Image Source: Phillip Morris

By Brian Nelson, CFA

On February 9, Phillip Morris (PM) reported fourth-quarter 2022 results. The company’s performance continues to be impacted by the War in Ukraine. Net revenue growth came in at 0.6% for the quarter, while operating income fell 0.8%. However, excluding sales in Russia and Ukraine, net revenue growth advanced 7.9% in the quarter, while operating income growth advanced 10.3%, a much better showing on an adjusted basis. Smoke-free products accounted for ~36.0% of total net revenue in the period. Here’s what Phillip Morris’ CEO Jacek Olczak had to say about the quarterly results:

Despite the challenging operating environment in 2022, due to the war in Ukraine, as well as supply-chain and global inflationary pressures, we delivered very strong full-year adjusted results led by the continued growth of IQOS and a robust performance in the combustible tobacco category.

We are well on our way to becoming a majority smoke-free company, with smoke-free products accounting for almost one-third of our total net revenues for the year. With the acquisition of Swedish Match and the agreement to take full control of IQOS in the U.S. in April 2024, we achieved two important milestones in our smoke-free transformation in 2022 and are well positioned to accelerate this journey.”

We enter 2023 as a truly global smoke-free champion, with two of the industry’s leading smoke-free brands, IQOS and ZYN, and continued innovation across our broader smoke-free product portfolio. For the year, we forecast organic top-line growth of 7% to 8.5% and currency-neutral adjusted diluted EPS growth of 7% to 9%, despite inflationary pressures and transitory impacts related to ILUMA deployment.

As noted above, looking ahead to 2023, Phillip Morris’ net revenue is expected to expand 7%-8.5% on an organic basis, but its operating margin is expected to decline 50-150 basis points organically as a result of continued inflationary pressures. The company’s guidance includes what it describes as “strong full-year performance for Swedish Match’s existing operations, underpinned by strong shipment volume growth for ZYN in the U.S.” More than two thirds of Swedish Match’s revenue is smoke-free, so the acquisition of the company has accelerated Phillip Morris’ smoke-free push. Phillip Morris expects more than 50% of total adjusted net revenue to come from smoke-free means by 2025.

Image Shown: Phillip Morris

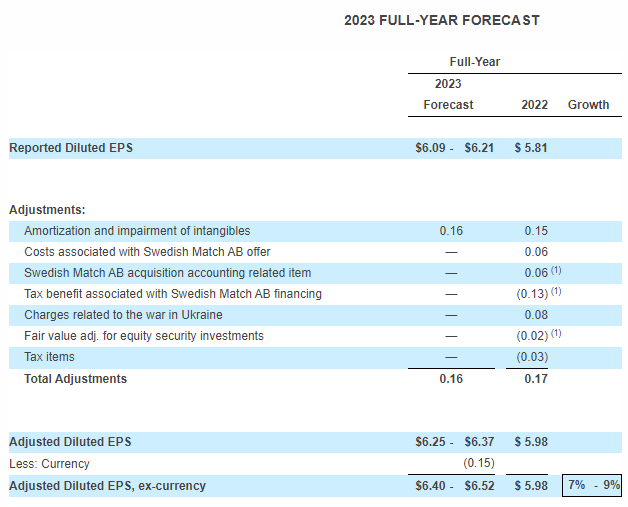

For 2023, Phillip Morris’ operating cash flow is targeted in the range of $10-$11 billion, while capital expenditures are expected to be ~$1.3 billion, meaning free cash flow is looking mighty strong for the year and should handily cover expected cash dividends paid. By comparison, operating cash flow during 2022 was $10.8 billion, while capital spending for the year was ~$1.1 billion. For 2022, 2021, and 2020, cash dividends paid came in at $7.8 billion, $7.58 billion, and $7.36 billion, respectively.

Phillip Morris’ adjusted diluted earnings per share for 2023, excluding currency fluctuations, is targeted in the range of $6.40-$6.52, which compares to $5.98 per share in 2022, implying strong 7%-9% growth. No share repurchases are expected during 2023. We continue to like Phillip Morris as an income idea, with shares yielding ~5% at the time of this writing. Our fair value estimate stands at ~$105 per share.

Tickerized for PM, SWMAY, MO, BTI, IMBBY, JAPAY, VGR, RLX

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.