By Brian Nelson, CFA

If you’ve been reading the headlines, you’ve probably seen these: Michigan gas prices increase to highest in 2023, Florida gas prices reach new 2023 high: AAA, Gas prices are higher again, hitting consumers ‘very directly and very profoundly.’ A month ago, the national average for gas prices stood at $3.54, but they have risen to $3.83, according to AAA. Though these levels are still down from the $4.03 average gallon price a year ago, investors have started to take notice. The intensifying war between Russia and Ukraine coupled with expectations that this hurricane season may be a troubling one have driven crude oil prices to the mid-$80s.

The energy sector (XLE) was the place to be in 2022, as not having some exposure to it likely meant some tough sledding, as most sectors faced pressure last year. Year-to-date, energy hasn’t fared as well, trailing other areas, advancing ~5% so far in the year. Over the last five years, the XLE has increased about ~22%, so while last year was a great year for energy stocks, the strength largely was a catch-up from the significantly poor performance in recent years. Our two favorite ideas within the energy space remain Exxon Mobil (XOM) and Chevron (CVX) due to their tremendous free-cash-flow generation capacity, which will only be augmented as a result of the latest increase in crude oil prices.

Right now, equity markets have to digest the huge gains in big cap tech and large cap growth, so many have been reallocating to areas that haven’t advanced as much so far in 2023, and that has been energy. We think the market’s ongoing move into energy equities will likely be temporary, however, and it will likely coincide with the pullback in the broader markets we had been expecting following Apple’s fiscal third-quarter report, Apple Breaks Through Uptrend; Expect Modest Market Pullback. The playbook for last year was to sell high-beta tech and to overweight energy and cyclical industrials, and while this rotation may last for a few weeks heading into the autumn months this year, we continue to prefer the net-cash-rich, free-cash-flow generation found within big cap tech and large cap growth.

Crude oil prices are notoriously difficult to predict, and while we could see a rally in black gold to triple digits, there are a number of headwinds working against sustainably higher crude oil prices. For one, as crude oil prices rise, the economics of shale oil become increasingly more attractive. Though 10-15 years ago, many were talking about ‘peak oil,’ an errant view that sent crude to ~$150 per barrel in 2008, today’s advances in horizontal drilling technology have altered the view to the point where the EIA notes that ‘shale oil and shale gas resources are globally abundant.’ Many exploration and production companies have scaled back their capital expenditures in recent years, but we don’t view traditional oil and gas plays as great long-term ideas in any case, as higher prices inevitably will bring new supply online.

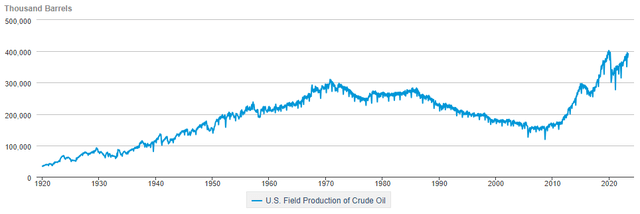

Image: US field production of crude oil is approaching record highs. Source: EIA

The next few weeks will likely see a rally in energy equities, but we note that U.S. field production of crude oil is approaching all-time highs and will likely eclipse all-time highs this year, given the pace of monthly year-over-year increases. With shale oil abundant and production still advancing nicely, the rise in crude oil prices this summer is largely of the speculative variety, in our view. We could see a run in black gold to the triple digits, but both supply and production remain healthy, and if crude oil prices reach the $100+ mark, we don’t see them staying there for long. We think investors are rotating out of this year’s big winners, a healthy consolidation, and we won’t be making any changes to the newsletter portfolios on account of what we believe is a temporary rotation into energy equities.

NOW READ: A Market Pullback Should Be Expected; Focusing on Generating Alpha

NOW READ (July 9, 2023): MUST READ: 17 Capital Appreciation Ideas In A Row!

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Tickerized for XOM, CVX, OXY, PSX, VLO, MPC, EOG, SLB, HAL, APA, BP, COP, PBR, XLE, USO, BNO, UCO, SCO, USL, DBO, DRIP, GUSH, USOI, NRGU

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.