Gold Is But a Shiny Yellow Metal

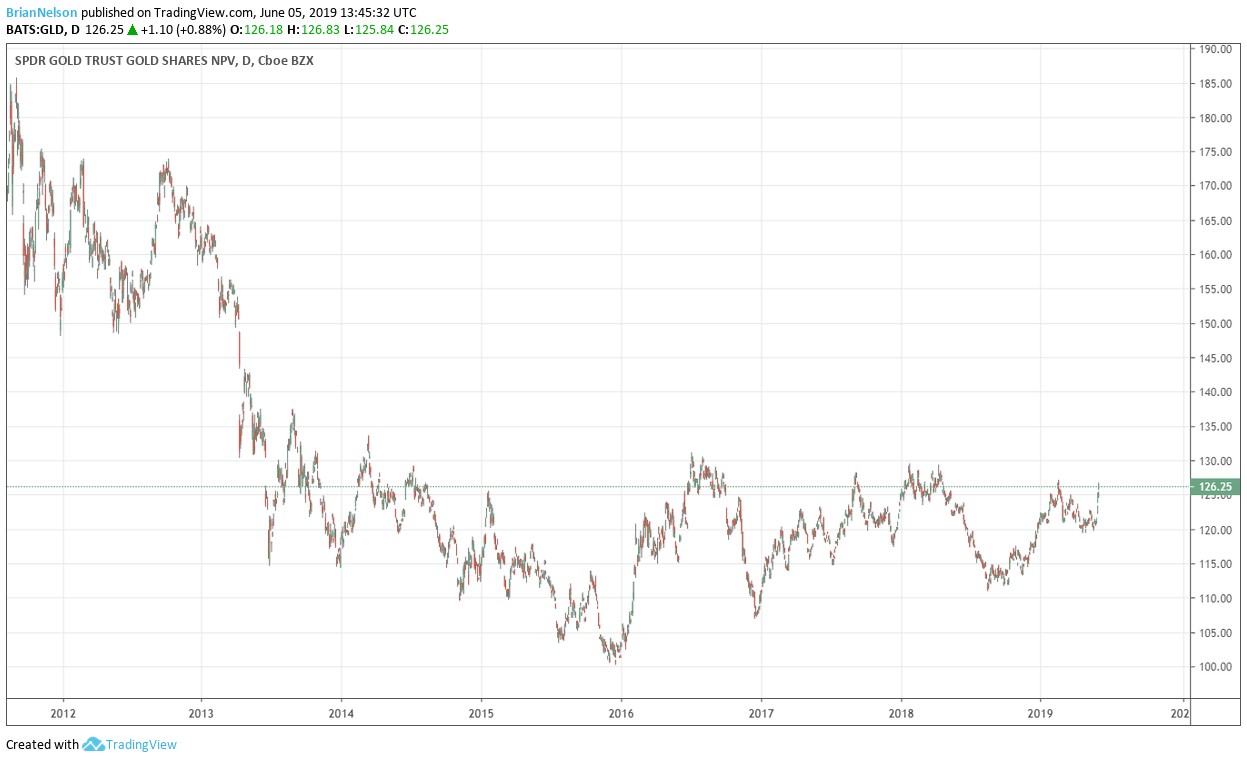

Image shown: The performance of an ETF tracking the price of gold bullion, less the expenses to run the ETF, since 2011.

"What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As 'bandwagon' investors join any party, they create their own truth – for a while." -- Warren Buffett (2011 annual letter to shareholders)

By Brian Nelson, CFA

Gold prices have been under pressure for years.

I’m always uncomfortable talking about the investment prospects of gold (GLD). It’s a sensitive issue. My opinion, like that of Warren Buffett’s, is rather unpopular. For one, there are readers out there that have stocked up on gold coins, buying into those fancy “convincing” infomercials that we see in the wee hours of the morning on television, just in case of the coming financial apocalypse, or so they warn.

We’re taught that gold is somehow, someway a hedge against global inflation, but yet besides some loose historical price correlations (brought about by learned buyer behavior), there’s no fundamental reason why buying a shiny yellow metal will help offset potentially weaker purchasing power of paper money. Mr. Nixon stopped the conversion of the US dollar, the world’s favorite reserve currency, into gold in 1971. It’s been more than 40 years.

With no tangible conversion rate to the US dollar, gold coins are simply collectibles, just like baseball cards and comic books. There is no cash-flow-derived intrinsic value; they don’t pay dividends, and their value is only in the eye of the beholder. Investors only think gold is worth something in the same way that investors think Mickey Mantle’s rookie baseball card is worth something and the first appearance of Superman in a comic book is worth something. Gold “collecting” is simply a hobby.

Please stop watching those infomercials!

A person buying gold, in any form, is playing the game of “greater fools.” He or she is hoping that a “greater fool” will eventually in the future buy the yellow metal from him or her at an ever higher price. This is different than buying a company, which generates earnings and pays out dividends to shareholders. I know my opinion on gold is an unpopular one, but just so you know I’m not off my rocker, let’s take a look at what the Oracle of Omaha said in his 2011 annual letter to shareholders:

“Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce...its value would be about $9.6 trillion. Call this cube pile A.

Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?”

...A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B."

Mr. Buffett has it right. Read up on the greater fool theory! And beware of those gold peddlers.

Metals & Mining - Gold: ABX, AUY, EGO, GG, KGC, NEM

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.