FAQ: Regarding your article, "Warning: The Master Limited Partnership Business Model May Not Survive..."

Q: Regarding your article, "Warning: The Master Limited Partnership Business Model May Not Survive," – what are you basing your comments on financial engineering the dividend on? It seems to me that Energy Transfer Equity has enough free cash flow to cover its dividend with a 1.2x coverage ratio. Am I missing something?

A: Thank you for your question.

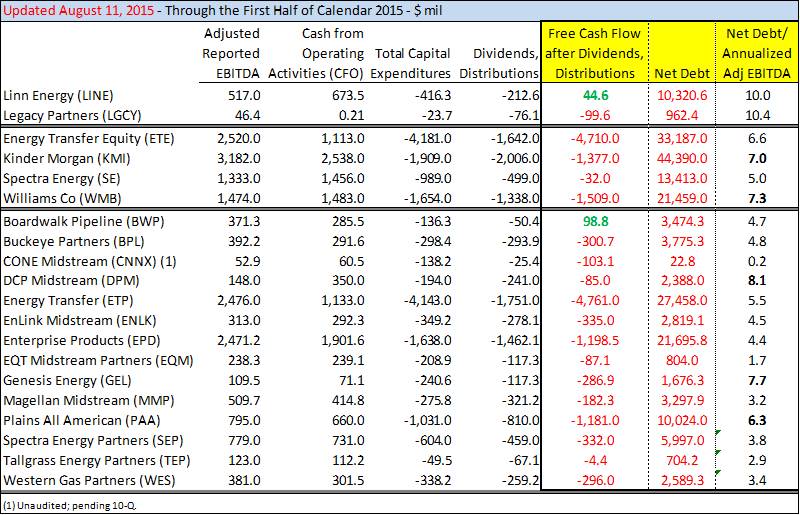

Most master limited partnerships and midstream corporates do not cover their distributions and dividends, respectively, on a traditional free cash flow basis, as measured by cash flow from operations less all capital spending. That means that such payouts are being financed in part, some more than others, from the cash flow from financing section of the cash flow statement, hence the term financially-engineered. Pasted below is a link to a chart that showcases the shortfall. The column is titled, 'Free Cash Flow after Dividends, Distributions', also shown below:

http://www.valuentum.com/articles/20150812