Transaction Alert: Closing Put Option Contracts

On Tuesday, September 30 (Tuesday of last week), we emailed you the following email, ‘Trimming Positions, Adding Protection.’ Here’s an excerpt of that email:

Changes to the Best Ideas Portfolio

On account of the article "This Just Feels Different...Mr. Brown" we are removing some of our cyclicals exposure and adding protection to the portfolio.

Specifically, we are selling out of our positions in Ford (F), Precision Castparts (PCP), and Buffalo Wild Wings (BWLD). These companies have been fantastic performers for members, and we trust you are happy with the tremendous gains.

Ford: $14.82 per share; Precision Castparts at $238.02 per share; Buffalo Wild Wings: $136.05 per share.

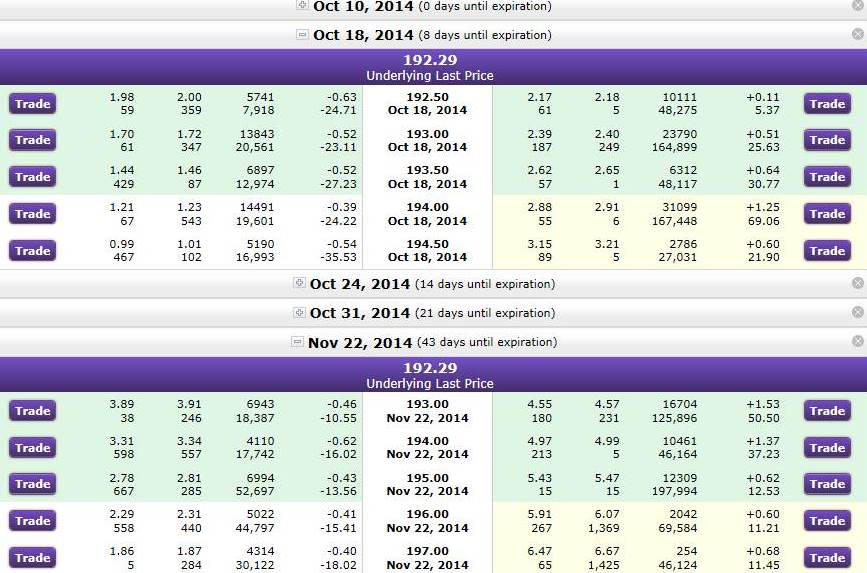

We are also adding protection in the form of 5 put option contracts on the S&P 500 (SPY), with Nov 22 expiration at 195.00 strike ($295 each). The options positions are hedges to the portfolio, and may or may not be of interest to you. They can expire worthless.

Changes to the Dividend Growth Portfolio

On account of the article "This Just Feels Different...Mr. Brown, (see above)" we are removing some of our cyclicals exposure and adding protection to the portfolio.

Specifically, we are selling our full positions in Phillips 66 (PSX), the spin-off from ConocoPhillips (COP), and Emerson Electric (EMR). Phillips 66 has been one of the best performers of the Dividend Growth portfolio, and it has raised its dividend on a number of occasions since the spin-off. Emerson Electric has also been a solid performer.

Phillips 66: $81.43 per share; Emerson Electric: $63.02 per share.

We are also adding protection in the form of 5 put option contracts on the S&P 500 (SPY), with Nov 22 expiration at 195.00 strike ($295 each). The options positions are hedges to the portfolio, and may or may not be of interest to you. They can expire worthless.

On Wednesay, October 1 (the day after the transaction alert email), we sent you the following, ‘We Have Your Attention Now! Thank You! October DG Newsletter.’ The opening of the October edition of the newsletter on the front page stated as follows:

The month of September represented some tough sledding for the markets, and we think things will get worse before they get better. If you missed our write up on the seven reasons why we think we’re due for a fall, please be sure to catch up on the piece (login required):

http://www.valuentum.com/articles/20140930

We made a number of changes to the Dividend Growth portfolio since the release of the previous edition of the newsletter. Let’s make sure you didn’t miss anything.

For one, yesterday, we added S&P 500 SPDR put option contracts to the portfolio to protect the large gains. Specifically, we added protection in the form of 5 put option contracts on the S&P 500, with November 22 expiration at $195.00 strike ($295 each). We noted in the transaction alert email that the options positions are hedges to the portfolio and may expire worthless.

Subsequent to the Wednesday email, we’ve reiterated on our website in the article series, ‘The Correction’, our views that caution should be in order. We’ve also stated a number of times in the article series of our decision to trim cyclical exposure and add protection to the portfolios in the form of the put options.

Today, October 10, we are closing out the put positions (here is the email you should have received today). Our cautious stance on the broader equity markets has not changed, but we think it is prudent to take profits in the put options positions, as our portfolios are still very cash-heavy. Further, with options, time and volatility can work against the value of the positions. Specifically, we are removing the options positions from both portfolios at $543 per contract for an 80%+ gain.

The total profit across both portfolios was $2,480 [($543-$295) x 10], far greater a few years’ worth of memberships at Valuentum. The option chain and pricing info for the removal is shown below. We no longer hold any option contracts in the portfolios following this move.

Please contact us with any questions.