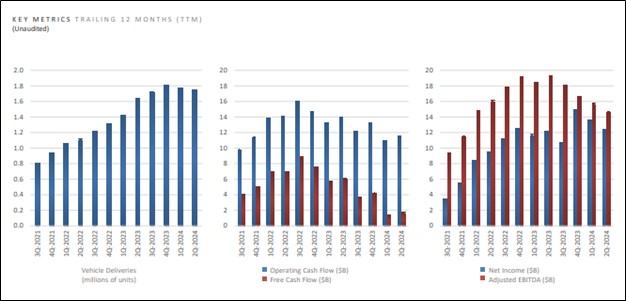

Image: Tesla’s trailing twelve-month performance across vehicle deliveries, operating and free cash flow, as well as adjusted EBITDA have faced pressure in recent quarters.

By Brian Nelson, CFA

On July 23, Tesla (TSLA) reported mixed second quarter results with revenue outpacing the consensus forecast, but non-GAAP earnings per share coming up short. Total automotive revenue fell 7% on a year-over-year basis, while growth in ‘energy generation and storage revenue’ and ‘services and other revenue’ helped to drive total revenue modestly higher on a year-over-year basis. In addition to a decline in vehicle deliveries, reduced average selling prices across its auto line-up hurt performance.

During the quarter, Tesla’s gross profit margin contracted 23 basis points, while swelling operating expenses drove income from operations 33% lower in the second quarter versus the same period a year ago (its operating margin fell more than 3 percentage points, to 6.3%). Tesla’s adjusted EBITDA dropped 21% in the period on a year-over-year basis, while adjusted EBITDA margins contracted more than 4 percentage points. GAAP and non-GAAP net income and diluted earnings per share measures all declined by more than 40% on a year-over-year basis.

In short, Tesla’s second quarter report wasn’t great and was weighed down by reduced vehicle selling prices, restructuring charges, higher operating expenses due to AI projects, and lower vehicle deliveries, which fell 5% on a year-over-year basis in the quarter. Tesla continues to focus on “reducing COGS per vehicle, growing (its) traditional hardware business and accelerating development of (its) AI-enabled products and services,” and all eyes remain fixated on the timing of its Robotaxi deployment as well as the pace of Cybertruck deliveries.

The environment in China remains ultra-competitive, and while a sequential increase in production to its vehicle line-up should be expected in the current quarter, management reiterated guidance that “in 2024, (its) vehicle growth rate may be notably lower than the growth rate achieved in 2023.” Free cash flow was $1.34 billion in the second quarter, an improvement on a year-over-year basis, but trailing twelve-month measures remain under pressure. Cash and cash equivalents expanded to $30.7 billion at the end of the quarter versus $2.3 billion in debt and finance leases. We remain on the sidelines with respect to shares.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.