Image Source: Verizon

By Brian Nelson, CFA

Verizon (VZ) recently reported mixed third quarter results, with revenue missing the consensus forecast and non-GAAP earnings per share edging out the market’s expectations by a penny per share. On a consolidated basis, total third-quarter operating revenue was essentially flat compared to the same period a year ago, while the company’s net income of $3.4 billion was weighed down by severance charges. Consolidated adjusted EBITDA for the third quarter came in at $12.5 billion, up from $12.2 billion in last year’s quarter. Adjusted earnings per share, excluding special items, was $1.19 in the quarter, down from $1.22 in the year-ago period.

Management had the following to say about the quarter:

This has been a pivotal quarter for Verizon, with transformative strategic moves and continued operational excellence. We continue to deliver strong results in mobility and broadband, and we are on track to meet our full-year 2024 financial guidance, with wireless service revenue and adjusted EBITDA trending at or above the midpoint of the guided range. Our new products — myPlan, myHome and Verizon Business Complete — and our brand refresh are resonating with customers. Through our pending acquisition of Frontier Communications, and our agreement for Vertical Bridge to lease, operate and manage thousands of wireless communications towers, we have set Verizon up for disciplined growth, now and into the future.

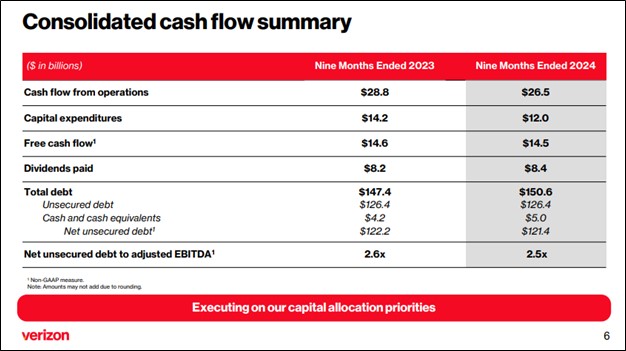

Year-to-date, cash flow from operations totaled $26.5 billion compared with $28.8 billion the same period a year ago, the decline driven by higher cash taxes and interest expense. Capital expenditures year-to-date were $12 billion, resulting in year-to-date free cash flow of $14.5 billion compared with $14.6 billion in the same period of 2023. Dividends paid during the first nine months of the year were $8.4 billion, so Verizon is doing a good job covering dividends with free cash flow.

ESG Strategy

Image Source: Verizon

Concluding Thoughts

Looking to 2024, Verizon expects total wireless service revenue growth in the range of 2%-3.5%, adjusted EBITDA growth of 1%-3% and adjusted earnings per share of $4.50-$4.70. The company’s total unsecured debt at the end of the third quarter was $126.4 billion, a $1.1 billion sequential increase, but a level that is lower compared to the end of the same period last year. Net unsecured debt to consolidated adjusted EBITDA was 2.5 times. Verizon’s Dividend Cushion ratio is weighed down by its massive net debt load, but the dividend is supported by free cash flow. Shares yield 6.1%. Our fair value estimate stands at $44 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.