Image Source: WEC Energy Group Inc – March 2022 IR Presentation

By Callum Turcan

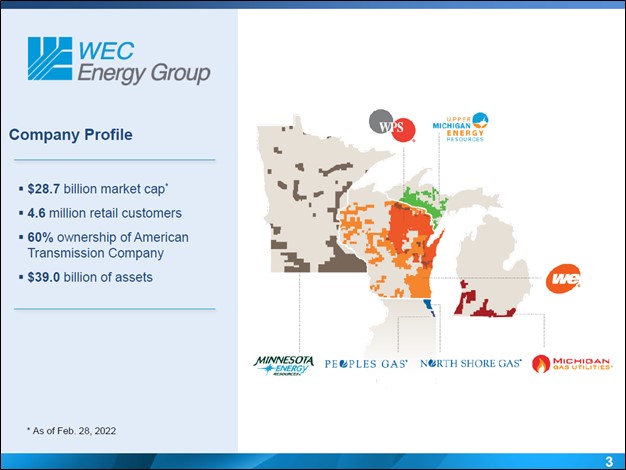

WEC Energy Group Inc (WEC) is a holding company that owns electric and natural gas utilities in the Upper Midwest (Minnesota, Wisconsin, Michigan, and Illinois), a ~60% stake in American Transmission Company (its service area is in the Upper Midwest and overlaps with the operations of WEC Energy’s other utility assets), and the merchant power firm WEC Infrastructure. WEC Energy serves roughly 4.6 million customers across its service area.

Some of its electric and natural gas utilities include Upper Michigan Energy Resources Corporation, Wisconsin Public Service Corporation, Minnesota Energy Resources Corporation, Peoples Energy LLC, The Peoples Gas Light and Coke Company, North Shore Gas Company, W.E. Power, Michigan Gas Utilities, and more. The bulk of WEC Energy’s asset base is represented by regulated utility operations which have incredibly stable and predictable cash flow profiles given the regulatory environment these companies operate in.

Our fair value estimate for WEC Energy sits at $96 per share with room for upside, as the top end of our fair value estimate range is $115 per share. The company is currently trading near its fair value estimate (~$98-$99) as of this writing.

Robust Capital Investment Pipeline

By 2035, WEC Energy intends to fully exit the coal-fired power generation space. In the next couple of years, the company is retiring 1,100 megawatts (‘MW’) of coal units at its Oak Creek power plant in Wisconsin. These are units that came online in the 1950s and 1960s, and beyond WEC Energy’s desire to become net carbon neutral by 2050, shutting down these operations is largely an economical decision. Older power plants generally are significantly more expensive to run than modern power plants (such as combined cycle natural gas-fired power plants and wind farms). WEC Energy intends keep running the natural gas-fired units at the Oak Creek plant, at least for now.

Additionally, WEC Energy and its partners Alliant Energy Corporation (ALE) and Madison Gas and Electric Company (MGEE) are retiring the 1,100 MW Columbia Energy Center (a coal-fired power plant) in Wisconsin by the end of 2024. Roughly 300 MW of the coal-fired power being retired is attributable to WEC Energy due to its approximately 28% stake in the asset.

WEC Energy’s modernization drive has created a robust capital investment pipeline for the company to capitalize on. Retiring power generation facilities requires WEC Energy to replace that lost capacity while there is also a need to meet growing electricity and natural gas demand. Investments in transmission and distribution networks are required as part of this process.

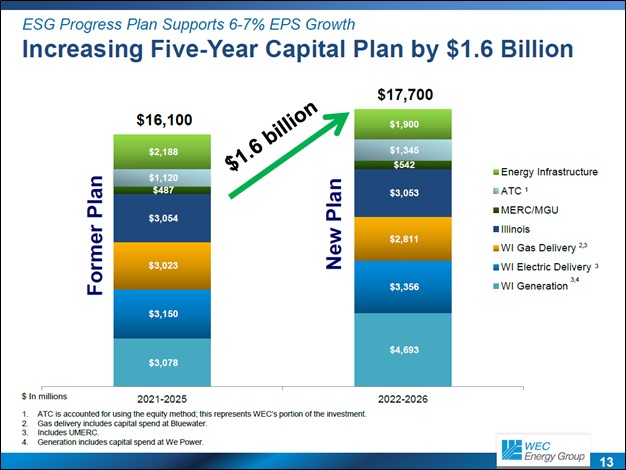

From 2022 to 2026, WEC Energy aims to spend $17.7 billion on its capital expenditures with a heavy focus on grid reliability and renewable energy. Roughly $3.5 billion of its planned capital expenditures during this period are going towards its regulated renewables segment (solar farms, wind farms, and battery storage facilities), with additional renewable energy investments planned for its merchant power business.

Image Shown: WEC Energy’s capital investment pipeline is robust. Image Source: WEC Energy – March 2022 IR Presentation

Financial Overview and Outlook

Over the long haul, WEC Energy is targeting 6%-7% annual EPS growth, primarily a product of its growing rate base at its regulated utility operations though growth at its merchant power business will help the firm deliver on its goals. WEC Energy targets a dividend payout ratio as a percentage of its earnings of 65%-70% over the long haul. Its dividend is expected to grow alongside its earnings over the coming years.

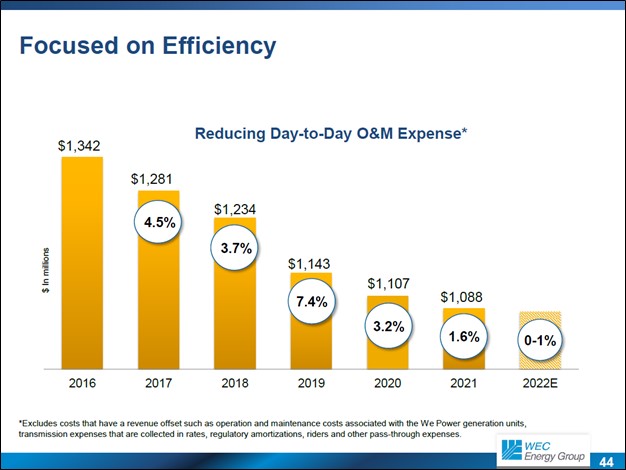

In January 2022, WEC Energy raised its dividend by over 7% sequentially, bringing its quarterly payout to $0.7275 per share or $2.91 per share on an annualized basis. Last year, WEC Energy grew its GAAP diluted EPS by over 8% year-over-year, bringing it up to $4.11. A combination of controlled operating and maintenance (‘O&M’) expenses, favorable weather effects, the recovering domestic economy, asset base growth, and other factors helped drive WEC Energy’s earnings higher last year.

The company has done a tremendous job improving its cost structure after its 2015 cash and stock acquisition of Integrys Energy Group through a $9.1 billion deal when including debt. Its annual “day-to-day” O&M expenses have plummeted since 2016, and management intends to keep a lid on O&M expenses going forward. Investments in technology and other efficiency initiatives should help on this front.

Image Shown: We appreciate that WEC Energy has steadily improved its cost structure since 2016 after competing a big acquisition in 2015. Image Source: WEC Energy – March 2022 IR Presentation

Please note that WEC Energy needs to maintain constant access to capital markets to fund its large capital expenditure budgets, cover its dividend obligations, and stay on top of its enormous debt load. At the end of December 2021, WEC Energy had $16.6 billion in total debt including short-term debt, offset by a negligible amount of hand on cash.

The company’s senior unsecured credit rating is investment grade (Baa1/BBB+/BBB+), indicating it should be able to continue tapping debt markets at attractive rates as needed. WEC Energy’s stock price has been trending in the right direction of late, which supports its ability to tap equity markets, though it generally prefers to tap debt markets. Historically, WEC Energy has repurchased a modest amount of its common stock each year, primarily to offset the dilutive effect of stock-based compensation.

In 2021, WEC Energy spent more on its capital expenditures ($2.3 billion) than it generated in net operating cash flow ($2.0 billion), allowing for negative free cash flows. WEC Energy also generated negative free cash flows in 2020. Last year, WEC Energy covered its $0.9 billion in dividend obligations and its growth ambitions (including the acquisition of Jayhawk Wind) by leaning on its balance sheet. The single biggest risk to WEC Energy’s dividend is its capital market dependence.

Concluding Thoughts

WEC Energy has a robust capital investment pipeline and an attractive earnings profile given that regulated utilities represent the bulk of its operations. The company has done a tremendous job improving its cost structure in recent years and its growth outlook is quite bright, which underpins its longer term annual EPS growth target of 6%-7%. Dividend growth will be a function of its earnings growth, and management has historically been committed to rewarding shareholders, something we expect will continue going forward.

The company’s bloated balance sheet and hefty capital expenditure requirements represent risks to its payout, though we expect WEC Energy will continue to fire on all cylinders as 2022 gets underway. WEC Energy intends to post $4.29-$4.33 in adjusted non-GAAP EPS this year, which represents 5% annual growth at the midpoint of guidance. Shares of WEC yield ~3.0% as of this writing.

—–

Utilities (Mid/Small) Industry – AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Utilities (Large) Industry – AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL

Related: XLU

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, and XLE and is long call options on DIS and FB. Utilities Select Sector SPDR ETF (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. NextEra Energy Inc (NEE) is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.