Image: Microsoft’s shares hit a record high in July!

By Brian Nelson, CFA

Microsoft’s (MSFT) shares hit an all-time high July 18 on news that it would raise prices on its Office products to account for the integration of AI into its tools. We’ve yet to test the new features that are collectively called 365 Copilot, but the new features will add $30/month to the overall price of the software, a meaningful percentage step-change that seems to be quite a needle-mover. Copilot, at the moment, will be a voluntary upgrade, but we think that over time, AI may become an entrenched feature across Microsoft’s entire product line-up, whereupon average selling prices across its customer base will meaningfully increase. AI may also prove to be a key avenue to gain share in search via Bing. Microsoft continues to work toward closing its deal with Activision Blizzard (ATVI), a combination that we have a lukewarm take on, and while that deal will eat into Microsoft’s net cash position, we’re huge fans of its future expected free cash flow generation, which remains very impressive. Microsoft is a key position in the newsletter portfolios.

Not to be left out of the AI-related news flow, Apple (AAPL) has reportedly built a generative AI tool for its employees, according to a Bloomberg report. The codename for the internal large language model is Ajax, and it remains uncertain how Apple will monetize the feature in the near term, but significant opportunities are out there. Both Microsoft and Apple have huge installed customer bases, and rolling out AI tools on existing products is an easy lever to drive material earnings and free cash flow expansion beyond their expected trajectories. According to TechCrunch, Apple employees are using the firm’s internal chatbot to create summaries and answer questions, and it appears to be “similar to Bard, ChatGPT and Bing AI, as it doesn’t [have] any additional features that separate…it from what’s currently commercially available.” We’re huge fans of Apple’s net cash position and strong free cash flow generation and expect fiscal 2024 to be a huge year for the company as it rolls out ‘Vision Pro’ and leverages its existing ecosystem.

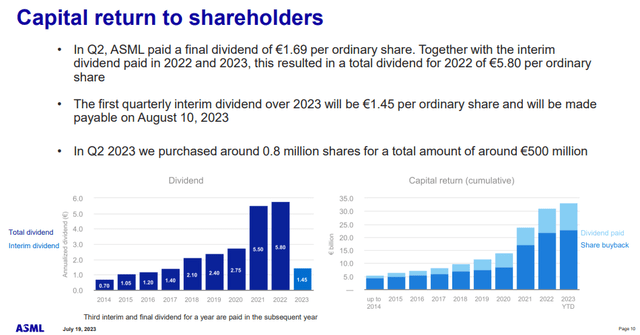

ASML Holding N.V. (ASML) has had a great run so far in 2023 with shares up over 30%. For those that don’t know ASML, the firm is one of the most prolific innovators in the semiconductor industry. The company provides chipmakers with hardware, software and services to make patterns on silicon with lithography, a vital system in the chip-manufacturing process that increases chip value while lowering costs. The resolution of ASML’s lithography systems contributes to the ever-shrinking nature of transistors and microchips needed for ongoing industry innovation. Smaller and smaller chips save on energy, cost and time, and the wavelength of the light used by ASML’s lithography systems can print smaller and smaller features to accommodate required shrink. ASML reported decent second-quarter results July 19 that revealed net bookings of $4.5 billion, up from $3.752 billion in the first quarter of the year. For 2023, ASML is targeting net sales growth “towards 30% compared to 2022.” We continue to like shares of ASML as one of our favorite ideas in the semiconductor arena.

Image: ASML continues to deliver for shareholders.

———-

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.