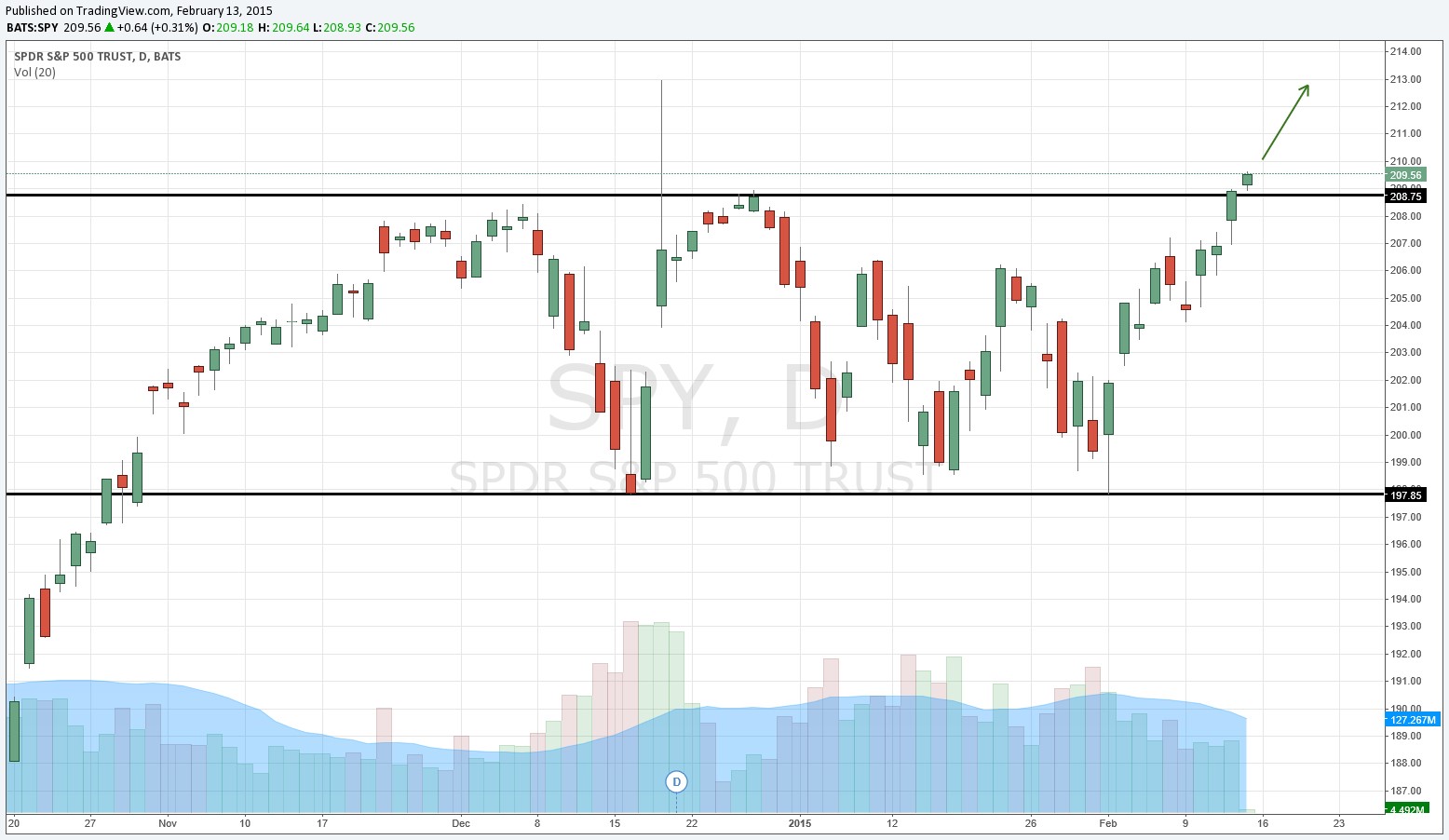

What Was Once Resistance Is Now Support

The S&P 500 (SPY) hit another new high February 13 after basing for much of the past few months. What once was resistance is now support. We find the resilience of the equity markets almost hard-to-believe. Geopolitical uncertainty, threats of an interest rate hike, foreign currency headwinds, slowing growth in the US and China, damage across the energy sector (XLE) and many other commodities, and the list goes on and on...

Yet, the broader equity markets continue to notch new highs…this time on news of a whopping 0.3% growth in the Eurozone economy for the fourth quarter. Yes, you read that correctly: 30 basis points, three tenths of one percent, of expansion in a quarter that’s already in the past. Europe may be stabilizing, but modest expansion is hardly worth getting excited about. If we weren’t already, we’re probably disconnected from underlying fundamentals now.

The quest for yield continues, but it is driving underlying equity valuations to extremes. Forward 12-month price-to-earnings multiples in almost every sector are now significantly above their 5-year and 10-year averages. According to third-party estimates, consumer staples equities (VDC, FSTA, XLP), in aggregate, are trading close to 20 times earnings relative to their 5-year and 10-year averages of ~16 times and ~17 times, respectively. That’s pricey. Utilities stocks (XLU, VPU), for goodness sake, are trading at almost 18 times forward earnings, relative to their 5-year and 10-year averages below 15. Can you believe that?

Without a doubt, utilities have some of the strongest and safest business models in all of our coverage thanks to monopolistic and regulated returns, but at nearly 18 times earnings, they are far from some of the safest stocks. We learn the difference between price and value in all aspects of our lives, and the same rings true in investing. Investors are paying a pretty penny for yield and safety. It’s so important not to ignore price.

At the very least, investors should pay close attention to high-yielders in their portfolios that have premium valuations. As we’ve seen even more recently with the REITs, any hint of sustained rate hikes by the Fed, and yield-sensitive industries will be the first to start their downward convergence to more reasonable, normalized earnings multiples. Three multiple turns, for example, is a rather big drop in the price of stocks. Please get familiar with the valuations of equities in your portfolios, if you haven’t already. Share prices eventually converge to intrinsic value, and not all overvalued equities will grow into their valuations.

That being said, it is probably more important, if not equally so, to reiterate our view that we’re not expecting a meaningful rate-tightening environment anytime soon. From our perspective, inflation is relatively subdued (have you seen the prices at the pump lately?) and employment meets the definition of “full,” which means to us that the status quo with respect to rates is the most amenable route at the moment. After all, why start raising rates meaningfully when everything is moving in the desired direction?

Disruptive rate hikes, in our view, would only lead to more unintended consequences, and I don’t think the Fed is in the business of damaging retirees’ equity income portfolios, now that, through interest rate decreases, it has driven many to that investment class. The Fed knows that individual investors will be among the last to react to changes, and as a result, suffer the most capital damage as a consequence. If your financial advisor is not aware of these risks, please be sure to let him or her know.

As a prudent observer of the markets, it’s near-impossible to pound the table on stocks “up here.” I’d love to be able to tell you that the next several years in stocks will be better than the previous several, but that’s likely not going to happen. For one, we’re almost 6 years from the March 2009 panic bottom, and the markets have tripled since then! We’ve only had one modest 10% correction in the past few years, and the Fed is desperately trying to walk away from its resuscitation efforts during the depths of the crisis.

We talk a lot about perspective, and keeping today’s market in the context of recent history will help keep expectations in line with reason. The equity markets are not going to triple again in the next 6 years, and investors should not be surprised if 2015 becomes a very difficult year. That, however, doesn’t mean that the newsletter portfolios won’t do well. It just means that it will be more difficult to achieve absolute positive returns. Even the best-performing stocks in the face of stiff headwinds may not be huge winners.

There are others that will tell you the market is headed to the moon, but we’re going to keep our feet on the ground. We want you to do well.