By Brian Nelson, CFA

On October 19, Philip Morris (PM) reported excellent third-quarter 2023 results that showed currency-neutral revenue advancing 16.4%, and non-GAAP adjusted diluted earnings per share beating the consensus forecast, increasing more than 20% to $1.67 per share. The company continues to benefit from strong pricing across its combustible tobacco portfolio, its integration of its purchase of Swedish Match, and the popularity of its nicotine pouch ZYN, where shipment volume in the U.S. increased ~66% from the year-ago period.

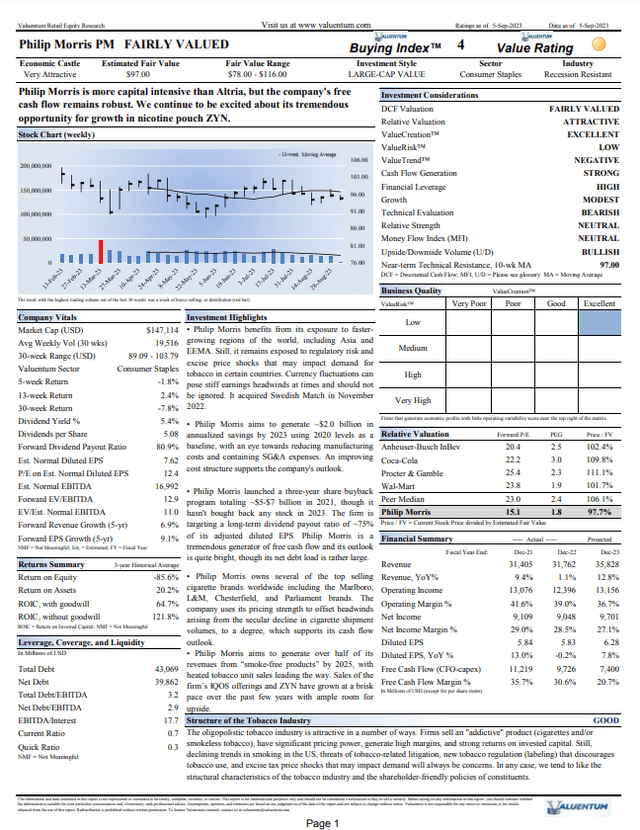

In conjunction with its strong third-quarter report, Philip Morris raised its outlook for adjusted diluted EPS to the range of 10%-10.5% expansion, excluding currency. The firm’s latest dividend increase was ~2.4%, to $1.30 per share, and its payout now stands at an annualized rate of $5.20. Though the firm doesn’t get high marks with respect to our dividend rankings, we still like Philip Morris as an income idea due to its tremendous free cash flow generation, with the company yielding ~5.6% at the time of this writing. Our $97 per share fair value estimate remains unchanged at this time.

Please select the image below to download its 16-page stock report.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.