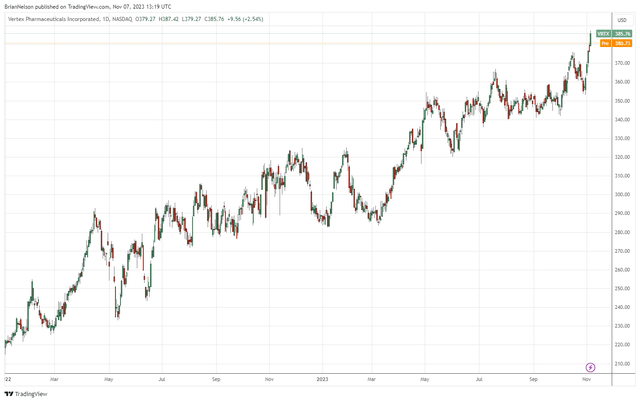

Image: Vertex Pharma is one of our favorite biotech ideas, and the company continues to power to new highs.

By Brian Nelson, CFA

Shares of Vertex Pharma (VRTX) have advanced nearly 35% so far year-to-date, and the company remains one of the best positioned biopharma names, boasting a lucrative cystic fibrosis (CF) franchise and potential novel therapies in acute pain management and other areas, including CRISPR gene-editing therapy. Though revenue didn’t quite come in-line with expectations in its third quarter report, released November 6, Vertex did raise its full year 2023 product revenue guidance to ~$9.85 billion as the firm will launch its CF therapy TRIKAFTA in the 2-5 age group and as its TRIKAFTA/KAFTRIO combination experiences increased demand internationally.

Here is what management had to say in the press release:

Vertex has delivered another strong quarter across the business. We remain relentless in our commitment to reach more patients with our cystic fibrosis medicines, while preparing for the potential launch of exa-cel in multiple geographies. Our R&D pipeline continues to make remarkable progress and we have a milestone-rich period coming up, with multiple major, near-term milestones, including completion of the Phase 3 pivotal trials for the vanzacaftor triple in cystic fibrosis and VX-548 in acute pain, as well as the Phase 2 VX-548 study data read-out in diabetic peripheral neuropathy.

Vertex Pharma is one of the best biopharma ideas on the market today. The company’s CF franchise throws off a lot of free cash flow, and it holds a pristine balance sheet with a huge net cash position. Not only this, but the firm’s pipeline has impressive potential. Vertex’s next line-up up of therapies could go a long way toward solving the opioid epidemic, while its ventures with CRISPR Therapeutics (CRSP) offer further long-term upside potential in gene-editing technology, one of the most exciting areas of biotech these days. The high end of our fair value estimate range stands north of $460, and we continue to like Vertex as a core idea in the Best Ideas Newsletter portfolio.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range