Image: Pfizer’s shares have been under considerable pressure the past few years.

By Brian Nelson, CFA

Pfizer’s (PFE) revenue has faced pressure of late from expected declines in COVID-related sales from Comirnaty and Paxlovid, as the pharma giant navigates a post-COVID-19 world. However, excluding weakness from COVID-19 related revenue, the company’s underlying revenue grew 7% during 2023. Pfizer is working to build a strong oncology portfolio as it strives to realize billions in annualized cost savings to get to the other side of its troubles.

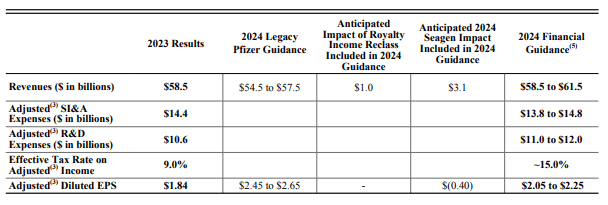

Image: Pfizer’s 2024 financial guidance.

For the full-year 2024, Pfizer is targeting revenue in the range of $58.5-$61.5 billion (was $58.5 billion in 2023) and adjusted diluted earnings per share in the range of $2.05-$2.25 (adjusted diluted EPS was $1.84 in 2023). Though the revenue environment continues to be challenging for Pfizer, the executive team remains optimistic, as outlined in their fourth-quarter press release:

We are encouraged by the strong performance of our non-COVID products in the fourth quarter of 2023, including significant contributions from new launches and robust year-over-year growth for several key in-line brands. In 2023, Pfizer received a record number of nine new molecular entity approvals by the U.S. Food and Drug Administration (FDA)—medicines and vaccines that are expected to favorably impact Pfizer’s performance in the coming years.

In addition, we completed the acquisition of Seagen in December 2023, a critical step toward our goal to achieve world-class Oncology leadership. With the combined strength of Pfizer’s and Seagen’s talent, portfolios and platforms, we believe we have the potential to transform outcomes by delivering cancer medicines that help patients live better and longer lives.

For 2024, Pfizer will continue to generate meaningful revenue from Comirnaty and Paxlovid, with expectations that the firm will generate a combined $8 billion in anticipated sales from these medications. Management expects to grow total revenue in 2024, but the headwinds from the COVID-19 sales boom haven’t completely lifted just yet. Including contributions from its acquisition of Seagen and excluding sales from Comirnaty and Paxlovid, however, operational revenue growth is targeted in the range of 8%-10%.

There are plenty of moving parts at Pfizer these days, but cash flow perhaps tells the best story. During 2023, cash flow from operations at Pfizer fell to $8.7 billion from $29.3 billion in 2022, while it shelled out $3.9 billion and $3.2 billion in capital expenditures for each year, respectively. Cash dividends paid, however, came in at ~$9.2 billion during 2023, indicating that at the moment, free cash flow is coming up short in covering the payout — meaning Pfizer’s dividend could eventually end up on the chopping block.

Though we are positive on Pfizer’s turnaround, its Dividend Cushion ratio of 0.3 is not to be taken lightly (any ratio below 1 indicates heightened risk of a dividend cut). Income-oriented investors seeking a turnaround story may be interested in Pfizer, but we’re staying on the sidelines. We’ll continue to monitor developments at the pharma giant, especially as patents on several of its major drugs approach expiration. Shares yield ~6% at the time of this writing.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for holdings in the XLV.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.