Image Source: Visa

By Brian Nelson, CFA

On October 28, Visa (V) reported better than expected fourth quarter fiscal 2025 results with both revenue and non-GAAP earnings per share exceeding the consensus forecast. Net revenue increased 12%, or 11% on a constant currency basis, while non-GAAP net income increased 7% to $5.8 billion, or $2.98 per share, the latter up 10% and better than the $2.97 consensus. Payments volume increased 9% in the quarter, while total cross-border volume totaled 12%, with processed transactions increasing 10%. Visa’s management had the following to say about the results:

In our fourth quarter, continued healthy consumer spending drove net revenue up 12% to $10.7 billion. For the full year, Visa delivered strong performance, with net revenue of $40 billion, up 11%, and broad-based growth across key metrics, underscoring the durability of our diverse business model. We continued to invest in our Visa as a Service stack to serve as a hyperscaler across the payments ecosystem. As technologies like AI-driven commerce, real-time money movement, tokenization and stablecoins converge to reshape commerce, our focus on innovation and product development positions Visa to lead this transformation.

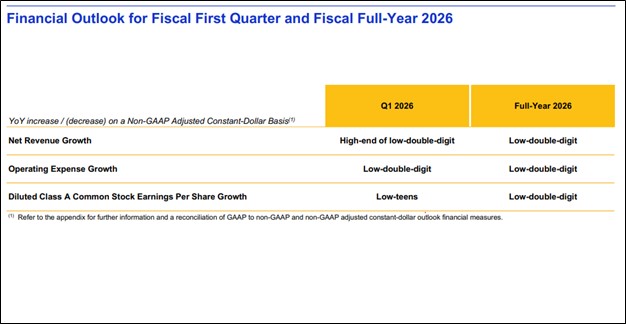

For the 12 months ended September 30, Visa hauled in $23.1 billion in cash flow from operations and spent $1.5 billion in property, equipment, and technology, resulting in free cash flow of $21.6 billion, or 53.9% of total revenue. Visa ended the year with cash and cash equivalents and investment securities of $19 billion and total debt of $25.2 billion. The company returned $6.1 billion in share buybacks and dividends in the quarter, and the board of directors increased its quarterly cash dividend 14%, to $0.67 per share. For full year fiscal 2026, management expects low-double-digit growth in net revenue, operating expense, and diluted earnings per share. We continue to like Visa as an idea in the Best Ideas Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.