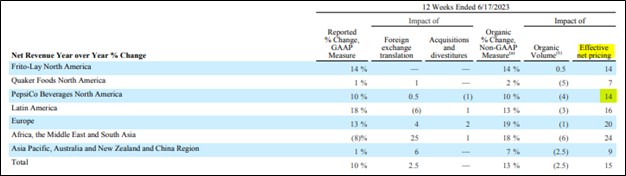

Image: Effective net pricing continues to be strong at Pepsi. Image Source: Pepsi

By Brian Nelson, CFA

On July 13, PepsiCo, Inc. (PEP) reported excellent second-quarter 2023 results. The firm’s pricing power continues to impress as the executive team manages modest losses in organic volume with huge effective net pricing increases. For the 12 weeks ended June 17, 2023, organic volume dropped 2.5% while effective net pricing increased a whopping 15% (effective net pricing increased 14% in PepsiCo Beverages North America). Operating income surged more than 75% in the quarter. For the 24 weeks ended June 17, 2023, free cash flow of $506 million was 32% higher than the $383 million mark in the same period a year ago.

Pepsi now expects full-year 2023 organic revenue to advance 10% (was 8%) and core constant currency EPS to increase 12% (was 9%). We’re not too happy about Pepsi’s growing debt position, but we continue to be fans of its ~2.7% forward estimated dividend yield. Pepsi will have to continue to drive better free cash flow performance to support its recently-raised dividend payout, but the quarterly results showed that cash-flow performance continues to move in the right direction. We’re sticking with the high end of our fair value estimate range for Pepsi of ~$220 per share as pricing power will likely continue for as long as pricing elasticities remain positive.

Related: How Much More Will Consumers Pay for McCormick Spices?

Related: General Mills Experiencing Tremendous Pricing Power, Positive Elasticities

Related: PepsiCo’s Pricing Actions Fantastic; Needs Better Free Cash Flow in 2023 to Cover 10% Dividend Hike

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Tickerized for PEP, KO, MDLZ, KDP, MNST, FIZZ, PRMW, BGS, CVGW, DANOY, LANC, MMMB, CALM, NOMD, LWAY, KHC, SMPL, BRBR, HAIN, BYND, HSY, LW, WEST, STKL, CPB, POST, GIS, K, CAG, VITL, CELH, PFGC, IBA, ASAI

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.