New England Wins!

Does that mean we’re doomed in 2015?

Don’t be silly. The Super Bowl indicator, which says that if a team from the NFC wins we’re in for a good year, is akin to reading the stars. But the AFC’s Patriots won the big game – so does that mean 2015 will disappoint? Perhaps 2015 will…but certainly not because of the Patriots won the Super Bowl. A person doesn’t have to look much further than the NFC’s New York Giants winning the Super Bowl in 2008 to understand why such things just don’t matter. The dawn of the Financial Crisis that year sent stocks a-tumbling.

It’s unfortunate that such things get so much attention because it makes it sound like the hours and hours that analysts put in assessing the future prospects of equities don't matter. We’re not gambling; we’re not rolling the dice; investing isn’t magic; there’s no wizard behind the curtain – though the widespread publicity of such things like the Super Bowl indicator make me think that the public thinks investing is like putting one’s chips on black (or red, whichever color is your fancy). Ugh. The reality is that correlation does not imply causation, even if the Super Bowl indicator boasts ~80% accuracy. We need to do a better job of weeding out such nonsense.

The week of February 2 started off rather mild in the markets, though if we’re talking about weather, most of the Midwest is now under a foot or two of snow. Most of us in Northern Illinois were shoveling most of Sunday. The snow drifts were impressive -- two to three feet in some places! My back is still aching. Traffic at Buffalo Wild Wings (BWLD) may have suffered as a result of the poor weather. For those in Florida or on the West Coast, I’m so jealous. Perhaps we can present at a conference by you to get away from the wrath of the Windy City. Let me know.

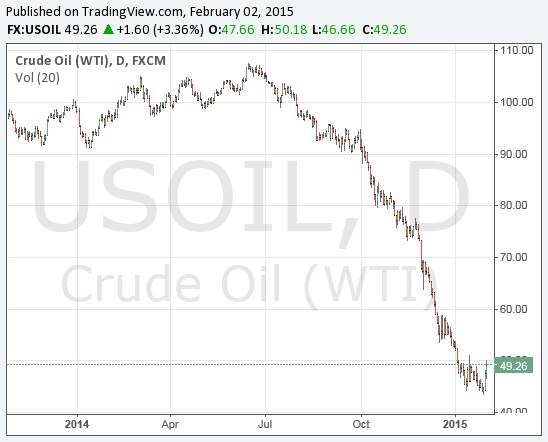

The speculative geopolitical premium embedded in the price of oil is helping prop up the black liquid. News hit that ISIS is causing trouble in the Iraq city of Kirkuk. We’d be misleading you, however, if we said that the move thus far was meaningful. Crude oil is barely trading above the $48-per-barrel mark at present. We talk a lot about putting price moves into context as one of the key drivers behind gaining experience in the markets (the other is the concept of materiality). Solar stocks including First Solar (FSLR) and SunEdison (SUNE) are breathing a modest sigh of relief, but it’s just a $3 move. The market seems like it is hoping and praying for a recovery, which makes me think a real recovery in the price of crude oil won’t happen anytime soon. The equity markets always seem to find a way to disappoint the vast majority of investors.

Exxon Mobil’s (XOM) fourth-quarter results, released February 2, were probably most telling of the pain the energy sector is feeling as a result of slide in crude oil prices. The firm’s adjusted earnings fell more than 20% in the quarter as a result of lower realized prices in its upstream division. This was largely expected, and the price pop following the quarterly release largely reflects a view that “things could have been much worse.” Exxon’s fourth-quarter refining and marketing earnings fell by more than 50%, and we think this is a rather big red flag for our refining coverage. Chevron (CVX) remains our favorite energy play among the majors but we don’t dislike Exxon, which boasts the highest economic return profile of the group. We removed Phillips 66 (PSX) from the Dividend Growth portfolio before the collapse in crude oil prices.

In other news, we added eight more companies to our coverage universe over the weekend. LyondellBasell (LYB) and Northern Tier (NTI) are two firms with refining exposure, and we dipped into the small cap space within the fast-casual restaurant arena. We added fast-growing Mediterranean-inspired restaurant chain Zoe’s Kitchen (ZOES). With less than 200 restaurants at present, the company thinks it has the potential to expand to over 1,600 units. This may be one of the best small-cap growth stories in restaurants we’ve seen in some time. However, the market is already pricing in such expansion potential.

We also added recently-public burger-joint chain Habit Restaurants (HABT), Bravo Brio (BBRG), Ruby Tuesday (RT), Ruth’s Chris (RUTH), and Kona Grill (KONA). Jamba (JMBA) and Nathan’s Famous (NATH) were added last week. Don’t forget to suggest companies for our coverage. We’re always adding new stocks. For those that missed the February edition of the Dividend Growth Newsletter, released over the weekend, you can download it here (pdf).