By Brian Nelson, CFA

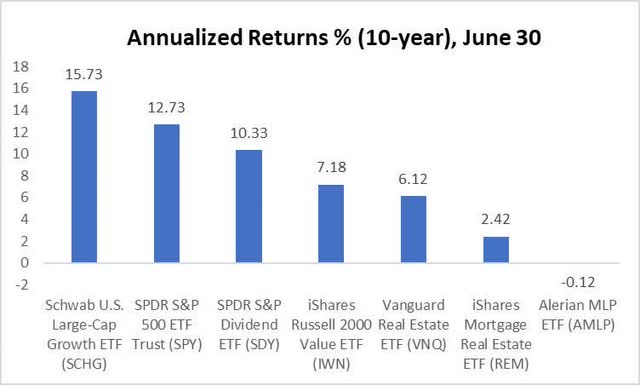

Stock prices and returns are in part a function of a company’s net cash on the balance sheet and changes in future expectations of free cash flow. Stock prices and returns are not driven by the dividend payment, and as such, a myopic focus on the dividend, by itself, could be costing investors considerably, at least with respect to the average market return–as measured by the market-cap weighted S&P 500 (SPY). The free dividends fallacy hypothesized that a myopic focus on chasing dividends could be costing investors anywhere between 2%-4% in returns per annum. During the past 10 years, for example, high-yielding Dividend Aristocrats have trailed the return of the market-cap weighted S&P 500 by about that much per year, while even higher yielding companies such as REITs (VNQ), mortgage REITs (REM) and master limited partnerships (AMLP) did even worse. Based on the past 10 years, one could make the argument that the higher the dividend yield, the lower the total return.

Image: Entities with large net cash positions and substantial free cash flow generation have outperformed not only the broader stock market, but also key high yield areas, including REITs, mortgage REITs and master limited partnerships during the past 10 years.

Though we have nothing against dividends, per se, the sorting of returns over the past 10 years makes a lot of sense to us. For example, many companies in the Schwab U.S. Large-Cap Growth ETF (SCHG) have tremendous cash-based sources of intrinsic value: net cash on the balance sheet and strong expected future free cash flow generation. Net cash is an add back to a company’s discounted enterprise free cash flows in arriving at an estimate of its intrinsic value. As expectations of future enterprise free cash flows increase, so should the company’s value and stock price, all else equal. As expectations of future enterprise free cash flows fall, so should a company’s value and stock price. Many Dividend Aristocrats, however, suffer from lofty net debt positions and huge future expected dividend liabilities that soak up much of their free cash flow, while their business models ebb and flow with the economic cycle. Remember: if you have a $10 stock and it pays a $1 in dividends, you don’t have a $10 stock and a $1 in dividends, but rather you have a $9 stock and a $1 in dividends.

REIT investors tend to view the laws of valuation differently, using valuation multiples instead of enterprise valuation (i.e. the discounted cash flow model)–many investors like to use the P/E ratio, too, and it has myriad pitfalls leading many investors into value traps–but doing so doesn’t change the dynamics that drive share prices and values. For example, one can certainly look at a REIT’s funds from operations [FFO] or adjusted funds from operations [AFFO] and throw a multiple on top of that measure, but the reality is that prices will be set on the basis of what the company holds on the balance sheet in the form of net cash and what it can generate in traditional free cash flow, as measured by cash flow from operations less all capital expenditures. This is what determines the valuation multiple. REITs tend to have tons of debt on their balance sheet and often dilute investors by issuing new equity, so their business models are often complicated by financing activities that muddy the waters in traditional valuation processes.

With this background provided, we’re going to continue to lessen our exposure to the equity REIT space, removing CubeSmart (CUBE) from the High Yield Dividend Newsletter portfolio on November 1 and replacing it with Altria (MO). We’re going to keep CUBE-rival Public Storage (PSA) in the High Yield Dividend Newsletter portfolio for now, but the self-storage space has come under some pressure as consumers may be balking at storage prices as they reassess their spending habits amid higher inflation. Altria doesn’t have a great balance sheet, but the firm does comfortably cover cash dividends paid with free cash flow generation, and the firm does have sizable stakes in Anheuser-Busch-Inbev (BUD) and Cronos (CRON) that offer it considerable financial flexibility. Shares of Altria look cheap, too. The swap out of CubeSmart and swap in of Altria within the High Yield Dividend Newsletter portfolio will be effective upon the release of the November edition of the High Yield Dividend Newsletter on November 1.

NOW READ: There Will Be Volatility

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.