|

|

Recent Articles

-

Visa Continues to Expect Low Teens Earnings Per Share Growth for the Full-Year 2024

Visa Continues to Expect Low Teens Earnings Per Share Growth for the Full-Year 2024

Jul 24, 2024

-

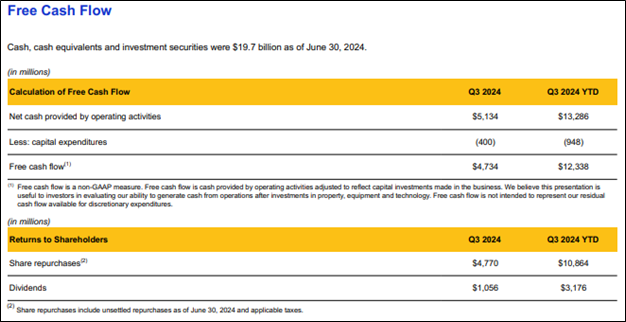

Image: Visa’s asset light business model throws off a lot of free cash flow, while the firm returns cash to shareholders via buybacks and dividends.

On July 23, Visa reported mixed fiscal third quarter results with the company missing expectations on the top line and the firm’s non-GAAP earnings per share coming in-line with the consensus forecast. We’re not reading too much into the company’s mixed fiscal third quarter results and remain fans of the company’s competitive positioning and asset light business model. For the fourth quarter, diluted class A earnings per share growth is expected in the high end of low double-digit growth, while low-teens growth is expected for the full-year 2024, in-line with its prior forecast.

-

Alphabet’s Free Cash Flow Faces Pressure in Second Quarter

Alphabet’s Free Cash Flow Faces Pressure in Second Quarter

Jul 24, 2024

-

Image: Alphabet’s shares have performed well so far in 2024.

Alphabet reported solid second quarter results with strong performance across its operating segments. In the quarter, Google Cloud revenue came in better than expectations, while YouTube ads missed only slightly. Alphabet now pays a dividend, and it continues to aggressively buy back stock. The company’s free cash flow faced pressure in the quarter due to investments to drive innovation, and while this may pressure ROICs in the coming periods, we still like Alphabet as an idea in the Best Ideas Newsletter portfolio.

-

Coca-Cola’s Organic Growth Surprises to the Upside

Coca-Cola’s Organic Growth Surprises to the Upside

Jul 23, 2024

-

Image: Coca-Cola’s shares are trading near all-time highs.

Coca-Cola reported solid second quarter results on July 23, with net revenues up 3% and organic non-GAAP revenues advancing an impressive and better-than-expected 15% thanks to a 9% increase in price/mix and 6% growth in concentrate sales. Looking to the full year 2024, Coca-Cola expects to generate organic non-GAAP revenue growth in the range of 9%-10%. For 2024, management is targeting comparable non-GAAP earnings per share growth of 5%-6% relative to $2.69 per share in 2023, while it expects to deliver comparable currency-neutral non-GAAP earnings per share growth of 13%-15% on the year. Free cash flow is expected to be $9.2 billion for the year. Shares of Coca-Cola yield 3% at the time of this writing.

-

Lockheed Martin Issues Strong Second Quarter Results, Raises Outlook

Lockheed Martin Issues Strong Second Quarter Results, Raises Outlook

Jul 23, 2024

-

Image: Lockheed Martin’s shares have recovered nicely since their October 2023 bottom.

Performance across Lockheed Martin’s Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space divisions continue to move in the right direction, with all four segments showcasing improved revenue and operating profit performance during the second quarter and for the first half of the year. We like that Lockheed Martin’s free cash flow covers its dividend nicely, and while the company has a net debt position, we’re not worried about the company meeting its obligations. We continue to like Lockheed Martin as a dividend growth idea, with shares yielding ~2.6% at the time of this writing.

|