Image Shown: PayPal Holdings Inc has been a big winner in our Best Ideas Newsletter portfolio, and we expect that to continue being the case going forward.

By Callum Turcan

PayPal Holdings Inc (PYPL) is one of our favorite companies out there in the payment processing/financial tech space, up there with top weighted Best Ideas Newsletter portfolio holding Visa Inc (V), and back on January 13 (link here) we increased our weighting in shares of PYPL in the Best Ideas Newsletter portfolio. We like PayPal’s rock-solid balance sheet, quality cash flow profile, and most importantly, its growth outlook.

Guidance Commentary

On January 29, PayPal reported fourth-quarter and full year earnings for 2019, and the company continued to outperform. The firm beat market consensus estimates on both the top- and bottom-line, but some analysts noted that PayPal’s forward guidance for 2020 wasn’t as strong as expected. Here’s what PayPal’s management team is expecting for this year:

Annual revenue growth of ~17-18% at current spot currency rates (as of the earnings report) and ~18-19% on a constant currency basis, which total revenue up to $20.8-21.0 billion.

GAAP diluted EPS of $1.84-$1.95 and non-GAAP diluted EPS of $3.39-$3.46, and please note that due to PayPal’s acquisition of Honey that closed in January 2020, there’s some noise here. PayPal’s earnings report noted that “the dilutive impact of acquisitions is estimated to be in the range of $0.68 – $0.70 on GAAP earnings per diluted share, including an estimated $0.30 of negative impact related to taxes associated with the acquisition of Honey, and $0.08 – $0.10 on non-GAAP earnings per diluted share” for 2020.

Double-digit top-line growth, and keeping in mind PayPal reported $3.10 in non-GAAP adjusted diluted EPS in 2019, double-digit adjusted non-GAAP diluted EPS growth for a company with a market capitalization of ~$141 billion as of this writing is quite good, in our view.

Please note that through our discounted cash flow analysis process, the estimated intrinsic value of an equity largely comes from the mid-cycle and perpetuity phase of the business cycle (keeping balance sheet considerations in mind as well), with the near-term business cycle phase (defined here as the next five full fiscal years) only representing at most ~25% of the estimated intrinsic value of an equity (in many but not all instances).

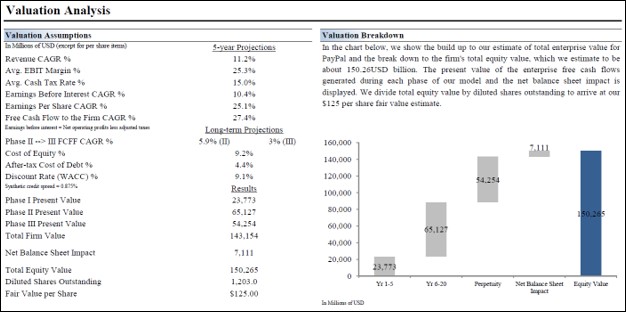

We provide a breakdown of our base case valuation assumptions used in our discounted cash flow models covering PayPal in the graphic below, from our 16-page Stock Report (which can be accessed here). In the event PayPal outperforms these valuation assumptions, shares of PYPL could march towards $150, the top end of our fair value estimate range.

Image Shown: Most of the estimated intrinsic value of PayPal’s equity comes from the mid-cycle and perpetuity phases of the business cycle.

The significance of PayPal’s guidance comes down to what management is communicating about the longer-term trajectory of the company’s free cash flows. In 2019, PayPal generated $4.6 billion in net operating cash flow and spent $0.7 billion on capital expenditures, allowing for material free cash flows of $3.9 billion (while lower on a year-over-year basis, please note that was largely due to very favorable working capital movements as it relates to ‘changes in loans and interest receivable held for sale, net’ in 2018).

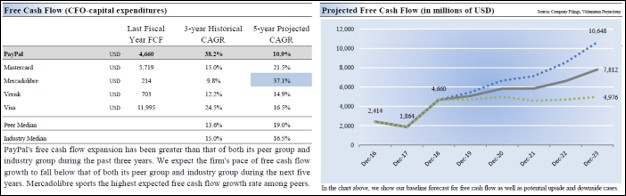

As the company does not pay out a common dividend at this time, some of that cash was added to the balance sheet and some was used to repurchase its common stock ($1.4 billion was spent on share buybacks in 2019). Please note PayPal’s weighted average diluted share count dropped by a little over 1% year-over-year in 2019. Strong forecasted top-line growth in 2020 should help keep the momentum going in terms of free cash flow growth over the long haul. In the graphic below, from our 16-page Stock Report, we highlight PayPal’s estimated free cash flow growth trajectory over the coming years.

Image Shown: Low capital expenditure requirements and nice top-line growth is expected to carry PayPal’s free cash flows significantly higher over the coming years, one of the big reasons why we really like the company.

Strong Fundamental Historical Performance

On a historical basis, PayPal’s GAAP revenues grew 15% annually in 2019 to $17.8 billion while its GAAP operating income grew by 24% to $2.7 billion. Margin expansion was a product of controlled operating expense growth, particularly as it relates to G&A, ‘technology and development’, ‘sales and marketing’, and ‘customer support and operations’ expenses. Furthermore, economies of scale and double-digit revenue growth were also key. Stock-based compensation represents a meaningful portion of its operating expenses, which is partially why PayPal repurchases a good chunk of its stock on a recurring annual basis. Here’s a slightly edited excerpt of what management had to say during the firm’s latest quarterly conference call with investors as it relates to margin expansion (emphasis added):

“In 2019, we expanded our operating margin by approximately 160 basis points or nearly 3 times the average annual rate of expansion contemplated by our medium-term guidance. In 2020, we expect our operating margin to remain essentially flat as a result of absorbing acquisition-related dilution, while continuing to invest in our other key strategic initiatives. This year [as previously discussed on the call], in addition to prioritizing spending on our recent acquisitions, we’re also investing in Venmo, our new partnerships, international expansion and our in-store point-of-sale strategies. We expect to deliver operating margin performance consistent with the highest in our history, while investing in these significant growth opportunities.”

We appreciate PayPal’s stellar performance last year and are pleased to see that this outperformance is expected to continue being the case going forward.

Honey Acquisition and PayPal’s Net Cash Balance

As mentioned previously, PayPal acquired e-commerce platform Honey at the start of 2020 for ~$4 billion. What Honey offers consumers is a loyalty program and a shopping assistant (i.e. price comparison tools), and for merchants and PayPal, Honey offers a boatload of data on consumer shopping habits and trends. The idea is that PayPal can offer merchants a way to substantially boost their sales and increase the total payment volume (‘TPV’) within PayPal’s own system. We like the purchase and covered the deal in detail here. Here’s an excerpt from that note:

Instead of competing just at the check-out page, PayPal will now be present during the entire phase of the consumer shopping experience (particularly for e-commerce). From the time the customer is initially checking out and researching items online, comparing various offerings to find the brand, product or service right for them, and ultimately at the final stage (checkout page), PayPal will now be able to gather a treasure trove of data that its ~24 million merchant accounts will likely find very useful.

Beyond Honey’s consumer user base, PayPal’s ~275 million active consumer accounts offers a great way for PayPal to quickly grow its ability to gather and mine customer data as it integrates Honey into its own operations. This data can be used to augment the ability for PayPal’s merchant clients to generate incremental sales from both PayPal’s user base (by sending targeted promotions and deals to PayPal’s consumer user base) and in general by taking that data into consideration for the merchant user’s internal purposes.

PayPal exited 2019 with $10.8 billion in cash, cash equivalents, and short-term investments. When including non-strategic long-term investments as well, that figure goes up to $11.7 billion according to PayPal’s 2019 Annual Report. As PayPal exited 2019 with $5.0 billion in long-term debt, even when including its purchase of Honey (which isn’t reflected yet in these figures), the firm still maintains a nice net cash position which we really appreciate.

On the topic of PayPal’s TPV, that grew by 23% in 2019 on an annual basis and when removing foreign currency effects, that growth rate pops up to 25%. Venmo, PayPal’s popular peer-to-peer money transfer app (primarily a mobile app but there’s a website as well), saw its TPV grow by 65% annually in 2019.

Concluding Thoughts

PayPal’s outlook is bright and only getting brighter. In late-2019 and early 2020, PayPal signed deals that allowed the firm to enter China’s enormous online payment market, and we’ll have a better idea of how that unfolds as time goes on. Its purchase of Honey further augments its growth outlook. We continue to really like PayPal in our Best Ideas Newsletter portfolio.

Financial Tech Services Industry – MA MELI PYPL VRSK V

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.