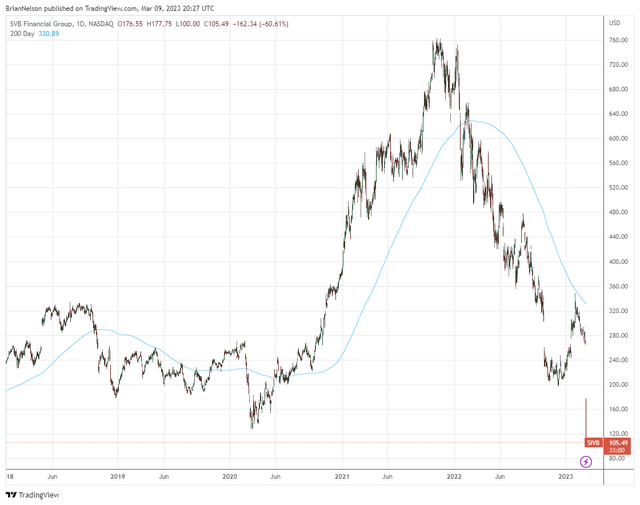

Image: SVB Financial looks to be collateral damage of the Fed’s rate-hiking cycle, and we can’t rule out that other regional banks could have also managed interest-rate risk wrong. Shares of SVB Financial have collapsed, and other banks could be facing similar issues that have yet to come to light. Image Source: TradingView

By Brian Nelson, CFA

We don’t include any banks in the newsletter portfolios, but we include slight “exposure” to the Financial Select Sector SPDR (XLF) in the Best Ideas Newsletter portfolio, primarily for diversification reasons. We have never been fans of the banking business model, and here is what we wrote in the first edition of Value Trap: Theory of Universal Valuation:

It’s likely we will have another financial crisis at some point in the future, the magnitude and duration of which are the only questions. My primary reason for this view is not to be a doomsayer, but rests on the human emotions of greed and fear and the nature of a banking entity’s business model, which does not hold a 100% reserve against deposits. Our good friend George Bailey, played by actor Jimmy Stewart, in the movie It’s a Wonderful Life knew this very well when he tried to discourage Bedford Falls residents from making a “run” on the beloved Building and Loan. It’s a movie that some of us have watched a dozen times or never at all, but it’s a scene, to me, that’s unforgettable. We attribute such a run-on-the-bank dynamic to the Great Depression, but WaMu fell prey to this very situation in 2008. If the market does not have confidence in a banking entity, that banking entity will likely cease to exist.

…the Financial Crisis taught more than just the importance of assessing capital-market dependence risk. For starters, there was really nothing in Lehman Brothers’ historical GAAP financial statements that would have warned you about what was to come. There was really nothing in WaMu’s SEC filings that could have put you ahead of the run-on-the-bank dynamic. Both companies had been operating the way they had for years, and during the go-go years prior to the bust, their share prices kept marching higher. The historic GAAP financials didn’t help investors in these cases. The technicals told the real story. The markets were factoring in future liquidity events at financial institutions around the world, and both the Fed and Treasury needed to provide a huge backstop to prevent the global financial system from unraveling.

SVB Financial (SIVB) announced March 8 what looks to be an emergency equity offering to the tune of $2.25 billion in common stock and convertible preferred shares. The company also announced that it had sold almost all of its available-for-sale (AFS) $21 billion bond securities portfolio, which resulted in an after-tax loss of ~$1.8 billion during the current quarter. This looks to be an effort to shore up liquidity while it can, and we would not be surprised to see some bad bets at the bank come to light.

SVB Financial’s client cash burn has accelerated, and the executive team noted that the “challenging market and rate environment has pressured Q1 performance, with implications to (its) 2023 outlook.” It’s difficult to know just how bad things are at SVB Financial, but the bank seems to have mismanaged interest rate risks and its asset sensitivity. SVB is reconstructing its AFS portfolio with short-duration fixed rate U.S. Treasuries. Though this may be the right move, the stark scenario for the bank is that if market participants lack confidence in the institution, there is more downside to come.

We talked about Silvergate Capital (SI) in one of our more recent notes, “Markets Bounce Off Technical Support But Not Out of the Woods,” and that bank is now winding down operations. In other news, Credit Suisse (CS) also revealed that it had received “a call” from the Securities and Exchange Commission (SEC), raising questions about its consolidated cash flow and its controls over financial reporting. [Credit Suisse has been a case study in poor corporate governance.] As a result of the SEC’s inquiry, the firm has now delayed the filing of its 10-K, which has further hurt confidence in the global banking sector.

With the news at SVB Financial, Silvergate Capital and Credit Suisse, shares of banking equities are getting pounded during the trading session March 9, and we continue to steer clear of any potential fallout in the financials space. The broader markets have now broken through their 200-day moving averages [on the S&P 500 (SPY), in particular], and if they hold below their 200-day moving averages at the close March 10, we’ll be looking to “raise cash” across the newsletter portfolios next week.

Stay tuned – the Fed may have finally broken something!

Also tickerized for SIVB, KRE, KBE, XLF, SI, CS, SBNY, PACW, FRC, HIPO, WAL, FHN, REM, EQR, IRT, AVB, INVH, AMH, CPT, AIRC, VRE, XHB, REZ, HOMZ, DB, TD, SCHW, UBS, BKX, TLT, MGI, TFC, HBAN, CFG, BPAY, IAT, KBWB, SPGP, TROW, ZION, BOH, MTB

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.