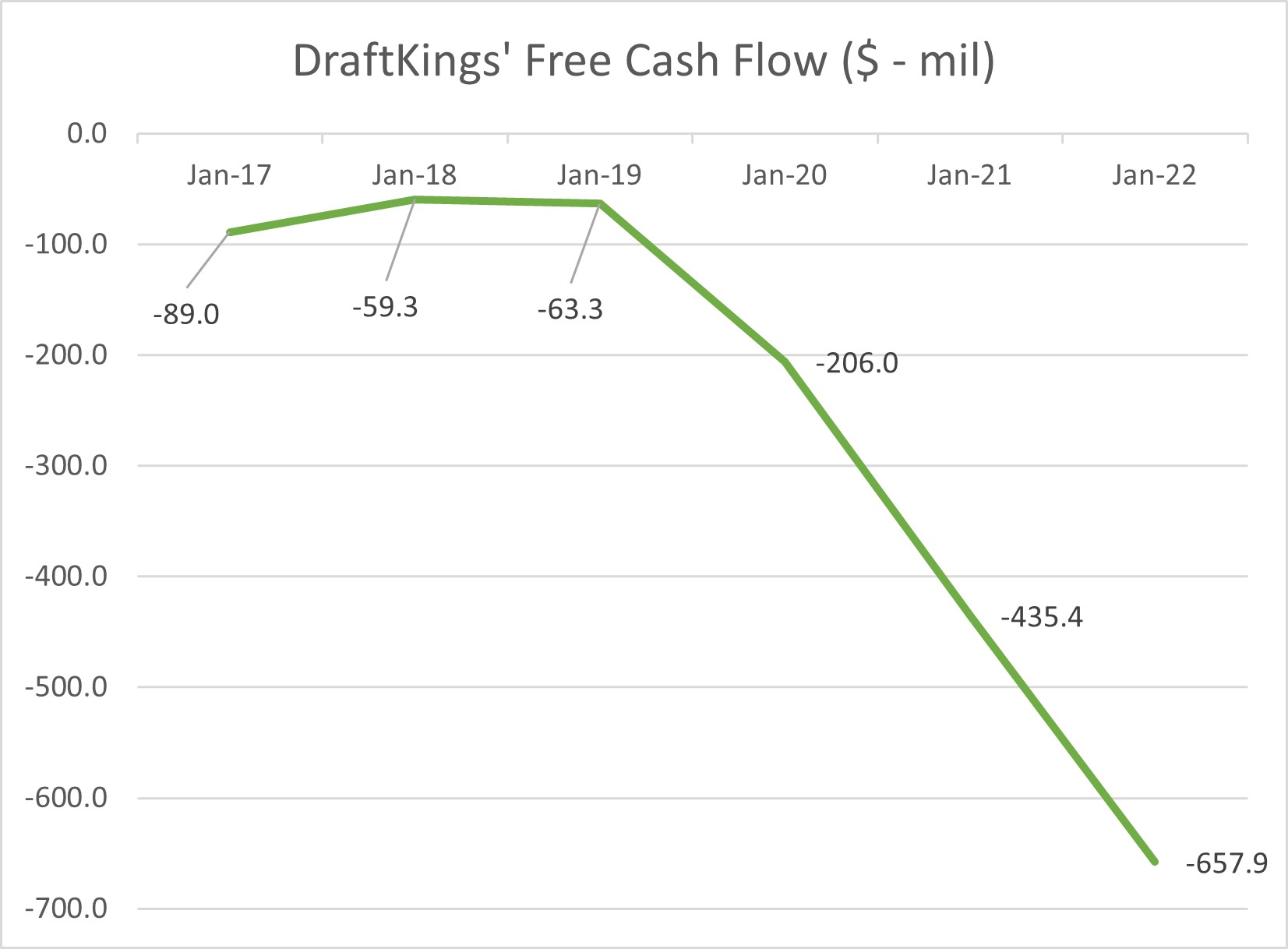

Image: Online sports betting platform DraftKings continues to burn through hundreds of millions of dollars each year. Data: SEC Filings, Seeking Alpha.

By Brian Nelson, CFA

Sports betting is now legal in 36 states and mobile sports betting is now legal in 26 states, and more states are expected to legalize sports betting in 2023. According to a report from Grand View Research, the global sports betting market is expected to increase at a compound annual growth rate north of 10% through 2030. In 2022 alone, it is estimated that Americans wagered roughly $80 billion betting on sports online. The NFL is among the biggest draws, and some estimate that more than 50 million American adults bet on the Super Bowl this year.

The backdrop for online sports betting is only getting more favorable for the operators. More states are expected to legalize online sports betting in the coming years, and with greater awareness comes greater wagering dollars. Several firms are poised to benefit from the improved operating environment, including Penn Entertainment (PENN), which recently closed on its deal to acquire Barstool Sports. The company’s Barstool Sportsbook is now live in 15 states, and Barstool’s 200 million followers across its platform offer tremendous growth potential for Penn. Several of Penn’s competitors in online sports betting include DraftKings (DKNG), FanDuel (PDYPY), Caesars Sportsbook (CZR), BetMGM (MGM), Bet365, and William Hill.

Though we like the tremendous future growth potential in online sports betting, Churchill Downs (CHDN), which exited online sports betting in July 2022, may be the best consideration for gaming exposure, in our view. During 2021, Churchill Downs generated $459.5 million in cash flow from operations, while it spent $91.8 million in capital expenditures, good for significant free cash flow generation. Through the first nine months of 2022, Churchill Downs’ cash flow from operations came in at $424.5 million, while capital spending totaled $263.7 million, but all but $37.1 million of those outlays were for expansion projects. Though Churchill Downs has a rather large net debt position of $1.48 billion, the company is much more established than a DraftKings, for example, that burned through $657.9 million in free cash flow during 2022.

Over the past 52 weeks, Churchill Downs’ stock has advanced ~10%, while DraftKings’ stock is down ~7% and Penn Entertainment’s shares have fallen over 34%. Online sports betting will only grow as more and more states pass laws in favor of its adoption and more and more consumers take up gambling as a hobby, but the best risk-adjusted opportunities may still rest with the more traditional gaming operators that aren’t burning through hundreds of millions in free cash flow every year to chase growth. We don’t like the moral underpinnings of the gambling industry at all, but we cannot deny the long-term growth potential of the industry. Churchill Downs may not be levered to online sports gaming anymore, but the company remains free cash flow rich with a tremendously lucrative asset base, and for that, it’s one of our favorite picks in the group.

Tickerized for PENN, DKNG, PDYPY, CZR, MGM, WYNN, GMVHF, PBTHF, GAN, FUBO, CHDN, IGT, SKLZ, BALY, GMGI, BRAG, ELYS, PSFE, PYTCF, GMBL, SRAD, GENI, GAMB, BYD, RSI, IBET

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.