Image Source: TSMC

By Brian Nelson, CFA

On October 16, Taiwan Semiconductor Manufacturing (TSM) reported better than expected third quarter results, with the top and bottom line exceeding the consensus forecasts. In U.S. dollars, third quarter revenue was $33.1 billion, which increased 40.8% year-over-year. Gross margin for the quarter was 59.5% (1.7 percentage points higher than 3Q24), operating margin was 50.6% (3.1 percentage points better than 3Q24), and net profit margin was 45.7%.

Management was upbeat on the outlook:

Our business in the third quarter was supported by strong demand for our leading-edge process technologies Moving into fourth quarter 2025, we expect our business to be supported by continued strong demand for our leading-edge process technologies.

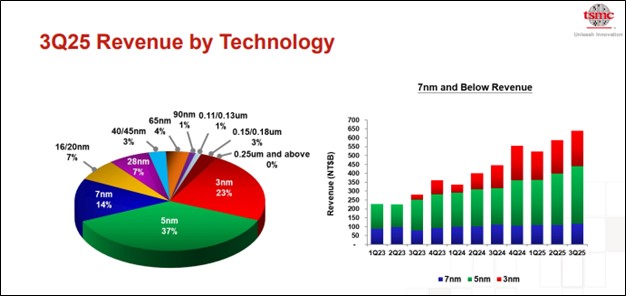

In the third quarter, Taiwan Semiconductor’s shipments of 3-nanometer accounted for 23% of total wafer revenue, while 5-nanometer accounted for 37%, and 7-nanometer accounted for 14%. Sequentially, revenue from smartphone, IoT, and automotive increased 19%, 20%, and 18%, respectively. In the nine months of 2025, cash flow from operations was $49.7 billion, while capital expenditures were $29.4 billion, resulting in free cash flow of $20.35 billion.

Looking to the fourth quarter of 2025, Taiwan Semiconductor’s revenue is expected to be between $32.2-$33.4 billion, with gross margin expected to be between 59%-61% and its operating margin targeted in the range of 49%-51%. At the end of the third quarter, cash and investments totaled $90.1 billion, while bonds payable and bank loans came in at $31.4 billion. We like TSMC’s pure-play foundry business model, and trends continue to look favorable for the chip maker.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.