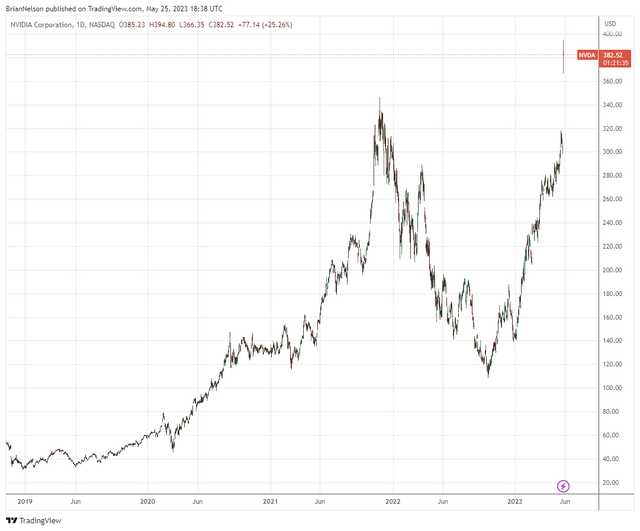

Image: Nvidia powers higher after releasing better-than-expected second-quarter fiscal 2024 guidance. The company continues to be a driver behind the outperformance of large cap growth as a stylistic area.

By Brian Nelson, CFA

We haven’t seen a quarterly guidance beat like this since Synaptics (SYNA) put up a monster quarter when Apple (AAPL) started using its innovative click-wheel technology in the first-generation iPod, almost 20 years ago. Nvidia Corp.’s (NVDA) outlook for the second quarter of its fiscal 2024 was phenomenal thanks to tremendous interest in its chips that power artificial intelligence [AI]. We expect a material increase in our fair value estimate of Nvidia, but shares remain quite pricey, in our view.

Revenue during Nvidia’s fiscal second quarter is expected to be ~$11 billion versus consensus that had been looking at ~$7 billion, implying a forward outlook more than 50% better than what the Street was looking for. Interestingly, Synaptics’ click-wheel technology started the wave of Apple products, which have been the go-to tech platform for years, and Nvidia may very well be the driving force behind AI proliferation, the next great technology platform.

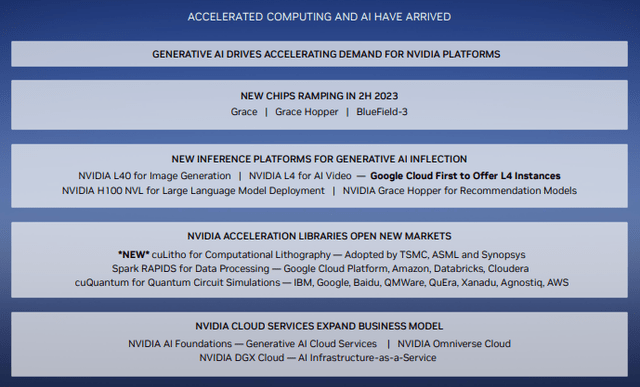

Generative AI is driving exponential growth in compute requirements and a fast transition to NVIDIA accelerated computing, which is the most versatile, most energy-efficient, and the lowest TCO (total cost of ownership) approach to train and deploy AI. Generative AI drove significant upside in demand for our products, creating opportunities and broad-based global growth across our markets.

Artificial intelligence [AI] is the real deal, in our view, and Nvidia has the chips to power it. When we first tested generative AI via ChatGPT, we were blown away by the technology. There may be some hype surrounding the technology powering large language models at these early stages of development, but from where we stand, the future is as much AI as the present is Apple products, Google (GOOG) (GOOGL) search, and Microsoft (MSFT) and Amazon (AMZN) cloud.

Image Source: Nvidia

AI is the latest catalyst to propel the area of large cap growth, which continues to trounce other areas of the market. Since the release of the first edition of the book Value Trap, an ETF that tracks large cap growth has outperformed an ETF that tracks small cap value by more than 75 percentage points, beating the market return handily, while leaving the strategies of dividend growth and real estate investing in its dust. We continue to like the area of large cap growth, and while we won’t be adding Nvidia to any newsletter portfolio, we’re loving the big cap derivative plays on AI, including Microsoft, Alphabet and Apple.

Let the good times roll!

NOW READ: Call Me Unconcerned

———-

Tickerized for NVDA, NVDL, SOXX, SMH, USD, WUGI, TRFK, VCAR, SYNA, AAPL, MSFT, TSM, AMD, MRVL, AI, SOUN, BBAI, GOOG, GOOGL, AMZN, PLTR, ORCL, META, NOW, DELL, HPE, LNVGY, LNVGF

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.