What Are the Qualities of Highly-Rated Stocks on the Valuentum Buying Index?

If you were a CEO, what are the 7 most important metrics to focus on to get a rating of 10 on the Valuentum Buying Index?

This is a great question because it hits at the absolute heart of the most important concept of investing. Investing may be about buying a great company with a solid and growing dividend, but it most certainly is about buying a great company at a discount to intrinsic value. The difference between what someone can pay for something and what something is worth is the most important concept of investing: price versus value. The price-versus-value component is an integral part of the Valuentum Buying Index. In fact, it is the first component. After all, price is what you pay for something; value is what you get.

This is a great question because it hits at the absolute heart of the most important concept of investing. Investing may be about buying a great company with a solid and growing dividend, but it most certainly is about buying a great company at a discount to intrinsic value. The difference between what someone can pay for something and what something is worth is the most important concept of investing: price versus value. The price-versus-value component is an integral part of the Valuentum Buying Index. In fact, it is the first component. After all, price is what you pay for something; value is what you get.

But a robust discounted cash-flow analysis to derive an intrinsic value estimate for a company is only the beginning. There are myriad benefits to using discounted cash-flow analysis, including deriving a fair value estimate for a company on the basis of the company's unique characteristics, but the outcome of the discounted cash-flow process is still sensitive to a large number of inputs, not the least of which is the discount rate applied to those future free cash flow streams. That’s why we look at a range of fair value outcomes (the fair value range) before determining whether a company’s shares are undervalued or overvalued. A fair value estimate is just the most likely fair value, not the “true” intrinsic value. Because all value is based on the future and the future is inherently unpredictable, *nobody* knows the true intrinsic value of a company. That doesn't mean the discounted cash-flow process isn't extremely valuable -- it just means that the outliers -- those that fall outside the fair value range -- are the most meaningful considerations.

To address some of the perceived pitfalls related to the discounted cash-flow process, we perform an extensive relative valuation assessment based on future expectations of a company and its closest peers or competitors. Some companies don’t have the best peer comparisons, but no company is exactly the same, in all cases. Much like the discounted cash-flow process, however, we’re less concerned about precision than we are about identifying valuation outliers. In the relative valuation process, we compare the forward P/E ratio and the forward 5-year PEG ratio (all derived in-house) to those of a company’s competitors and peers. If both measures are attractive, we'd consider the company undervalued from a relative valuation standpoint. If both measures are unattractive, we'd consider the firm overvalued from a relative valuation standpoint. We want to be approximately right than precisely wrong. Precision in valuation, and investing, is unattainable.

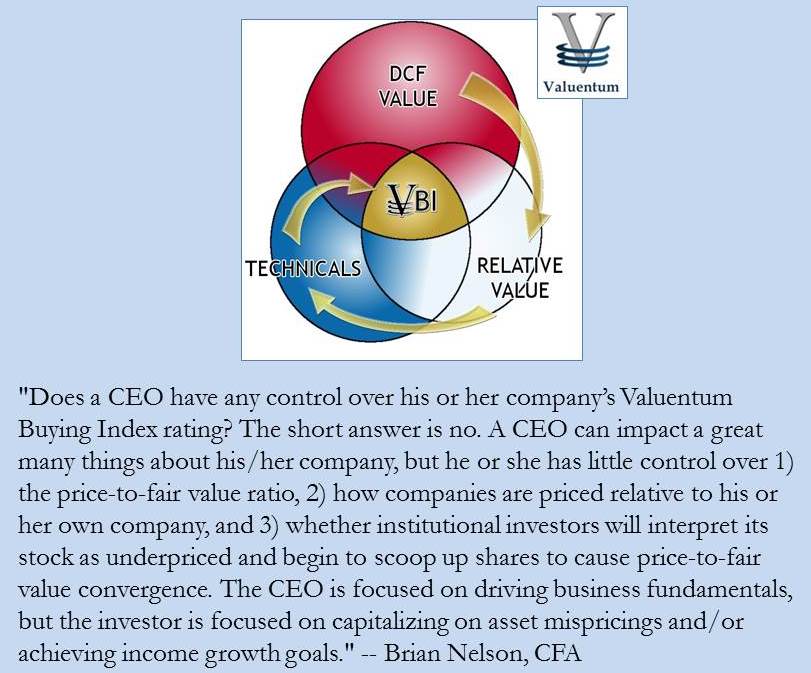

Identifying stocks that are trading at a large discount to a discounted cash-flow-based intrinsic value estimate and versus peers is only part of investing, however. Eventually we want those stocks to converge to our estimate of their intrinsic value -- and in order for a stock to converge to intrinsic value, other investors must purchase that stock, driving its stock price higher. This represents the basic building blocks of any market. When large institutional investors start purchasing a company’s stock, it takes time for them to fill their entire positions. Therefore, underpriced stocks that are being purchased by institutional buyers will tend to continue to exhibit strong price momentum for some time into the future. This increases the likelihood of what we describe as price-to-fair value convergence. A stock that is undervalued both on a discounted cash-flow basis and relative valuation basis and has just started to exhibit strong technical and momentum indicators scores high on the Valuentum Buying Index.

So, with this knowledge, does a CEO have any control over his or her company’s Valuentum Buying Index rating? The short answer is no. A CEO can impact a great many things about his/her company, but he or she has little control over 1) the price-to-fair value ratio, 2) how companies are priced relative to his or her own company, and 3) whether institutional investors will interpret its stock as underpriced and begin to scoop up shares to cause price-to-fair value convergence. The CEO is focused on driving business fundamentals, but the investor is focused on capitalizing on asset mispricings and/or achieving income growth goals. However, there are several things a CEO can do to put his company in the best position to achieve the highest rating on the index. Let’s dig into 7 of them.

1) A focus on free cash flow. Free cash flow, as measured by cash flow from operations less all capital spending, is the primary building block of the valuation equation, and companies that generate gobs of free cash flow tend to offer investors opportunities as most market observers tend to mostly be satisfied with just looking at accounting earnings per share (EPS). Improving working capital turns (faster collections, reduced inventory), driving better levels of profitability (higher EBIT margins), and finding more efficient ways to invest capital (reducing capital spending on low-return projects) are three areas in which free cash flow can be bolstered. The best cash-flow generators will be those with high-EBIT-margin, asset-light operations such as software firms Adobe (ADBE) or Microsoft (MSFT) or online based entities such as Booking Holdings (BKNG), formerly Priceline.

2) A healthy balance sheet. The net cash, total cash less total debt, on a company's balance sheet is a key component of the valuation equation. The net cash on the balance sheet is to a company as the cash in your personal savings account is to you. There’s potentially a lot of value there. But most of the market may only be looking at the income statement, as many could be most interested in evaluating earnings per share for the next quarter, for example. Valuation mispricings often occur because investors aren’t paying enough attention to the balance sheet, in our view. Cisco (CSCO) and Apple (AAPL) have two of the most net-cash-rich balance sheets on the market today.

3) Monetize hidden assets. Again, the market doesn’t spend too much time digging into a company’s regulatory filings to uncover hidden assets. For example, Altria (MO) recently presented a fantastic opportunity because of its hidden investment in SABMiller (SBMRY). Yahoo (YHOO) had one of its best stock-price runs in history during the past few years because of its hidden investment in Alibaba (BABA). Graham Holdings (GHC), formerly the Washington Post, has a pension fund that is ~$1.2 billion overfunded. These are assets that the market misses when they just focus on the income statement, or on earnings per share.

4) A focus on return on invested capital (ROIC). If a CEO’s compensation is still being tied to EPS performance, the company may be setting itself up for disappointment. A look at the incentive structure behind the compensation of IBM’s (IBM) executive suite, for example, may have explained why management had a formal operating EPS target. The operating EPS target led the company to buy overpriced stock to meet short-term EPS targets, and perhaps dull its focus on improving operating performance. IBM has suffered as a result. We think all CEOs should be incentivized primarily or in part on the basis of some internal measure of return on invested capital (ROIC). The companies with the highest returns on invested capital will have the highest-rated Economic Castles. A few of these companies are Domino’s Pizza (DPZ), Morningstar (MORN), Oracle (ORCL), and Raytheon (RTN).

5) Target growth markets. In order to score well relative to peers in any forward-looking PEG assessment, a company must be growing the bottom-line. A CEO that is targeting growth with high-ROIC projects is going to generate significant free cash flow generation while adding value to the organization. On the other hand, the likelihood of companies heading to obscurity (and their stocks heading to $0) is exponentially increased when revenue and earnings are falling. These firms can only add value via cost-cutting, and cost-cutting is a finite exercise. Eventually, they reach the bone. Blackberry (BBRY) and Radio Shack (RSH) are two examples of companies where revenue has faced material pressure. On the other hand, Facebook (FB) and Alphabet (GOOGL) are two fast-growing companies that are generating significant economic profit (ROIC-less-WACC) for shareholders.

6) A healthy and growing dividend. This focus may seem like a surprise, given that the Valuentum Buying Index measures only the capacity for wealth creation (capital appreciation). In fact, there is no explicit lever within the Valuentum Buying Index that considers the dividend because, as investors, we’re interested in the entire free cash flow stream, not only the portion paid out as dividends. Recent studies, however, have indicated that some of the best-performing stocks over time have been dividend initiators and dividend growers. In the current market environment, this outperformance has held true, and many dividend growth stocks have been exhibiting fantastic stock pricing momentum. A focus on the Dividend Cushion ratio not only ensures better capital discipline (higher ROIC) by management, but it also indicates that there is ample future expected free cash flow generating capacity and excess capital on the balance sheet to keep the dividend growing into the future. Some companies with lofty dividend yields and high Dividend Cushion ratios include Johnson & Johnson (JNJ) and Hasbro (HAS).

7) Exhibit the highest ethical standards. There’s nothing more controversial (and risky) than businesses that have questionable business models. If there’s a company that we’re not comfortable doing business with ourselves, we won’t rank it high on the index. Stocks such as Valeant Pharma (VRX) have never registered high on the Valuentum Buying Index rating system. We’ll never be insiders at a company, so we have to come to trust management and what they say. If there are companies that violate our trust, we can’t afford to put our reputation on the line with them. All we have is your trust, and we won’t do anything to jeopardize that.

Did you find this article helpful? Let us know.

To subscribe: https://valuentum2.ssl.subhub.com/subscribe

A version of this article appeared on our website November 23, 2014. Updated July 11, 2018.