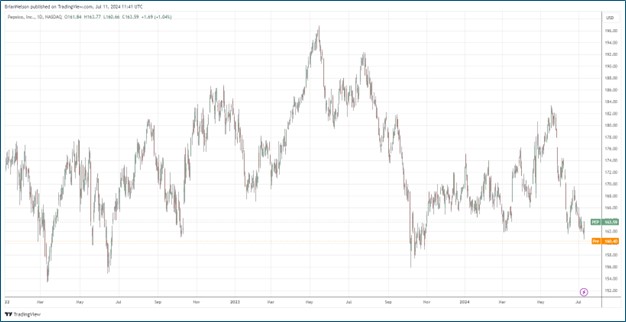

Image: PepsiCo’s shares have been choppy since the beginning of 2022.

By Brian Nelson, CFA

On July 11, PepsiCo (PEP) reported mixed second quarter results with the firm missing estimates slightly on the top line, but exceeding the consensus forecast on the bottom line. Net revenue growth in the second quarter came in at 0.8%, while organic revenue expansion was 1.9%, below the 3% the Street had been expecting. Core earnings per share was $2.28 versus the consensus estimate of $2.16, while core constant currency earnings per share leapt 10% on a year-over-year basis.

PepsiCo’s volume was down 2% in the Convenient Foods segment, while it was flat in its Beverages division. Volume fell 4% in Frito-Lay North America, while it was down 17% in its Quaker Foods North America division due in part to product recalls. Core constant currency operating profit expanded 7% thanks to strength in Europe and its PepsiCo Beverages North America division, which was partially offset by weakness in Quaker Foods North America.

Management’s commentary in the quarter spoke to slightly lower revenue expectations:

During the second quarter, our business delivered net revenue growth, strong gross and operating margin expansion and double-digit EPS growth, remaining agile despite facing difficult net revenue growth comparisons versus the prior year, subdued category performance within North America convenient foods and the impacts associated with certain product recalls at Quaker Foods North America…we now expect to deliver approximately 4 percent organic revenue growth (previously at least 4 percent) and have a high degree of confidence in delivering at least 8 percent core constant currency EPS growth for full-year 2024.

ESG Matters

PepsiCo’s ESG-oriented efforts are called pep+ (PEP Positive) with a focus on three pillars: 1) agriculture, 2) its value chain and 3) choices. Management had the following to say about its ESG progress in its 2023 ESG Summary Report:

Last year, we made tremendous progress against many of our goals while also seeking to address challenges to others. Virgin plastic use and scope 1 and 2 emissions went down compared to 2022. We doubled our regenerative farming footprint. We made further improvements to water efficiency and introduced innovative new packaging. We continue to improve the nutritional qualities of our biggest selling brands. We set new goals on sodium and on including positive nutrients, such as legumes and whole grains, across our food portfolio. And on beverages we made low and zero sugar drinks the key pillar of our growth strategy.

At the same time, we’ve made real strides in our goal of improving the lives of many farmers through dedicated programming aiming to support economic prosperity, cut emissions, and increased our use of recycled plastic. Our focus on diversity is unwavering, with women and underrepresented groups making up a growing portion of our leadership.

Concluding Thoughts

We’re not reading too much into PepsiCo’s modest downward organic revenue growth guidance revision for 2024 (approximated 4% versus at least 4%), as the firm’s underlying profitability remains strong, with expectations for at least 8% core constant currency expansion in 2024. Total cash returns to shareholders is targeted at $8.2 billion for 2024, consisting of dividends of $7.2 billion and share repurchases of $1 billion. For the 24 weeks ended June 15, PepsiCo had negative free cash flow, while it retained a hefty net debt position on the balance sheet. Though PepsiCo is not a net-cash-rich, free cash flow generating powerhouse, we like the diversification benefits it provides in the Best Ideas Newsletter portfolio.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for PEP, KO, KDP

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.