Image Shown: Alphabet Inc Class C shares are trading at bargain basement levels, in our view.

By Callum Turcan

Alphabet Inc (GOOG) (GOOGL) reported second quarter 2022 earnings that missed consensus top- and bottom-line estimates. However, investors were clearly expecting the tech giant to perform much worse as shares of GOOG leapt higher following the report. We continue to like Alphabet Class C shares (ticker: GOOG) as a top-weighted idea in the Best Ideas Newsletter portfolio. Our fair value estimate (adjusted for Alphabet’s recent 20:1 stock split) sits near $157 per share of GOOG, well above where shares are trading at as of this writing.

Earnings Update

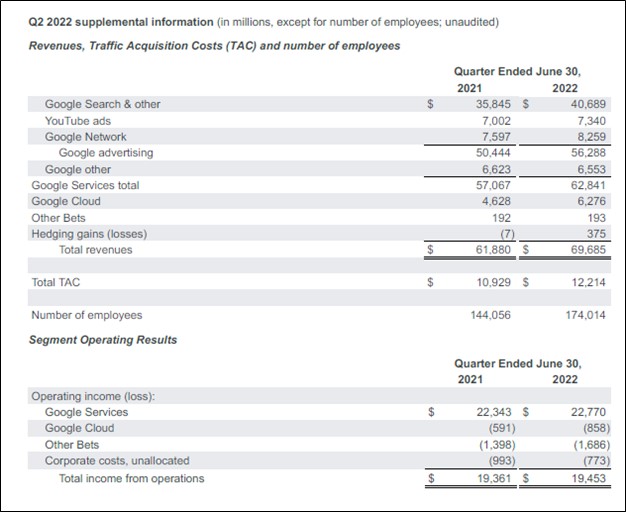

During the second quarter of 2022, Alphabet’s GAAP revenues grew 13% year-over-year and 16% on a constant currency basis. The company’s ‘Google advertising’ revenues grew nicely (up 12% year-over-year) as did its ‘Google Cloud’ revenues (up 36% year-over-year), though its ‘Google other’ revenues pulled back modestly (includes YouTube subscription, Play Store, and hardware sales). Alphabet’s GAAP operating income grew marginally year-over-year last quarter as operating expense growth, largely a function of the 21% year-over-year increase in its headcount, ate into its revenue growth.

While Alphabet’s growth rate is clearly slowing down, that the company can put up double-digit revenue after growing its GAAP revenue by 62% year-over-year in the same period in 2021 is simply stunning. Digital advertising remains the best way for most enterprises to communicate to their potential customers and should continue to grow as a percentage of total advertising spend by taking away market share from newspapers, linear TV, radio, and other mediums.

Image Shown: Alphabet’s second quarter earnings report was impressive given the tough year-over-year comparisons. Image Source: Alphabet – Second Quarter of 2022 Earnings Press Release

The firm’s GAAP operating margin fell ~335 basis points year-over-year to 27.9% in the second quarter of 2022, though please note that Alphabet’s core digital advertising business is significantly more profitable than meets the eye. Its ‘Google Services’ segment generated $20.8 billion in segment-level operating income last quarter while Google Cloud lost $0.9 billion and ‘Other Bets’ lost $1.7 billion, and the firm also incurred $0.8 billion in unallocated corporate level costs. We expect Alphabet’s Google Cloud segment will become a major earnings generator in the medium-term as it scales up this business, though for now Alphabet is focused on gaining market share in this space.

As an aside, Alphabet is in the process of acquiring the US-based cybersecurity firm Mandiant Inc (MNDT) through an all-cash deal worth ~$5.4 billion when including Mandiant’s net cash on hand. The deal is expected to close by the end of 2022 and will bolster Alphabet’s Google Cloud unit.

With that pending acquisition in mind, management clearly communicated to investors during Alphabet’s latest earnings call that the firm was taking action to rein in operating expense growth (emphasis added, lightly edited):

“With respect to Alphabet headcount, we added 10,108 people in the second quarter with the majority of hires for technical roles. Given the uncertain global economic outlook and the hiring progress achieved to date… we intend to slow the pace of hiring. We expect our actions on hiring to become more apparent in 2023. Our headcount additions in the third quarter will reflect we already have a strong number of commitments, including new graduate hires.

As a reminder, we also expect the acquisition of Mandiant to close by the end of the year, which will further increase headcount on top of hiring. Although we expect the pace of headcount growth to moderate next year, we will continue hiring for critical roles, particularly focused on top engineering and technical talent.” — Ruth Porat, CFO of Alphabet

As Alphabet’s headcount and operating expense growth moderates, the firm should be in a prime position to grow both its operating income and operating margin going forward, aided by expected revenue growth at its digital advertising and cloud computing operations. We appreciate that management is placing a greater emphasis on profitability as Alphabet’s revenue growth rate “normalizes” after its banner performance in 2020 and 2021.

Financial Firepower

The firm exited June 2022 with $125.0 billion in cash, cash equivalents, and current marketable securities on hand along with $30.7 billion in non-current marketable securities (largely represented by strategic assets). Stacked up against $14.7 billion in long-term debt with no short-term debt on the books, Alphabet’s enormous net cash position provides it with ample financial firepower. Its deal for Mandiant will hardly put a dent in it fortress-like balance sheet.

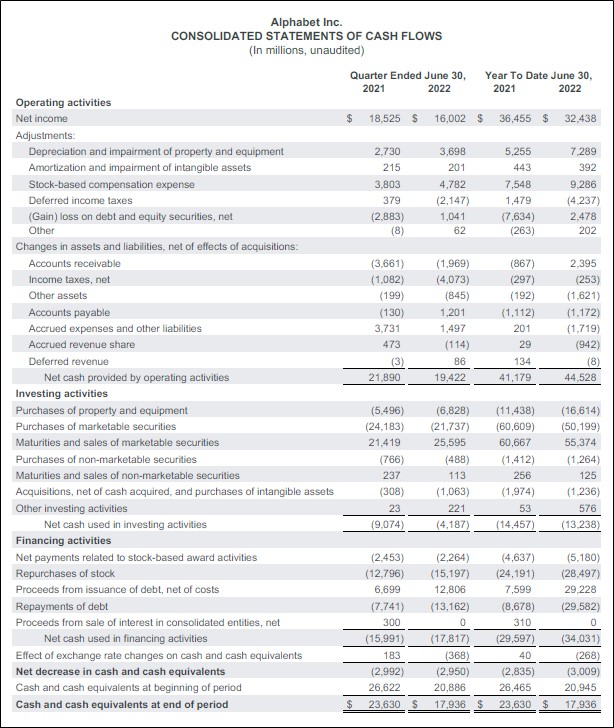

Alphabet generated a whopping $27.9 billion in free cash flow during the first half of this year while spending $28.5 billion buying back its stock via its share repurchase program. We are big fans of its share buyback strategy given that shares of Alphabet are trading well below their intrinsic value as of this writing and have been for some time. Going forward, we forecast that Alphabet will continue to take advantage of “panic selling” in US equity markets seen year-to-date to repurchase “gobs” of its stock, aided by its stellar free cash flow generating abilities and enormous net cash position.

Image Shown: Alphabet is utilizing its financial strength to repurchase enormous amounts of its stock. Image Source: Alphabet – Second Quarter of 2022 Earnings Press Release

Management Commentary

During Alphabet’s second quarter earnings call, management noted that year-over-year revenue growth comparisons would be difficult given the strong performance the firm put up in 2021, though they were impressed with the resilience of Alphabet’s digital advertising business. Management touted the firm’s Google Cloud segment several times during the conference call as this segment represents one of its best medium-term growth drivers. Alphabet’s Google Cloud growth story is just getting started and management is making sure to prioritize investments towards this part of the company’s portfolio:

“Turning to Google Cloud. Customers are transforming their businesses, utilizing GCP’s secure infrastructure with data analytics and AI capabilities, uncovering real-time insights and leveraging the collaborative tools of workspace. They are in the early days of this transformation, and we continue to invest in our products, go-to-market capabilities and cloud regions.” — CFO of Alphabet

Alphabet’s management team also noted that foreign currency headwinds were expected to persist going forward as the U.S. dollar remains quite strong. Furthermore, the company’s capital expenditures are still expected to increase in 2022 versus last year’s levels as the firm scales up its data center operations to support growth at its Google Cloud segment while also continuing to invest in its corporate office facilities.

In response to an analyst’s question during the firm’s latest earnings call concerning its investment priorities, Alphabet’s management team noted that (emphasis added):

“I think it’s a good time to sharpen our focus. Personally, I find moments like these clarifying. It’s a chance to digest and make sure we are working on the right things as a company with taking a long-term view, making sure we are continuing to invest in deep technology and computer science and doing differentiated work, and gives a chance to assess everything we are doing with the critical lens and reallocate resources to our most critical priorities.

So, it’s a constrained optimization problem. I think it gives us a chance given the strong — given a few years of strong growth to double down and focus, and we’re going to be very disciplined in terms of how we will approach it. But our focus on the long-term areas, be it AI, be it Cloud and other critical areas will continue.” — Sundar Pichai, CEO of Alphabet

Earlier in the earnings conference call, Alphabet’s management team noted (emphasis added, lightly edited):

“With an uncertain global economic outlook, our strategy to invest in deep technology and computer science to build helpful products for the long term is the right one. Our ability to take the long view stems from our timeless mission, to organize the world’s information and make it universally accessible and useful…

We’ll continue to invest in areas like AI, Search and Cloud, and we’ll do it responsibly and in a way that is responsive to the current environment. Earlier this month, I announced that we’ll be slowing our hiring and sharpening our focus as a company. We are focused on hiring engineering, technical and other critical roles. And we are working to improve productivity and ensure that the great talent we do hire is aligned with our long-term priorities.” — CEO of Alphabet

While Alphabet is slowing down the pace of its operating expense growth, the firm is still investing considerable sums towards its most promising opportunities. In our view, Alphabet will focus on limiting headcount growth as it concerns administrative, marketing, and other corporate roles to ensure it can continue bulking up its engineering and programming headcount to remain competitive.

Concluding Thoughts

Overall, we liked what we saw in Alphabet’s latest earnings update. The company is responding to the changing macroeconomic landscape in a reasonable manner and by 2023, management expects these efforts will be reflected in Alphabet’s bottom-line. Alphabet’s growth story isn’t over, far from it, as its exposure to secular tailwinds (digital advertising, cloud computing, self-driving car technology via its Waymo unit, AI, the Internet of Things trend, cybersecurity, work collaboration activities, and much more) underpins one of the best investable growth stories out there, in our view. The company grew its revenues by double-digits last quarter, even in the face of myriad exogenous shocks and tough year-over-year companions. That is stunning.

We like Alphabet as a top-weighted holding in our Best Ideas Newsletter portfolio given its bright growth outlook, fortress-like balance sheet, immense pricing power given the differentiated nature of its offerings, and ability to generate “gobs” of free cash flow in almost any operating environment. Efforts to improve its cost structure should help Alphabet meaningfully expand its operating margins going forward. Shares of Alphabet are trading well below our fair value estimate as of this writing, and we see ample room for capital appreciation upside potential going forward. Recently, it seems the market has started to warm back up to Alphabet.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for GOOG, GOOGL, MNDT, XLC, IXP, VOX, FCOM, SCHG

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, and V. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.