Image Source: Walmart

By Brian Nelson, CFA

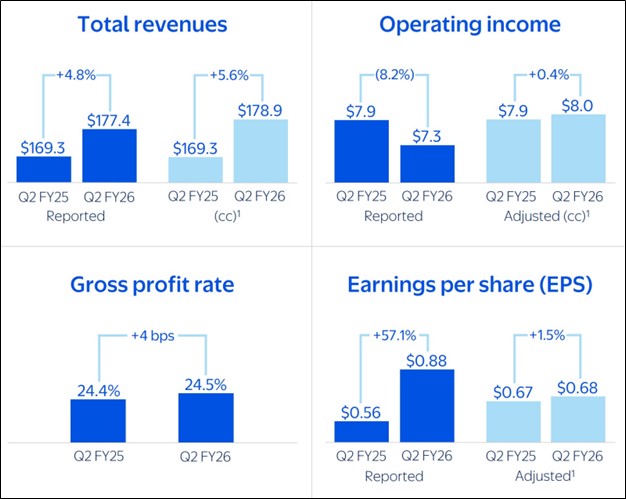

On August 21, Walmart (WMT) reported disappointing second quarter results that showed a beat on the top line, but a miss when it came to non-GAAP earnings per share. Revenue growth was 4.8% on a year-over-year basis, up 5.6% in constant currency. Walmart U.S. comp sales were up 4.6% (consensus was 4.1%), with strong growth in grocery and health & wellness. Operating income, however, decreased 8.2%, and up only a marginal 0.4% on an adjusted basis (constant currency). Adjusted non-GAAP earnings per share of $0.68 missed estimates by $0.06. On a global basis, eCommerce expanded 25% led by store-fulfilled pickup & delivery and marketplace.

Management had the following to say about the results:

The top-line momentum we have in our business comes from how we’re innovating and executing. Connecting with our customers and members through digital experiences is helping to drive our business, and the way we’re deploying AI will make these experiences even better. We’re people-led and tech-powered, and I love how our associates continue to drive change and results for our company.

During the second quarter, Walmart’s global advertising business grew 46%, including VIZIO. Walmart Connect in the U.S. was up 31%. Membership and other income advanced 5.4%, including 15.3% growth in membership income globally. Its gross margin rate in the quarter increased 4 basis points. Cash and cash equivalents totaled $9.4 billion at the end of the quarter, with total debt of $50.3 billion. For the six months ended July 31, operating cash flow expanded $2 billion, to $18.4 billion, while free cash flow of $6.9 billion represented an increase of $1.1 billion. Walmart continues to be a veritable free cash flow machine.

Looking ahead, Walmart issued guidance for the third quarter, with net sales expected to increase 3.75%-4.75% and operating income to increase 3%-6%. For fiscal 2026, the company raised its outlook for net sales growth to the range of 3.75%-4.75% (was 3%-4%) and adjusted earnings per share in the range of $2.52-$2.62 (was $2.50-$2.60) versus the $2.62 consensus mark. Walmart’s guidance for adjusted operating income growth of 3.5%-5.5% remained unchanged. We liked the guidance revisions at Walmart, but we remain cautious on the tariff impact on its business given an unchanged adjusted operating income growth target, despite a better top-line view. The high end of our fair value range stands at $113 per share.

—–

Tickerized for WMT, TGT, COST

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.