The Times They Are a-Changing

This article was first published September 2013. It has not been updated. It has been republished to recognize the Nobel Prize in Literature being awarded to Bob Dylan October 13, 2016.

Image Source: Mikko Tarvainen

Come writers and critics

Who prophesize with your pen

And keep your eyes wide

The chance won't come again

And don't speak too soon

For the wheel's still in spin

And there's no tellin' who

That it's namin'

For the loser now

Will be later to win

For the times they are a-changin'.

-- Bob Dylan – Times They Are a-Changin

I was reading an article the other day that had come to the conclusion that stock funds will get more asset flows (read: be easier to sell) because their 5-year performance measures will soon look better as they roll off a large portion of the performance collapse of the Great Recession. According to the piece, the average annualized 5-year return for the US large blend category was 0.57% through August 31, 2013. However, once we finish September, the category’s 5-year average annualized return will improve to a more than 10% return.

The article struck me because it somehow had accepted without debate (or even a second thought) the notion that investors are still looking in the rear-view mirror to decide which funds or stocks are the best to include in portfolios. It read as though it was written for an investment community that had been force-fed the idea that for some reason backward-looking analysis mattered and that it was still relevant. Today, investors are wising up to these performance gimmicks, and financial advisors across the world are helping investors understand what’s truly behind backward-looking analysis: only as much as it informs the future. Financial advisors have always been looking to meet their clients’ needs for the future, and they are now finding relevant tools that incorporate forward-looking assessments. The Times They Are A-Changing.

Let’s think about this a bit further.

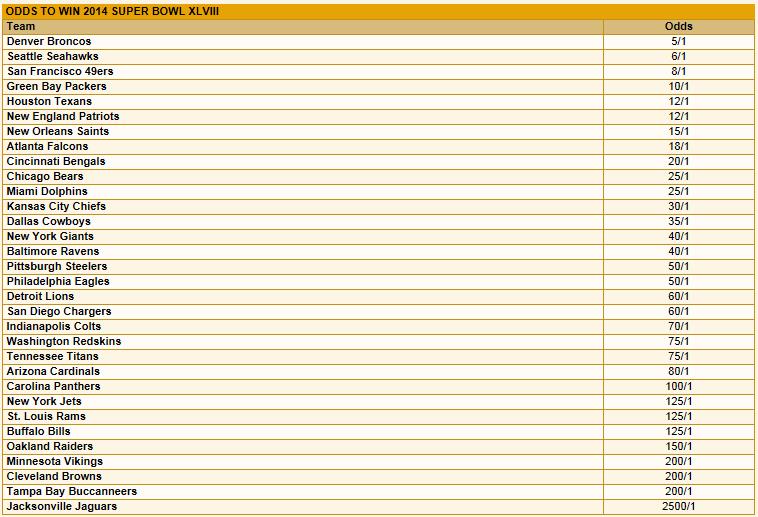

For those that are big football fans, applying backward-looking analysis to the future is like saying the Tampa Bay Buccaneers will win the Super Bowl this year because they won it 10 years ago (2002 season), or the New York Giants will win this year because they won it 5 years ago (2007 season). Or the Pittsburgh Steelers or New England Patriots will be this year’s champ because they were teams that won the Super Bowl TWICE during the past 10 years (2005, 2008 seasons; and 2003, 2004 seasons, respectively). Granted, it’s possible each of these teams may win this year. The odds in Vegas actually favor the Denver Broncos, but that’s not the point of this discussion.

Source: VegasInsider

A team will win this year, not because it has won in the past, but because the talent (“fundamentals”) of the team will translate into bringing home the Lombardi Trophy. A fund will not perform well this year because it has done so in the past, but because the constituents of it will do well. A stock will not perform well this year because it has had a great 10-year track record, but because the fundamentals and momentum characteristics of the entity are both attractive at this time. Investors are no longer being deceived by the teachings of yesteryear.

Sales people may love the updated performance figures, but investors are demanding relevant, forward-looking analysis. They are now demanding a fresh, unique perspective that will help them achieve their future goals. They are becoming less interested in holding a portfolio of yesterday’s winners. They want tomorrow’s success stories. And we’re with them!