Image Source: Republic Services Inc – 2018 Annual Report

By Callum Turcan

Let’s talk about the story of two garbage haulers, one that is extremely pricey and one that we just added to the Dividend Growth Newsletter portfolio.

Casella Waste Systems Inc (CWST) has grown from a one truck company back in 1975, building Vermont’s first recycling facility in 1977, to a mid-sized waste disposal and recycling company as of today. The rally in shares of CWST over the past ~5 years has been stunning, with shares up over 12-fold since December 2014. We recently updated our models for Casella and the environmental services industry at-large (those reports can be viewed here), and want to caution our members that the rally in CWST has now outdone itself, in our view. At the top end of our fair value range estimate we value CWST at $49 per share, below where Casella is trading at as of this writing. Please note Casella does not pay out a common dividend at this time.

On the other hand, we just recently added Republic Services Inc (RSG) to our Dividend Growth Newsletter portfolio (please see our portfolio update article here). Republic Services is the second-largest provider of non-hazardous solid waste collection, disposal, recycling, and removal services in the US. Shares of RSG yield ~1.7% as of this writing and are supported by Republic Services’ solid 1.9x Dividend Cushion ratio, which provides for a nice per share dividend growth trajectory. Republic Services is trading right near our fair value estimate, and the top end of our fair value estimate range (currently at $113 per share) implies shares of RSG could have room to move higher still given their strong technicals of late.

Solid waste disposal, both specialty (nuclear and medical waste) and non-hazardous services, is an attractive industry to operate in given the barriers to entry and oligopolistic/monopolistic market dynamics (given the barriers to entry). Here’s how we view the industry:

The oligopolistic US non-hazardous solid-waste services industry is dominated by Waste Management (WM), Republic Services and Waste Connections (WCN), which collectively generate over half of industry revenue and control an equal percentage of valuable disposal capacity. Most operators boast strong returns on capital and predictable cash flow streams, buoyed in part by real pricing expansion. The landfill business has significant barriers to entry, while Stericycle’s (SRCL) niche in the medical-waste industry and US Ecology’s (ECOL) monopolistic radioactive waste disposal assets are compelling. We like the structure of the group.

Geographic Diversity

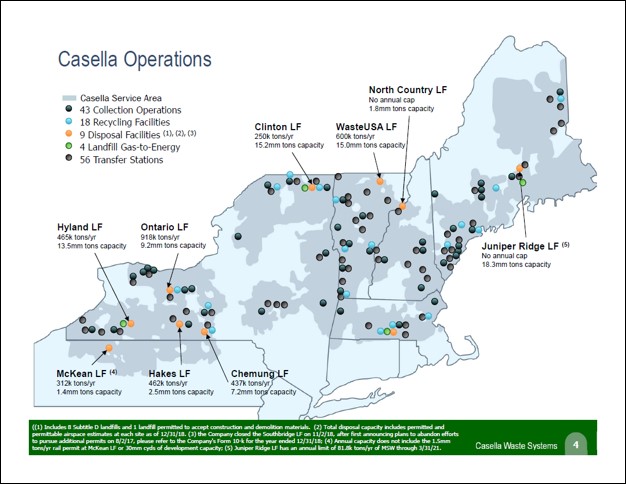

A key reason why we like Republic Services is its large geographic footprint and the diversification its operations offer. While Casella caters to a handful of US states in the New England region, Republic Services has meaningful operations in 41 US states and Puerto Rico. There are favorable market dynamics in New England, and that’s supported strong pricing growth at Casella’s collection and landfill services, which in turn, was instrumental in its strong stock price performance during the past few years given the firm’s ever-improving free cash flow growth outlook. Republic Services’ footprint is also supported by favorable dynamics given its exposure to high-growth coastal markets, withits Apex landfill in Nevada arguably representing one of the crown jewels of the domestic non-hazardous solid waste disposal industry.

Casella is very exposed to unsystematic risks such as a change in regulatory policy (government actions that enable more landfills to be created in New England, actions that seek to limit price increases, etc.) or pressures caused by a regional economic downturn (reducing disposal volumes and the ability to push through price increases). For instance, should the construction industry experience a sharp downturn in New England, that would likely put a tremendous amount of pressure on disposal volumes. Republic Services is better-positioned to capitalize on the value creation opportunities this industry provides in any environment given its ability to shift resources toward growing markets and away from weaker markets.

Image Shown: There are attractive dynamics in the New England non-hazardous solid waste disposal market, largely due to environmental and other regulations limiting landfill capacity as several sites have been closed over the past decade. That’s expected to cause a shortfall in disposal capacity in New York, Vermont, New Hampshire, Maine, and Massachusetts over the coming years. Image Source: Casella – November 2019 IR Presentation

Image Shown: Republic Services has quality operations across the entire US, mitigating the risks posed by geographic concentration. Image Source: Republic Services – November 2019 IR Presentation

Financial Differences

When it comes to defensive names, simply being in a defensive industry isn’t enough. Scale is required to realize most of the benefits. As of November 2019, Republic Services had solid investment grade credit ratings from all the major agencies (BBB+/Baa2/BBB). Casella received two credit rating upgrades in 2019 (as of November 2019); however, the firm’s weak balance sheet and geographic concentration are two reasons why its credit rating remains speculative (BB-/Ba3). We strongly prefer companies with investment-grade credit ratings as that indicates those firms retain access to capital markets at attractive rates.

Image Shown: A look at Republic Services’ investment grade credit ratings and manageable debt maturity schedule as of September 30, 2019. Image Source: Republic Services – November 2019 IR Presentation

Image Shown: Casella’s leverage ratio has come down materially since 2014, however, its balance sheet leaves much to be desired given its speculative or “junk” credit ratings. Image Source: Casella – November 2019 IR Presentation

At the end of September 2019, Casella had a net debt load of $523 million (inclusive of short-term debt) and management expects the company will generate $52-$55 million in “normalized free cash flow” in 2019 (up from ~$47 million in 2018). From 2016-2018, Casella’s free cash flows (net operating cash flow less capital expenditures) averaged ~$39 million per year. Casella has a target to generate $65-$70 million in normalized free cash flow by 2021.

Republic Services exited September 2019 with a net debt load of $8.4 billon (inclusive of short-term debt and ‘restricted cash and marketable securities’), and management expects the company will generate $1.125-$1.175 billion in “adjusted free cash flow” in 2019. From 2016-2018, Republic Services’ free cash flows (net operating cash flow less capital expenditures) averaged ~$1.0 billion per year while its dividend obligations averaged ~$0.4 billion per year. Please note Republic Services also repurchased a meaningful amount of its stock over this period. Going forward, management forecasts Republic Services’ “adjusted free cash flow” will grow to $1.15-$1.20 billion in 2020.

While both companies have substantial net debt loads on a relative basis, Republic Services’ scale and investment grade credit ratings provides for better overall financial strength.

Concluding Thoughts

Casella has experienced an impressive growth spurt during the past few years, and we model in substantial growth in the coming years, but now the rally in CWST has gotten ahead of itself. Given the unsystematic risks Casella faces and the enormous amount of growth priced into its stock, shares of CWST could fall materially should the company stumble.

We prefer the stability and strength of Republic Services in terms of its large geographical footprint, managed debt maturity schedule, investment-grade credit ratings, and free cash flow growth outlook. Republic Services also pays out a nice dividend with room for substantial payout growth, while Casella is using its free cash flows to fund its growth ambitions. We like Republic Services as a top quality, defensive addition to our Dividend Growth Newsletter portfolio.

The non-hazardous solid waste disposal industry is quite lucrative and one that offers a lot of upside, keeping in mind the current economic expansion is long in the tooth. Having some exposure to more defensive industries is a prudent move, in our view.

Environmental Services Industry – CWST RSG SRCL WCN WM

Related: ECOL, EVX

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Republic Services Inc (RSG) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.