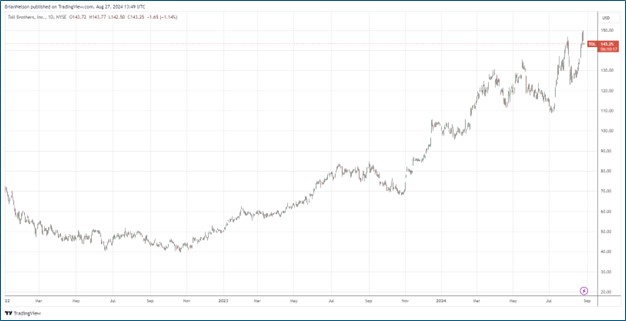

Image: Toll Brothers stock has done quite well during the past couple years.

By Brian Nelson, CFA

Luxury homebuilder Toll Brothers (TOL) recently reported fiscal third quarter results with revenue and non-GAAP earnings per share coming in better than expectations. Home sales revenues advanced 2% from the same period a year ago, while pre-tax income came in at $503.6 million, down from $553 million in last year’s quarter. Fiscal third quarter earnings per diluted share was $3.60 compared with $3.73 in the same period a year ago, but it exceeded the consensus forecast of $3.31 per share.

Net signed contract value was $2.41 billion in the quarter, up 11% from last year’s period, while contracted homes were also up 11% on a year-over-year basis. Its backlog value was $7.07 billion at the end of the fiscal third quarter, down 10% from the fiscal third quarter of last year, while homes in backlog fell 7%. Toll Brothers’ adjusted home sales gross margin, which excludes interest and inventory write-downs, was 28.8% compared to last year’s mark of 29.3%.

Management had a lot to say about the quarterly results in the press release:

We are very pleased to report another quarter of strong results. In our third quarter, we delivered 2,814 homes at an average price of $968,000, generating record third quarter home sales revenue of $2.72 billion. Our adjusted gross margin, at 28.8% in the quarter, significantly exceeded guidance due to favorable mix and greater efficiencies in our home building operations, and our SG&A margin of 9.0% beat guidance by 20 basis points. This combination of revenue and margin outperformance drove earnings of $3.60 per diluted share in the quarter.

Net signed contracts were up year-over-year approximately 11% in both units and dollars, with July being our strongest month in the quarter. We are also encouraged by our solid deposit and traffic activity through the first three weeks of August. With mortgage rates at their lowest point in a year and trending lower, favorable demographics, and continued imbalance in the supply and demand of homes for sale, we are optimistic that demand will remain solid through the end of fiscal 2024 and into 2025.

Based on our third quarter outperformance and our expectations for the fourth quarter, we are raising our full year guidance across all key home building metrics, including adjusted gross margin, which we now expect to be approximately 28.3% for the full year. We also expect to earn between $14.50 and $14.75 per diluted share with a return on beginning equity of approximately 22.5%.

We remain on target to achieve our goal of operating from 410 communities by fiscal year end, representing 11% community count growth this year. At the end of the third quarter, we owned or controlled 72,700 lots, providing us sufficient land to grow community count in fiscal 2025 and beyond. We have a healthy balance sheet with low net debt, no significant near-term debt maturities and ample liquidity. In our third quarter, we repurchased $246 million of common stock, bringing our year-to-date repurchases to $427 million. We continue to generate strong operating cash flows and we are increasing our expected share repurchase total for fiscal 2024 from $500 million to $600 million as we continue to both return capital to shareholders and invest in growth.

For its fiscal year 2024 guidance, Toll Brothers expects deliveries of 10,650-10,750 units (was 10,400-10,800) with an average delivered price per home of $975,000. Its adjusted home sales gross margin is targeted at 28.3% for fiscal 2024 (was 28%), while SG&A as a percentage of home sales revenue is expected at 9.4% for the year. Toll Brothers ended its fiscal third quarter with $893.4 million of cash and cash equivalents and $2.8 billion in total debt. Its net debt-to-capital ratio stood at 19.6% at the end of the fiscal third quarter. Though Toll Brothers’ backlog faced declines in its fiscal third quarter, we liked the increased guidance across its key homebuilding metrics.

—–

NOW READ: What to Do During This Market Selloff

Tickerized for holdings in the XHB.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.