market-related information is not current.)

First, let’s cover some financials. Kinder Morgan, the largest energy infrastructure company in North America, is on pace to generate ~$4.5 billion in “distributable cash flow” in 2015. Traditional free cash flow, however, will be substantially less than "distributable cash flow" during the year given growth capital investments that are necessary to drive future increases in net income, a component of future "distributable cash flow." This is a very important point that will be critical later in this example.

Let’s assume that Kinder Morgan’s “distributable cash flow” will advance at a ~10% clip over the next few years, in line with management’s expectation for the pace of dividend growth over the same time frame. Kinder Morgan’s enterprise value is currently ~$120 billion, consisting of about $75 billion in equity and $45 billion in debt (at the time the example had been written).

Apple holds over $200 billion in cash, cash equivalents and marketable securities on its balance sheet, as of June 27, 2015. For illustration purposes, let’s have Apple create a corporation called iNewCorp, in which it sets up a partnership agreement by which Apple contributes ~$4.5 billion, more or less, in cash to iNewCorp per annum in exchange for 100% ownership of iNewCorp.

The agreement stipulates no minimum distributable-cash-flow to dividends-paid ratio, meaning that dividends can exceed Apple's cash contributions at any time, which equivalently happens periodically across the master-limited-partnership arena when distributions exceed distributable cash flow in certain periods. From a baseline of ~$4.5 billion, let’s also assume that iNewCorp plans to increase dividends to its future shareholders by 10% each year through 2020 and by a more-reasonable growth rate after that.

The initial ~$4.5 billion “start-up” obligation could easily be covered by Apple, an entity with $200 billion on the books and one that has generated ~$68 billion in cash flow from operations during the nine months ending June 27. Apple can cover the initial ~$4.5 billion obligation 40+ times over with cash on the balance sheet and 15+ times over with nine-months-worth of cash from operations.

Let’s now assume that Apple guarantees iNewCorp’s growing dividend stream and any and all of iNewCorp’s debts, thereby giving iNewCorp an investment-grade credit rating. With such an investment-grade rating, iNewCorp then borrows ~$45 billion against the future cash flow stream that is implicitly backed by Apple, coincidentally approximating Kinder Morgan’s debt outstanding.

If you think this is good thus far, it gets better.

iNewCorp then uses this $45 billion in newly-raised debt to backstop its very own future dividend payments to its very own future shareholders. With the newly-raised debt alone, iNewCorp would then be able to cover growing dividends to its future shareholders for ~5-10 years depending on the growth rate, without any future Apple cash contributions.

Apple now IPO’s iNewCorp.

iNewCorp can now raise equity on the open market such that, with its newly-raised debt, the corporate is now able to fund its entire growing dividend stream via external capital-raising efforts, maybe on a 50%/50% equity/debt split if it wants to. Said differently, iNewCorp can fund its entire future and growing dividend stream purely from financing activities.

Under this scenario, to sustain iNewCorp's dividend, Apple itself would not have to pay any more ongoing cash to iNewCorp after the initial ~$4.5 billion outlay. Since there is no minimum distributable-cash-flow to dividends-paid mandate within this particular partnership agreement, Apple would only have to stand as a backdrop and guarantee the newly-created entity’s future dividends and debt load. The external financing markets are sustaining the dividend.

What Apple has done in this example is financially engineer the future dividend stream and capital structure of a new “Kinder Morgan,” which we have called iNewCorp, and it has done so with effectively no capital at all. Apple is just standing behind iNewCorp reinforcing its investment-grade borrowing capacity, which supports the dividend that supports the equity price, which provides incremental equity capital that can also be used to support iNewCorp's dividend, and so on.

On the basis of the current enterprise value of the actual Kinder Morgan, iNewCorp should theoretically fetch an enterprise value of at least $120 billion (or it was at the time), which would be all equity in iNewCorp’s case, until borrowings are distributed to iNewCorp’s shareholders as dividends. If dividends should happen to be paid directly from newly-issued equity, then there’s no reason to believe iNewCorp’s equity wouldn’t hold a ~$120 billion equity price, all else equal (at least in this market).

There's more that meets the eye, however, and this is where it becomes clear that growth capital cannot be ignored in the valuation of oil and gas pipeline entities. (Please note that given recent changes in the market price, Kinder Morgan’s price-to-distributable cash flow ratio has fallen significantly from noted levels below).

Kinder Morgan has been trading at a price to distributable cash flow ratio of ~16.5 times (a ~6% distribution yield, or it had at the time), and some may argue the enterprise value and equity market capitalization of iNewCorp should theoretically be higher than Kinder Morgan's. After all, Kinder Morgan requires maintenance and growth capital to fuel future net income and dividend growth and has exposure to commodity price shifts and other operating risks, while iNewCorp does not. Apple's newly-created corporation is pure and growing cash.

In our view, however, iNewCorp should be the one to fetch a ~16.5 times price-to-distributable multiple (~6% distribution yield), while Kinder Morgan's price-to-distributable cash flow ratio should be substantially lower given commodity and operating risks as well as the maintenance capex and massive growth capex that is required to drive future net income expansion. They both can’t have the same price-to-distributable cash flow ratios just because their distributable cash flow is the same—one requires significant cash outflows to sustain the payout while the other requires none. In the example of iNewCorp, valuing different equities with varying growth capital outlays and commodity/operating risks on a standardized price-to-distributable cash flow ratio is fraught with inconsistencies and imbalances.

Furthermore, in this hypothetical example, with less than 5% of its balance sheet or with perhaps nothing at all, Apple has created in iNewCorp ~$120 billion in incremental equity value, or a ~20% boost to Apple’s entire market capitalization (Apple would have received the proceeds from the IPO of iNewCorp or retained an ownership stake). That's certainly a needle-mover for one of the largest companies in the world!

One may even say that Apple can easily cover an arrangement like this many times over. If you believe in the financial engineering above, then theoretically Apple can create trillions of equity capitalization repeating this over and over again. Apple’s balance sheet and cash flow generation are assets much like the pipelines in the ground are assets.

There is a very good reason, in our view, why dividends should be paid out of traditional free cash flow (cash from operations less all capital spending) or earnings, as anything else is textbook financial engineering and arguably misleading to the individual investor that believes all dividends/distributions are created equal, which they are not. We’re sticking with companies that have organically-derived dividends, and we're not omitting varying growth capital outlays and operating risks from our analysis.