What to Do with Tesla?

Image Shown: Tesla’s shares have surged during the past 7-8 months driven by a confluence of factors from fundamental improvements, a massive short squeeze, quantitative momentum traders and speculators anticipating its addition to larger indexes.

We’re maintaining our view that shares of Tesla are overvalued, and investors need to be careful dabbling in these types of equities where price-agnostic trading is running wild.

By Brian Nelson, CFA

Tesla (TSLA) is a cult stock.

There are those that either love it or hate it, and we seem to be among the few that are in the middle camp. We think the company makes awesome products, and we’re excited to learn more about the Cyber Truck, but its stock has served as a dire warning to the individual investor.

Stocks tend to get a lot of attention when they’re on the move, and let me tell you, Tesla has been on the move! In early June 2019, Tesla’s shares were trading in the mid $170s, but over the past 7-8 months or so, they have catapulted to a 52-week high of nearly $970 per share by the trading session February 4. Investors seemingly can’t get enough of these shares.

During the trading session February 5, however, Tesla’s shares tumbled more than 20% at its lows on the day, following news regarding the impact of the coronavirus on February deliveries in China and a Citron tweet the night prior that said the following: “We love $TSLA and promised never to be short again. BUT when the computers start driving the market, we believe even Elon would short the stock here if he was a fund manager. This is no longer about the technology; it has become the new Wall St casino.”

The best way to “play” Tesla, in our view, is not to have been involved. There are some companies that are simply “uninvestable” and Tesla is one of them. The reality is that Tesla’s range of fair value outcomes is so large that euphoric investors can justify any price. Based on our fair value distribution, however, the probability that Tesla’s true intrinsic value is between $700-$1,000 is practically nil. Be careful.

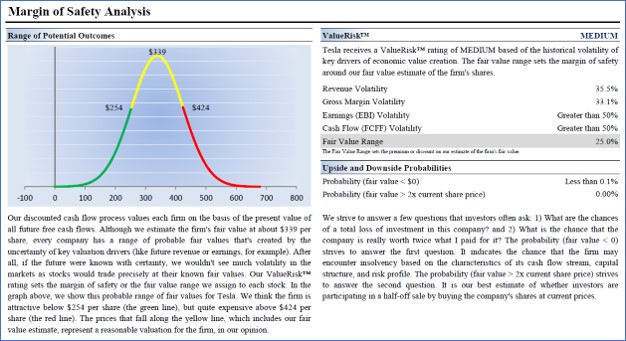

Image Shown: Valuentum’s margin of safety analysis of Tesla. We assign a fair value estimate range of Tesla’s shares of $254-$424, with a point fair value estimate of $339. We believe the probability that shares of Tesla are worth twice as much as our fair value estimate, or about where they are currently trading as of this writing, is practically nil.

That said, Tesla has a lot of things going for it. We asked Valuentum’s Callum Turcan for some of his latest thoughts on the name, and here’s what he had to say:

Tesla's free cash flow outlook is much better than the perma-bear $TSLAQ group would have you believe. There's a real lucrative business here in being a leading electric vehicle (‘EV’) company. However, the big risk investors aren't pricing in, in my view, is the rising competition Tesla will face throughout the early-to-mid 2020s.

For a long time, Tesla hasn't had any meaningful competition in the same category. The Nissan (NSANY) Leaf and the Chevy (GM) Volt and Bolt offerings aren't in the same realm as a Model S, X or 3 offerings from Tesla. However, Porsche (POAHY) is getting into the race with its Taycan offering and Daimler's (DMLRY) Mercedes-Benz is launching a line-up of EV offerings as well, and others are following suit. Tesla's push into the EV pickup market, specifically in the US, is quite interesting and could test the strength of Ford’s (F) popular F-150.

Another key factor for Tesla is that the company also has a battery production facility in the US, while many of its competitors are getting their batteries from third-party suppliers in East Asia (Korea, Japan, or China) and are actively working on building battery plants as of this writing, giving Tesla an edge. Tesla's push into the pickup space with its new Cybertruck offering, the start-up of its first factory in China, and the advantages provided by having a battery facility in the US are all key drivers behind its stock surging.

With that in mind, Tesla's valuation is stretched, and even under very optimistic assumptions, its future free cash flows aren't likely to meet those lofty targets implied by the price very bullish investors are willing to pay, given rising competitive threats.

In short, Tesla's fundamental improvements have brought in new buyers, causing a massive short squeeze, which in turn, has attracted quantitative momentum traders, ultimately driving Tesla’s stock to levels never seen before (to almost $1,000 per share). This, in turn, has attracted buyers that believe shares will need to be added to larger indexes (given its market cap rise), causing even more price-agnostic buying. Only during the trading session February 5 has Tesla's stock given a chunk of its hefty gains back.

Though bulls and bears will continue to battle it out about Tesla, what is clear is that the stock’s meteoric rise is reminiscent of the dot-com bubble, and we wonder if its fall will be reminiscent of the dot-com crash, too. The action in its stock is simply not normal and driven mostly by price-agnostic trading, something we warn extensively about in the book Value Trap. Whatever the stock’s fate in the long run, we’re not going near shares, even as the biggest bulls call for a rise to $6,000.

We want no part of this volatility. Tesla remains “uninvestable,” in our opinion.

-----

Auto Manufacturers: F, GM, HMC, HOG, TM, TSLA

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson and Callum Turcan do not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment