Image Source: Walmart

By Brian Nelson, CFA

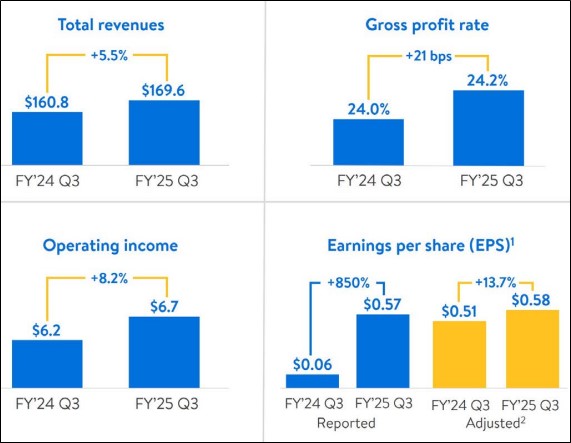

On November 19, Walmart (WMT) reported glowing third quarter results with both revenue and non-GAAP earnings per share coming in better than the consensus forecast and the company raising its guidance. Consolidated revenue grew 5.5% in the quarter, up 6.2% in constant currency, while consolidated operating income advanced 8.2% in the period, up 9.8% in constant currency.

Walmart benefited from higher gross margins, growth in membership income, and reduced losses in e-commerce. Globally, e-commerce revenue grew 27% thanks in part to increases in store-fulfilled pickup and delivery, with penetration up across all segments. Walmart U.S. comp sales increased 5.3% thanks in part to positive growth in general merchandise (transactions increased 3.1%, while average ticket increased 2.1%).

Management had the following to say about the quarter:

We had a strong quarter, continuing our momentum. Our associates are working hard to save people time and money and to transform our business. In the U.S., in-store volumes grew, pickup from store grew faster, and delivery from store grew even faster than that. Our teams are executing and delighting our customers and members with the value and convenience they expect from Walmart.

Walmart’s global advertising business advanced 28% in the quarter, including 26% for Walmart Connect in the U.S. Adjusted earnings per share came in at $0.58 in the quarter, up 13.7% from the $0.51 mark it achieved in the same period a year ago. The company ended the quarter with $10 billion in cash and cash equivalents versus total debt of $47.3 billion. Year-to-date, operating cash flow came in at $22.9 billion, up $3.9 billion, while free cash flow came in at $6.2 billion, up $1.9 billion. Walmart bought back 46 million shares so far this year, while inventories fell 1% at the end of the quarter.

Looking ahead to all of fiscal 2025, Walmart now expects constant currency net sales to increase in the range of 4.8%-5.1% versus 3.75%-4.75% previously. Constant currency adjusted operating income is targeted in the range of 8.5%-9.25% growth in the year versus 6.5%-8% previously. Adjusted earnings per share is expected in the range of $2.42-$2.47 up from its prior forecast of $2.35-$2.43. Walmart continues to execute well in the current market environment, and we liked its raised guidance. The high end of our fair value estimate range stands at $90 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.