Image Shown: PayPal Holdings Inc grew at a robust pace in 2021 though its margin outlook is not as promising as once believed. Image Source: PayPal Holdings Inc – Fourth Quarter of 2021 earnings press release

By Callum Turcan

On February 1, PayPal Holdings Inc (PYPL) reported fourth quarter 2021 earnings that beat consensus top-line estimates but missed consensus bottom-line estimates. While PayPal put out guidance that called for its revenues to grow by mid-to-upper teens in 2022, the market was unimpressed with its non-GAAP earnings outlook that called for marginal growth at the midpoint.

It now stands to reason that PayPal’s operating/earnings leverage potential is not what it first appeared to be, particularly in light of the meager earnings growth expectations for 2022, and we have therefore fine-tuned our valuation model accordingly. Our updated fair value estimate now stands at $160 per share. Both the refreshed model and report will be available on the website in the coming days.

That said, PayPal remains a free cash flow cow with a pristine balance sheet that has been growing its revenues by double-digits annually for many years now and is expected to continue doing so this year. However, its ability to boost its operating margins over the long haul may be limited due to rising competitive pressures from the likes of Affirm Holdings Inc (AFRM) and Block Inc (SQ).

Shares of PYPL will remain an idea in the simulated Best Ideas Newsletter portfolio for the time being, as we evaluate the next few quarters of margin performance at the firm.

Earnings Update

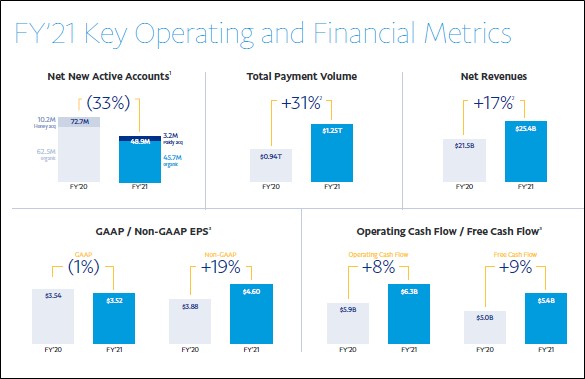

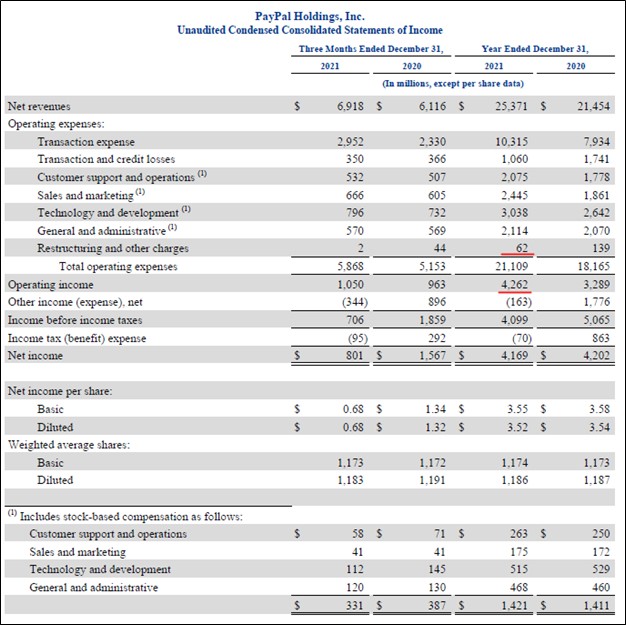

During the final quarter of 2021, PayPal grew its GAAP revenues by 13% as its total payment volumes (‘TPVs’) grew by 23% on both a spot and constant-currency basis. PayPal’s operating expenses grew by 14% year-over-year last quarter, which limited its GAAP operating income growth to just 9% year-over-year.

However, the company noted that its non-GAAP adjusted operating income was flat year-over-year last quarter when removing special items from this picture. PayPal is investing heavily in its business which weighs on its operating profit, though part of this is also due to the company pursuing aggressive and expensive customer acquisition strategies that we will cover in just a moment.

PayPal added 9.8 million net new active accounts (‘NNAs’) to its business last quarter, with 3.2 million of those NNAs coming from a recent acquisition. In September 2021, PayPal announced it was acquiring Paidy, a buy-now, pay-later (‘BNPL’) company focused on Japan, for ~$2.7 billion (mostly in cash). That deal closed in October 2021. In all, PayPal’s business is performing quite well though the company needs to do a better job controlling its operating expenses.

Guidance Adjustment

PayPal’s management team noted during the firm’s latest earnings call that parts of the ambitious guidance laid out during its big February 2021 Investor Day event were no longer feasible. For instance, PayPal thought at the time that it would be able to grow its active user account base to 750 million by 2025 which would represent a 15% CAGR from 2020-2025. However, that goal now appears out of reach.

This is likely why PayPal was rumored to be interested in acquiring Pinterest Inc (PINS) last year, before PayPal denied a potential acquisition (we are glad the deal did not go through). Here is what PayPal’s management team had to say as it concerns the firm’s user base growth during its latest earnings call (emphasis added):

“We are evolving our customer acquisition and engagement strategy, and we now expect to add 15 million to 20 million net new customer accounts this year. In addition, we no longer believe that the 750 million medium-term account aspiration we set last year is appropriate. I’ll explain. Over the past 2 years, we’ve added more than 120 million customer accounts to our platform. This is, without question, remarkable growth and a complete step change from our trajectory prior to the pandemic.

Our strategy for this has been twofold: continue to add net new actives and increase the engagement of our customer base. Last year, given the strong user growth, we pursued a strategy to retain those customers most likely to churn as well as attract many more new customers. We also leaned into incentivized customer acquisition tactics to a much greater extent than we ever have in our history.” — John Rainey, CFO and EVP Global Customer Operations of PayPal

Margins Aren’t Expanding as We Would Have Liked

From 2017 to 2020, PayPal’s non-GAAP adjusted operating margin (removing ‘restructuring and other charges’ from the picture) declined to 16.0% from 17.3% due to a combination of back office growth (R&D and G&A expenses), more aggressive customer acquisition tactics (its sales and marketing expenses have ballooned higher in recent years), and rising transaction and credit losses during the 2018-2020 period. The coronavirus (‘COVID-19’) pandemic played a role here as it concerns provisions for expected credit losses in 2020.

In 2021, PayPal’s adjusted operating margin rose to 17.0%, up over 100 basis points versus 2020 levels, but part of that was due to a large reduction in its transaction and credit losses line-item on a year-over-year basis as the global economy recovered from the worst of the COVID-19 pandemic (putting downward pressure on expected credit losses). Its sales and marketing expenses, however, continued to grow like a weed in 2021 and were up 21% year-over-year (representing ~9% of PayPal’s revenues last year).

Though PayPal’s adjusted operating margin showed improvement in 2021, its adjusted operating margin for the year is still lower than the 17.3% mark in 2017 (1). We appreciate PayPal’s ability to aggressively grow its revenues over this time period, but the company has not demonstrated the ability to drive sufficient earnings leverage and margin expansion along the way, in our more skeptical view.

That said, PayPal does have options to improve its margins over time. Going forward, it is possible PayPal can focus more on economical customer acquisition efforts instead of growth at any cost, a change that over time could improve its margins. Beyond improving the trajectory of its sales and marketing expenses, this strategy could also reduce pressure to boost its ‘customer support and operations’ expenses which were up 17% year-over-year in 2021 (representing ~8% of PayPal’s revenues last year). PayPal could slow down the growth of its corporate-level operations to improve its margins over time, too, with an eye towards its G&A expenses.

However, it won’t be until PayPal puts concrete plans into place before the market will change its opinion regarding PayPal’s future margin expansion potential.

Image Shown: PayPal’s adjusted operating margin stood at 17.0% in 2021 after removing ‘restructuring and other charges’ from this picture. Key items are underlined in red by the author. Image Source: PayPal – Fourth Quarter of 2021 earnings press release with additions from the author

Near Term Outlook

PayPal generated $4.60 in non-GAAP adjusted EPS in 2021 and is guiding to generate $4.60-$4.75 in non-GAAP EPS in 2022, which at the midpoint would represent marginal growth on an annual basis. Considering PayPal forecasts that it will post 15%-17% in annual revenue growth in 2022, its near term outlook indicates the company expects its margins will face sizable headwinds this year. PayPal expects its TPVs will grow by 21%-23% annually this year on a constant-currency basis, impressive growth that is aided by the proliferation of e-commerce and PayPal’s strategy to continuously launch new services and products to grow its market share and improve its growth runway.

Image Shown: An overview of PayPal’s near term guidance. Image Source: PayPal – Fourth Quarter of 2021 earnings press release

Free Cash Flow Cow and Pristine Balance Sheet

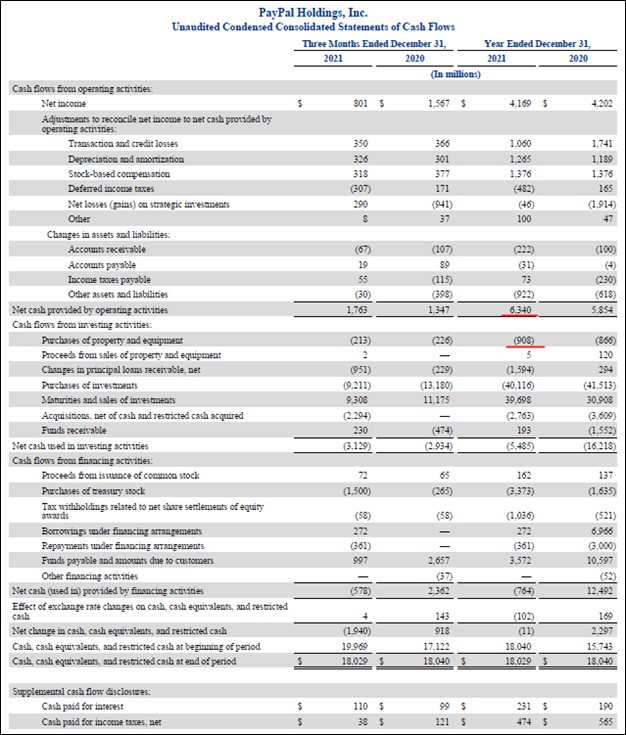

In 2021, PayPal generated $5.4 billion in free cash flow, up from $5.0 billion in 2020 and up sharply from the $1.7 billion in free cash flow PayPal generated in 2017. The company spent $3.4 billion buying back its stock through its repurchase program in 2021, and PayPal does not have a common dividend program at this time.

PayPal’s asset-light balance sheet and relatively modest capital expenditure requirements to maintain a given level of revenues is one of the reasons why we are fans of its business model. Going forward, PayPal will likely step up the pace of its share repurchases in the wake of the intense selling pressures facing its shares, in our view.

Image Shown: PayPal’s free cash flows continued to grow in 2021 and have grown at a robust pace in recent years. Image Source: PayPal – Fourth Quarter of 2021 earnings press release with additions from the author

At the end of December 2021, PayPal had $16.3 billion in cash, cash equivalents, and short- and long-term investments on hand with total debt of $9.0 billion on the books (according to its slide deck presentation). PayPal’s $1.5 billion net cash position at the end of this period combined with its stellar free cash flow generating abilities should help the firm to continue buying back sizable chunks of its stock going forward.

Image Shown: PayPal’s balance sheet is pristine. Image Source: PayPal – Fourth Quarter of 2021 earnings press release

Venmo

PayPal is steadily working on monetizing its popular peer-to-peer (‘P2P’) money transfer app Venmo. Recently, Venmo signed a strategic partnership with Amazon Inc (AMZN) that could lead to meaningful upside (Amazon will enable Venmo accounts to pay for purchases at its namesake e-commerce platform). Here is what PayPal’s management team had to say regarding Venmo’s nascent monetization efforts during the firm’s latest earnings call (emphasis added):

“Venmo had a solid finish to the year and closed out 2021, with more than $0.25 billion of revenue in the fourth quarter, up 80% year-over-year. We are still at the beginning of our monetization journey, with Amazon implementing the option to pay with Venmo later this year. And Venmo is turning an important corner and in Q4 helped to drive the sequential increase in our overall take rate.” — Dan Schulman, President and CEO of PayPal

We are keeping a close eye on PayPal’s efforts to monetize Venmo as the company is only in the first inning as it concerns its upside potential. PayPal’s revenue growth trajectory is underpinned in part by strong expected growth at Venmo.

Concluding Thoughts

PayPal is a solid enterprise supported by its pristine balance sheet, strong free cash flows, and promising revenue growth outlook. The proliferation of e-commerce provides PayPal will a powerful secular tailwind to capitalize on. However, PayPal’s operating leverage is not what it once appeared to be, and that weighs negatively on its margin expansion potential. As noted previously, we have fine-tuned our cash flow valuation model on the company, and now value shares at $160 on a point fair value estimate basis. We continue to include PayPal as an idea in the Best Ideas Newsletter portfolio for the time being (as we evaluate the next few quarters).

PayPal’s refreshed stock page and report will be available shortly.

—–

(1)

Image Shown: PayPal’s adjusted operating margin, removing ‘restructuring and other charges’ from this picture, stood near 17.3% in 2017. Key items have been underlined in red by the author. Image Source: PayPal – 10-K SEC filing covering 2017 with additions from the author

Tickerized for V, MA, DFS, AXP, COF, PYPL, SQ, ADS, SYF, FISV, GPN, GBTC, BITO, BTF, COIN, BKKT, BKNG, TRIP, EXPE

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Related: AFRM, SQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.