By Brian Nelson, CFA

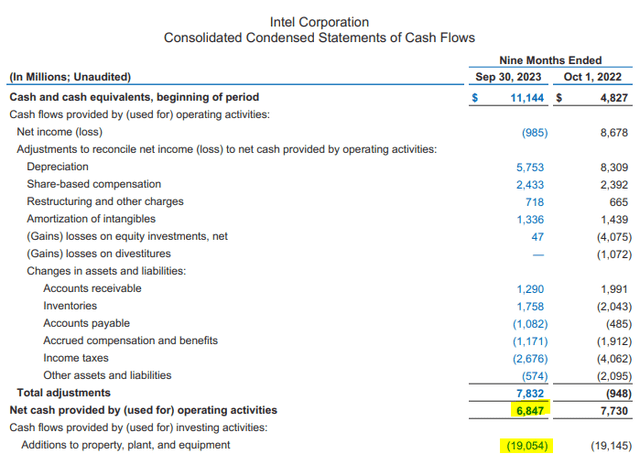

On October 26, Intel (INTC) reported third-quarter earnings that left a lot to be desired. Revenue fell 8% on a year-over-year basis, while the company’s earnings per share dropped 72%, to $0.07. Management tried to spin the quarter as coming in better-than-expected, but the reality is that Intel’s business transformation is testing even the most patient of investors. At the end of September, Intel held ~$25 billion in cash versus short-term debt and long-term debt of ~$2.3 billion and ~$46.6 billion, respectively. For the first nine months of 2023, Intel’s cash flow from operations dropped to ~$6.8 billion, and it spent ~$19.1 billion in additions to property, plant and equipment. Revenue and earnings pressure, a massive net debt position, considerable free cash flow burn, and a recent dividend cut mean that we’re going to be staying far away from Intel in any of our newsletter portfolios. We tend to prefer net-cash-rich, free-cash-flow generating, secular growth powerhouses, as we write in this note.

Image: Intel’s cash flow from operations is under pressure, as it continues to shell out capital expenditures, resulting in materially negative free cash flow generation.

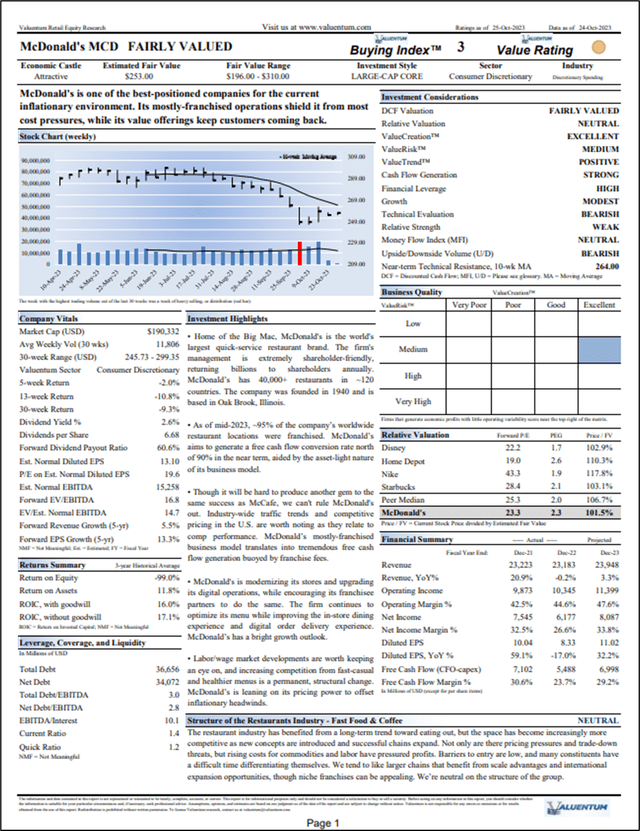

On the other hand, we continue to be huge fans of McDonald’s (MCD), which is included as a key idea in the Best Ideas Newsletter portfolio. Inflationary pressures tend to burden its franchisees more so than the parent equity, and we like how McDonald’s menu is positioned for the current market environment. We think consumers continue to see value in the company’s 2 for $2-and-change offerings and its bundles that include a McDouble, Daily Double, or McChicken and small fries for $3-and-change. We think McDonald’s positioning to serve both the affluent consumer seeking convenience and lower-income consumer with its value offerings is largely the reason for its strong comparable store sales growth, which hit 8.8% around the globe, as reported in the firm’s third-quarter report on October 30. Recently, McDonald’s raised its dividend 10%, to $1.67 per share on a quarterly basis, a ~2.6% annualized dividend yield on a forward-looking basis. We continue to like shares.

Please select the image below to download its 16-page stock report.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.