Twitter’s Valuation Enigma

Here come the technicians -- all aboard Twitter’s (TWTR) stock!

Here come the technicians -- all aboard Twitter’s (TWTR) stock!

Fortunately, we know better than to play the greater fool game.

Enthusiasts will talk about how Twitter’s revenue doubled in its calendar fourth quarter and how the firm earned a whopping dozen pennies per share on a non-GAAP basis, exceeding expectations, but that’s not what’s going on. The reality is that Twitter posted a $125 million net loss in the fourth quarter and a $578 million net loss for the full year, both on a GAAP basis. It did so with 288 million monthly active users (MAUs), and that number is only growing 20%.

The reality is that even after all the adjustments to arrive at 2014 adjusted EBITDA of $301 million, the firm is trading at an EV/EBITDA multiple of ~80 times! If we normalize Twitter’s EV/EBITDA multiple with that of a “more mature” peer such as Google (GOOG), which is trading at ~16 times trailing EBITDA, Twitter would have to quintuple current levels of EBITDA and still have the growth prospects of “a” Google on a forward-looking basis to justify its current share price in the low $40s.

That’s a tall order, and there are plenty of things that can go wrong before then.

The fact that Twitter is not Google is probably the most important point of the above back-of-the-envelope analysis. If Twitter should happen to grow into a more appropriate multiple, will the company have staying power like “a” Google? Now, that’s the real question--that’s the question investors should be asking, not the quarterly pace of MAUs. Nobody, not even the Oracle of Omaha himself, knows whether Twitter will be around in the next decade, let alone sustainably so. Sadly, the firm’s calendar fourth-quarter results, released February 5th, offer little to answer the most important question.

So, should individual investors take seriously any recommendations on the stock? In my view, I don’t know how they could. For one, you don’t have to look much further than the most recently-reported quarter to see how difficult it is for analysts to forecast Twitter’s net revenue and adjusted EBITDA – and that’s for the most recent quarter. So, how can the investment community say with confidence that, at current, pre-quarter levels, Twitter will be the next Google after it quintuples adjusted EBITDA? They cannot.

Throwing an enterprise multiple on adjusted EBITDA doesn’t solve the valuation problem either. You can’t ignore the long-term by using near-term EBITDA forecasts as a baseline for the valuation. Implied in the ‘EV’ in the numerator of any EV/EBITDA multiple when setting a target price is many a long-term forecast. Yes, there’s even an implied assumption of the perpetuity value in multiple analysis. The long-term is not avoided in multiple analysis; it is just hastily applied.

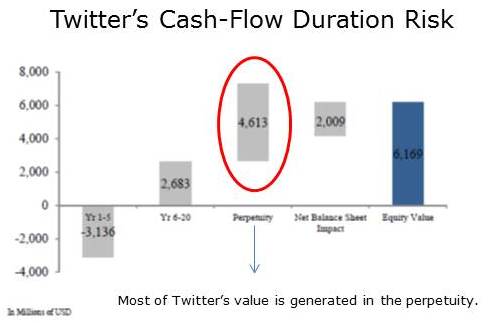

The challenge in any valuation thesis of Twitter is something called cash-flow duration risk. By far, the largest source of the aspiring social media giant’s intrinsic value rests in expectations of the firm’s steady-state perpetuity value, which is extremely sensitive to the relationship between the terminal growth rate and the discount rate -- which themselves are difficult to estimate. This perpetuity value isn’t determined until 20 years hence…will Twitter even be around in 20 years?

The unfortunate reality of Twitter’s business at the moment is that its valuation is near impossible to derive with any sort of meaning. Said differently, the probable range-of-outcomes associated with the firm’s valuation are so great that Twitter’s shares could pretty much trade all over the map, and there’s really no strong valuation argument one way or another.

We value Twitter in the range of $17-$50 per share at the moment, and the wide range speaks volumes about the uncertainty of the forecasts, not the quality of the analysis. In my view, the wider the estimated fair value range of Twitter, the more experienced the investor. The only thing about precision in valuation is that any single estimate of value will be precisely wrong.

All that said, there is one thing we do know for sure about Twitter. Its cash-flow duration risk will guarantee that its stock will be highly volatile in the quarters and years ahead.

Fasten your seatbelts!