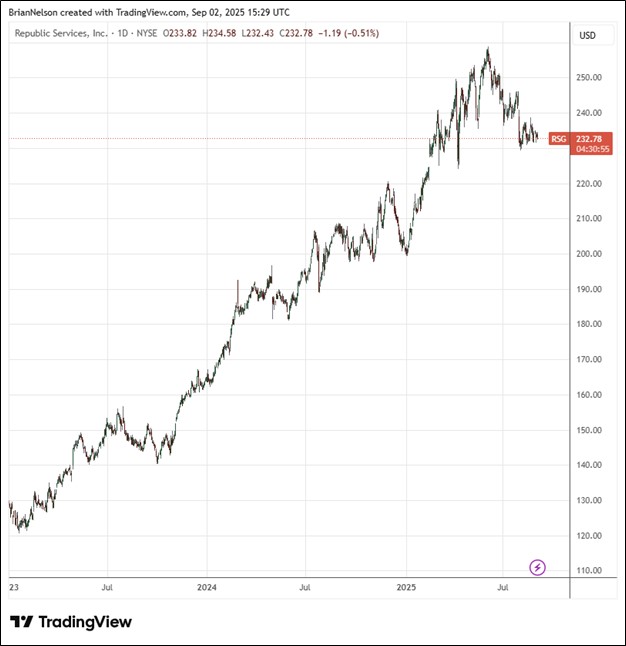

Image Source: TradingView

By Brian Nelson, CFA

Garbage hauler Republic Services (RSG) recently reported second quarter results that were mixed. The firm beat non-GAAP earnings per share estimates but missed when it came to revenue growth. Total revenue growth of 4.6% included 3.1% organic growth and the balance coming from growth from acquisitions. Net income was $550 million in the quarter, reflecting a margin of 13%, while adjusted earnings per share came in at $1.77, an increase of 9.9% over the prior year. Adjusted EBITDA was $1.36 billion, as its adjusted EBITDA margin expanded 100 basis points, to 32.1%.

Management had the following to say about the results:

We are pleased with our second quarter results which demonstrate the resilience of our business model and the benefit of the investments in our differentiated capabilities. We produced double-digit growth in EBITDA and 100 basis points of adjusted EBITDA margin expansion by continuing to price ahead of cost inflation and consistently executing our operational plan.

Year-to-date, Republic Services’ cash flow from operations was $2.13 billion while year-to-date adjusted free cash flow was $1.42 billion. Year-to-date, Republic has invested $888 million in acquisitions. Year-to-date cash returned to shareholders was $407 million, consisting of $45 million of buybacks and $362 million of dividends paid. For full year 2025, Republic now expects revenue in the range of $16.675-$16.75 billion and adjusted EBITDA in the range of $5.275-$5.325 billion. Adjusted diluted earnings per share is reiterated in the range of $6.82-$6.90 for the year, while adjusted free cash flow is now targeted in the range of $2.375-$2.415 billion. We continue to like Republic Services in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.