Image Source: Target

By Brian Nelson, CFA

Target (TGT) recently reported third quarter 2024 results that missed on both the top and bottom lines, and the retailer issued ho-hum guidance for the holiday fourth quarter. Third quarter comparable sales advanced 0.3% in the third quarter (versus consensus expectations of 1.5%) as strong traffic and digital performance were offset by a comparable store sales decline of 1.9%. Guest traffic grew 2.4% in the quarter, however, while digital comparable sales increased 10.8% thanks to growth in same-day delivery and drive up.

Beauty comparable sales grew more than 6% in the quarter, while Food & Beverage and Essentials categories grew low-single digits compared to the same period last year. Its gross margin rate fell 0.2 percentage points on a year-over-year basis in the quarter, while its third quarter operating income margin rate came in at 4.6% compared with 5.2% in 2023. GAAP and adjusted earnings per share of $1.85 were nearly 12% lower than last year’s mark and missed the $2.30 consensus by a large margin. Management was cautious in the press release:

I’m proud of our team’s efforts to navigate through a volatile operating environment during the third quarter. We saw several strengths across the business, including a 2.4 percent increase in traffic, nearly 11 percent growth in the digital channel, and continued growth in beauty and frequency categories. At the same time, we encountered some unique challenges and cost pressures that impacted our bottom-line performance. Looking ahead, our team is energized and ready to deliver the unique combination of newness and value that holiday shoppers can only find at Target, and we remain confident in the underlying strength and fundamentals of our business, and our ability to deliver on our longer-term financial goals.

Target paid $516 million in dividends in the third quarter, while it repurchased $354 million in stock. At the end of the quarter, Target had $9.2 billion of remaining capacity under its buyback program. Target ended the third quarter with $3.4 billion in cash and cash equivalents and $16 billion in short- and long-term debt. Inventory totaled $15.2 billion at the end of the quarter, up from $11.9 billion at the beginning of February and $14.7 billion at the end of October.

ESG Matters

Image Source: Target

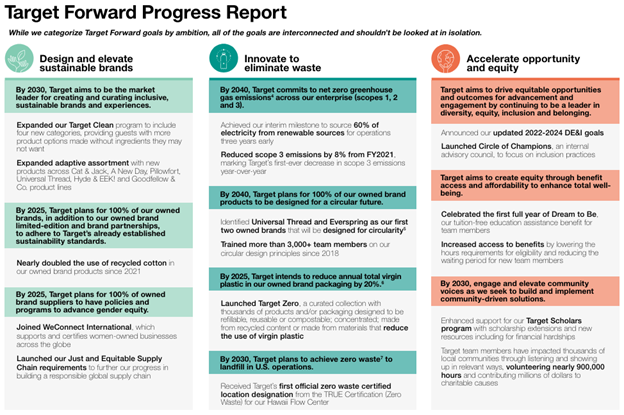

The company’s sustainability strategy is called Target Forward and focuses on three initiatives: design and elevate sustainable brands, innovate to eliminate waste, and accelerate opportunity and equity. “By 2025, Target plans for 100% of owned brand suppliers to have policies and programs to advance gender equity.” By 2040, the firm is committed “to net zero greenhouse gas emissions across (its) enterprise.”

By 2030, Target “plans to achieve zero waste to landfill in its U.S. operations.” Target is also heavily focused on renewable energy, and by 2030, is committed “to source 100% of electricity from renewable sources for its operations.” Target is also looking to reduce plastic in its owned brand packaging by 20% by 2025. Women make up 56% of the company’s total workforce and 38% of its Board of Directors.

Concluding Thoughts

For the holiday fourth quarter, Target expects 1.5% comparable sales growth with GAAP and adjusted earnings per share in the range of $1.85-$2.45 (versus $2.64 consensus), translating to a full year expected GAAP and adjusted earnings per share range of $8.30-$8.90. The midpoint of the guidance range was down compared to its prior outlook in the range of $9.00-$9.70 and the consensus mark of $9.52. Target appears to be losing share against Walmart (WMT), Amazon (AMZN) and Costco (COST), and there is no clear path to regaining it. Target’s shares yield 3.3% at the time of this writing.

Article updated January 16 to reflect Target’s new comparable sales growth estimate for the fourth quarter.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.