Image Source: Sonos Inc – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

Executive Summary: Sonos Inc’s financial performance staged an impressive turnaround in fiscal 2021. The company exited fiscal 2021 with a $640 million net cash position and generated $208 million in free cash flow that fiscal year. Sonos is leveraging its financial strength by buying back its stock. The firm is also considering potential M&A activities that could be used to enhance its growth runway, with an eye towards the potential for Sonos to expand into the premium wireless headphone space. Sonos forecasts that it will grow its revenues by double-digits annually in fiscal 2022, though its margins are expected to face moderate headwinds this fiscal year. Shares of SONO have faced sizable selling pressures of late as concerns mount over its medium-term outlook. We love the company’s products, but we’re cautious on the stock in the near term given its cloudy EBITDA outlook. That said, we see potential upside in the stock to the high-$20s from a valuation perspective (modestly above where shares are trading at this time).

By Callum Turcan

Best known for its wireless home audio equipment, Sonos Inc (SONO) saw its sales boom in the wake of the coronavirus (‘COVID-19’) pandemic as households upgraded their home theater setups and added wireless audio capabilities throughout their home to listen to their favorite podcasts. After rallying throughout 2020 and during most of 2021, shares of SONO started moving south since September 2021.

It appears investors are questioning whether the strong financial performance Sonos has put up in recent quarters can be maintained over the long haul as households resume outside activities and return to the office while inflationary headwinds and supply chain hurdles pressure the company’s margins. We love the company’s products and are big fans of its net cash position and free cash flow potential, but its EBITDA outlook may pose a near-term headwind to shares. We value the company’s equity in the high-$20s at this time. Shares are trading at ~$25 each at the time of this writing.

Image Shown: Sonos has a fantastic line-up of products, but shares have come under pressure of late.

Sonos’ Major Turnaround from GAAP Losses Years Ago

Let’s dig into the analysis, but first, a quick housekeeping item: Sonos’ fiscal year ends in late-September or early-October. With that said, from fiscal 2016–2020, the company generated negative GAAP net income each fiscal year and the firm also ran at a GAAP operating loss during four of those five fiscal years (Sonos generated a marginal amount of positive GAAP operating income in fiscal 2019). Sonos’ GAAP revenues grew by 47% from fiscal 2016 to fiscal 2020.

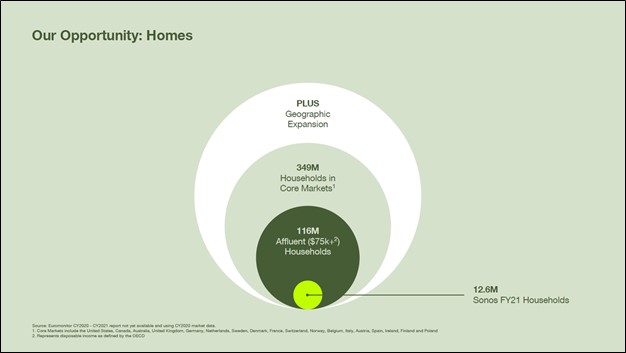

In fiscal 2021, Sonos’ financial performance staged a major turnaround. Sonos sold about 6.5 million products in fiscal 2021, up from 5.8 million in fiscal 2020 and 6.2 million in fiscal 2019, as it continued to grow its presence in global households. The company generates roughly half of its sales outside of the U.S.; Sonos’ GAAP revenues grew by 29% annually last fiscal year to climb over $1.7 billion, while its operating expenses grew by just 9% year-over-year. At the end of fiscal 2021, Sonos had 37.1 million products registered across 12.6 million households around the world.

Aided by its pricing power, Sonos posted a GAAP gross margin of 47.2% in fiscal 2021 (up sharply from 43.1% in fiscal 2020 and 41.8% in fiscal 2019). Revenue growth, gross margin expansion, and controlled operating expense growth enabled Sonos to post $155 million in positive GAAP operating income (its GAAP operating margin stood at 9.0%) and $159 million in GAAP net income in fiscal 2021. We appreciate the impressive turnaround in Sonos’ financial performance seen last fiscal year.

Growth Opportunities Are Fantastic But EBITDA Outlook Is Cloudy

Sonos launched its Sonos S2 app and operating system in June 2020 that added new features as it concerns managing its home audio equipment and improved the user experience. When looking at Sonos’ financial performance of late, it appears that the Sonos S2 update was well-received by the company’s customer base. Sonos is primarily targeting upper middle class and affluent households across its core geographical markets in North America, Europe, and Australia.

Image Shown: Sonos has a sizable position in the home audio equipment space in its core markets. Image Source: Sonos – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

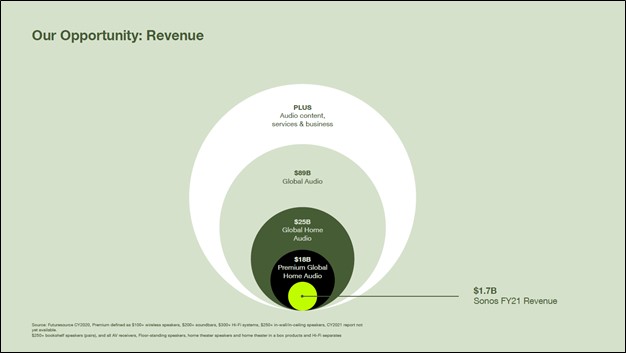

When looking at the size of the premium home audio and mass market home audio space, Sonos views its revenue growth runway quite favorably. This is a competitive arena, and Sonos will need to work relentlessly to ensure that households continue to view its brand as a premium offering. In theory, Sonos could expand into adjacent markets within the audio hardware arena, such as pushing into the premium wireless headphone space, to extend its growth runway. We will cover that later in this article.

Image Shown: Sonos views its revenue growth outlook quite favorably. Image Source: Sonos – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

Though Sonos has put up stellar financial and operational performance of late, what matters most is future expectations. Based on the trajectory of Sonos’ share price since September 2021, it appears investors are increasingly pessimistic that the turnaround in the company’s financial performance seen of late will last. When Sonos reported its final earnings report for fiscal 2021 in November 2021, the company offered guidance for fiscal 2022 that called for 12%-16% annual revenue growth and a gross margin of 46%-47%.

That guidance indicates Sonos expects its gross margin will decline modestly this fiscal year (at the midpoint) versus fiscal 2021 levels, though its revenues are still expected to grow at a decent clip. Management noted during Sonos’ fiscal fourth quarter earnings call that Sonos had been facing headwinds from rising materials costs and logistical expenses, though a favorable product mix shift towards higher-margin products and reduced promotional activity was helping offset those headwinds. Going forward, it appears Sonos is going to lean on its pricing power and moderate its promotional activity to preserve its strong margin performance in the face of inflationary and other headwinds.

Sonos also forecasted that it would grow its non-GAAP adjusted EBITDA by 1%-17% annually (quite the range) in fiscal 2022 and it expects to post adjusted EBITDA margins of 14.5%-16.2% this fiscal year. For reference, Sonos more than doubled its adjusted EBITDA in fiscal 2021 on a year-over-year basis and posted an adjusted EBITDA margin of 16.2% last fiscal year. Its guidance for fiscal 2022 indicates Sonos expects its adjusted EBITDA margins will move lower (at the midpoint) and its growth trajectory will slow down considerably versus fiscal 2021 levels.

With that in mind, the company noted that it was “ahead of schedule” as it concerns meeting its financial targets for fiscal 2024 during its fiscal fourth quarter earnings update. Sonos’ longer-term guidance is laid out in the upcoming graphic down below.

Image Shown: Sonos is ahead of schedule as it concerns meeting its longer term financial targets by fiscal 2024. Image Source: Sonos – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

Impressive Cash Flow Profile and Pristine Balance Sheet

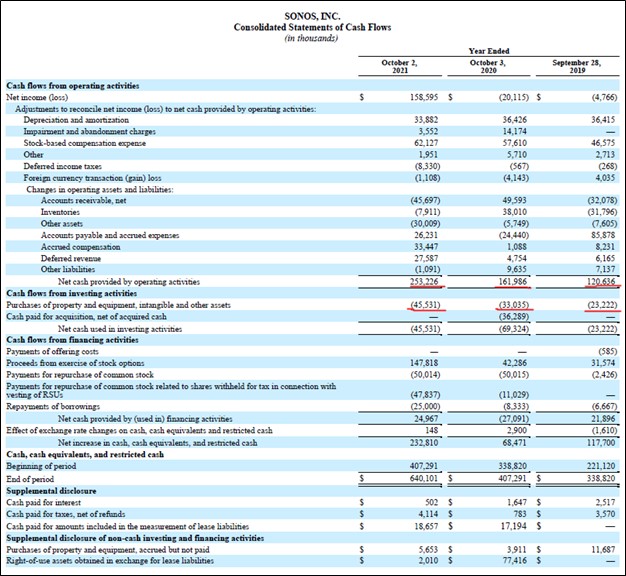

While Sonos has not historically generated consistent profits, it has historically generated sizable free cash flows. This is primarily because Sonos has an asset-light business model and that requires relatively modest capital expenditures to maintain a given level of revenues. Sonos outsources the manufacturing of its home audio equipment to third parties, primarily in China, though more recently Sonos has also been working on adding contract manufacturing partners in Malaysia to its operations to diversify its supply chain. The pandemic delayed those efforts into fiscal 2022.

Sonos designs hardware, services, and software, activities that require some capital expenditure outlays, but not much (relatively speaking) as one can see in the upcoming graphic down below. From fiscal 2019 to fiscal 2021, Sonos generated about $145 million in free cash flow on average. In fiscal 2021, Sonos generated $208 million in free cash flow and spent $50 million buying back its stock. The company does not have a common dividend program at this time.

Image Shown: Sonos has historically been quite free cash flow positive, made possible through its asset-light business model. Key items are underlined in red by the author. Image Source: Sonos – 10-K SEC filing covering fiscal 2021 with additions from the author

Sonos exited fiscal 2021 with $640 million in cash and cash equivalents on hand with no debt on the books, and its pristine balance sheet provides the company with ample financial firepower. When Sonos reported its fiscal fourth quarter earnings update in November 2021, the firm also announced a new share repurchase program with up to $150 million in share buyback capacity. Going forward, Sonos could meaningfully step up its share repurchase efforts given its rock-solid financial position and the recent decline in its stock price.

Image Shown: Sonos has a nice net cash position with no debt on the books. Key items are underlined in red by the author: Image Source: Sonos – 10-K SEC filing covering fiscal 2021 with additions from the author

Potential to Use M&A to Improve Growth Runway

During Sonos’ fiscal fourth quarter earnings call, management was asked how investors should view the company’s capital allocation priorities going forward in the wake of its new share buyback program, specifically as it concerns buybacks versus investing in the business versus potential M&A activity. Here is what management had to say (emphasis added):

“I think we have stated that all 3 of those are really an important part of our plan. So we will execute on M&A, we will continue to repurchase shares through our new share repurchase program, and we are talking about really investing in the business for fiscal year ’22, as well. So I don’t think it’s an either or, it’s really all of the above.” — Brittany Bagley, CFO of Sonos

We find it interesting that Sonos is considering M&A activity. Sonos may consider an acquisition in the realm of headphones for consumers to push into that space after companies like Apple Inc (AAPL) have hit it big selling premium wireless headphones. Sonos does not currently offer wireless headphones, at least not on a readily available basis. During its latest earnings report (period ended December 25, 2021), Apple sold $14.7 billion in ‘Wearables, Home and Accessories’ products with its AirPods playing a key role here.

Please note we are only speculating on Sonos’ intentions but moving into the premium wireless headphone space would likely fit in well with its current strategy. Tech-oriented news outlets have also speculated that Sonos may move into the premium wireless headphone space.

Concluding Thoughts

From a valuation perspective, using Sonos’ $208 million in free cash flow in fiscal 2021 as a baseline, assuming it grows its free cash flows by 3% annually into perpetuity, using a discount rate of 10%, and taking its nice net cash position into account), conservatively speaking, Sonos’ equity has an intrinsic value of around $3.6 billion or ~$28-$29 per share. That is moderately higher than where shares of SONO are trading at as of this writing. However, please note that should Sonos find a way to preserve its strong margin performance seen of late and/or effectively push into new adjacent markets (such as launching its first premium wireless headphone product) to extent its growth runway, its longer term free cash flow growth outlook could become much more promising. There is ample room for valuation upside.

There is plenty to like about Sonos given its strong financial position, but the company operates in a highly competitive market that may cool off in the near term. The home audio equipment space put up banner performance in the recent past due to households staying and working at home in the wake of the COVID-19 pandemic, and this dynamic is unlikely to last as the world is steadily putting the worst of the public health crisis behind it. As households resume outdoor activities and start returning to the office in earnest, it will likely be difficult for Sonos to put up the kind of growth that it has of late without expanding into new markets. We expect Sonos will remain a nice free cash flow generator going forward and appreciate the company’s pristine balance sheet, which we expect management will leverage to continue repurchasing sizable chunks of Sonos’ stock.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for SONO, LOGI, SIRI, SNE, BBY, CRSR, HEAR

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.