Member LoginDividend CushionValue Trap |

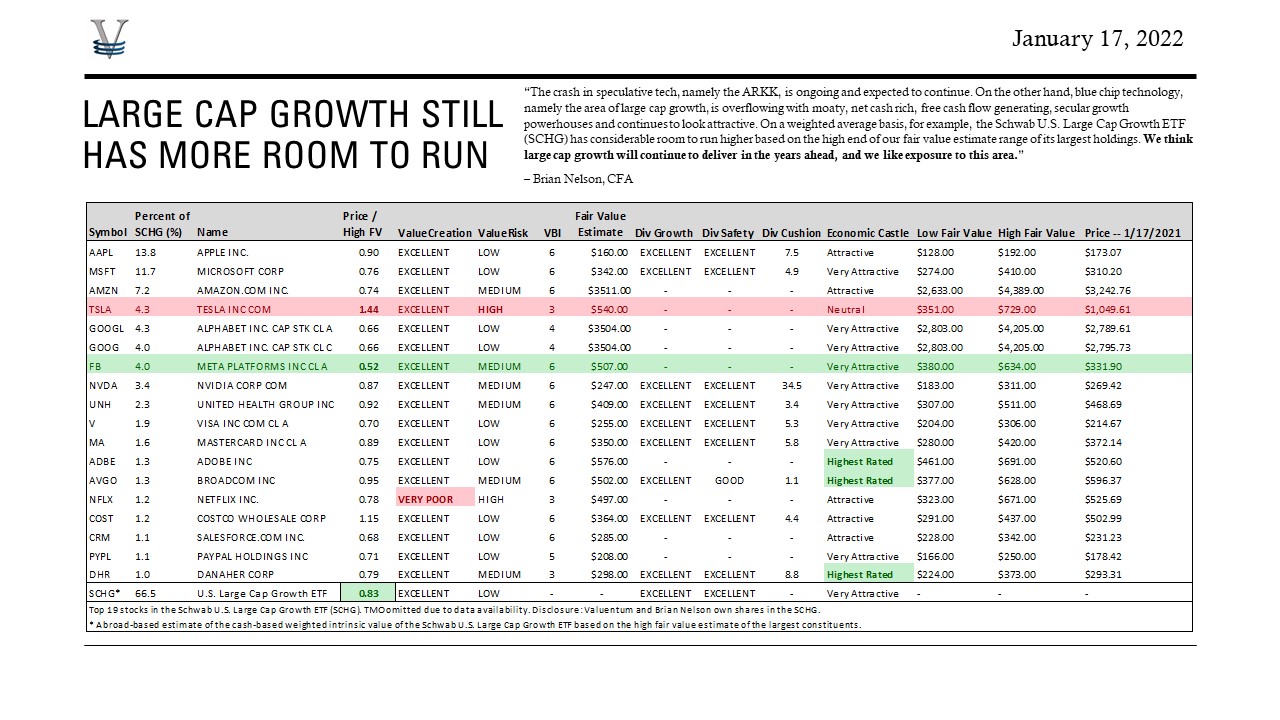

The ARKK CRASHED But Large Cap Growth/Tech Is Still Cheap!

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.

|