Image Source: Nvidia Corporation – October 2020 IR Presentation

By Callum Turcan

On November 18, Nvidia Corporation (NVDA) reported third quarter earnings for fiscal 2021 (period ended October 25, 2020) that beat both consensus top- and bottom-line estimates. The company’s GAAP revenues jumped higher by 57% year-over-year last fiscal quarter, aided by growth at its ‘Data Center’ (sales were up 190% year-over-year) and ‘Gaming’ (sales were up 37% year-over-year) business operating segments, which combined represented ~88% of its revenues last fiscal quarter. Nvidia’s ‘Professional Visualization’ and ‘Automotive’ business operating segments both posted year-over-year declines in sales.

The ongoing coronavirus (‘COVID-19’) pandemic has accelerated recent trends in the digital world, such as the pivot towards offsite cloud-computing solutions to meet IT needs. In turn, this dynamic has sharply increased demand for data centers that make the transition towards cloud-computing possible, which has proven to be a boon for Nvidia. The work-from-home (‘WFH’) trend has driven up demand for PCs and laptops over the past few quarters. Additionally, rising demand for video games entertainment options, something that we just recently covered here, is likely supporting demand for higher end PCs and laptops as well. Nvidia has so far been able to rise to the occasion and meet surging demand for data centers, laptops, and PCs during these turbulent times.

Quarterly Update

Due to a moderate decline in its GAAP gross margin and sharply higher operating expenses, Nvidia’s GAAP operating margin contracted by approximately 120 basis points in the fiscal third quarter on a year-over-year basis, hitting ~29.6%. Nvidia’s GAAP operating income still rose by an impressive 51% versus year-ago levels during this period. In order to stay near the top of the pack in the hypercompetitive industry Nvidia operates in, material R&D expenses are required and Nvidia continues to ramp up its investments towards the space.

The company also remains a cash flow generating machine. In the first nine months of fiscal 2021, Nvidia generated ~$3.75 billion in net operating cash flow (up 14% year-over-year), and please note this strong performance was in the face of a significant working capital build. The company spent ~$0.85 billion on its capital expenditures during this period, allowing for $2.9 billion in free cash flows, which fully covered $0.3 billion in dividend obligations; also note Nvidia did not repurchase a significant amount of its stock during this period (in order to improve its balance sheet and get the firm ready to fund future acquisitions). Shares of NVDA yield a paltry ~0.1% as of this writing.

Update on Arm Acquisition

Nvidia is quickly becoming a semiconductor giant. As we covered in the recent past (article link here), the firm is getting ready to “acquire Arm Limited (a semiconductor company with a heavy focus on smartphones and gaming devices) from SoftBank Group Bank Corp. (SFTBY) and SoftBank’s Vision Fund through a transaction valued at approximately $40 billion” through a cash-and-stock deal. For more information on this large acquisition, we encourage our members to check out our article from September 2020.

Back when that deal was announced, the relevant parties expected it would close within 18 months. During Nvidia’s latest earnings call, management did not have much to update investors on beyond noting “we are incredibly excited about the combined company’s opportunities and we are working through the regulatory approval process.” Please note that the regulatory hurdles here are material given perennial anti-trust concerns in the semiconductor industry and the high-tech space more broadly. Nvidia, Arm, and Softbank are going through the motions and so far, things seem to be progressing in the right direction. We are keeping a close eye on this deal.

Back in April 2020, Nvidia closed its all-cash acquisition of Mellanox which had a transaction value of roughly $7.0 billion. This deal significantly grew Nvidia’s presence in the data center arena. With that in mind, Nvidia retained its pristine balance sheet after the deal closed as management opted to conserve cash on the books instead of buying back stock as mentioned previously (as an aside, Nvidia’s outstanding diluted share count has been steadily rising of late, up a little over 1% year-over-year during the first nine months of fiscal 2021).

As of October 25, Nvidia had $3.2 billion in net cash on the books (inclusive of short-term debt). We are big fans of companies with pristine balance sheets, though we caution that Nvidia is pursuing a transformative acquisition by attempting to acquire Arm, which if completed would fundamentally alter its financial position.

Management Commentary

Here is what Nvidia’s management team had to say regarding the firm’s Data Center segment and its recently acquired Mellanox operations during the company’s latest earnings call (emphasis added, lightly edited):

“Now moving to Data Center. Revenue was a record $1.9 billion, up 162% year-over-year and up 8% sequentially, driving growth with a strong ramp of our A100-based platforms, continued growth with Mellanox and record T4 shipments for inference…

Our new NVIDIA Ampere architecture gained further adoption by cloud and hyperscale customers and started ramping into vertical industries. Over the past weeks, Amazon Web Services (AMZN), Oracle Cloud Infrastructure (ORCL) and Alibaba Cloud (BABA) announced general availability of the A100, following Google Cloud platform (GOOG) (GOOGL) and Microsoft Azure (MSFT)…

In Q3, the A100 swept the industry standard MLPerf benchmark for AI inference performance… Our winning performance in AI inference is translating to continued strong revenue growth. Alongside the continued ramp of the A100, T4 sales set a record as the NVIDIA AI inference adoption is in full throttle…

Mellanox had another record quarter with double-digit sequential growth well ahead of our expectations, contributing 13% of overall Company revenue… Mellanox reached record revenue in both InfiniBand and Ethernet, driven by cloud, enterprise and supercomputing customers… As the data center becomes the new unit of computing in the age of AI, Mellanox networking is foundational to modern scalable architectures.” — Colette Kress, CFO of Nvidia

We appreciate Nvidia’s exposure to numerous secular growth tailwinds including the growing prevalence of cloud-computing and AI offerings as the backbone of a modern enterprise’s IT operations.

Concluding Thoughts

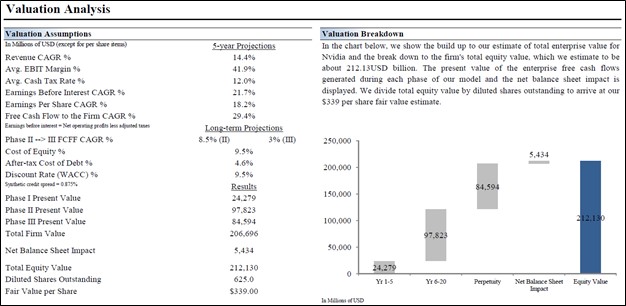

Shares of NVDA are trading well above the top end of our fair value estimate range (which sits at $427 per share) as of this writing. It is possible that the market is expecting Nvidia to put up significantly stronger growth rates than what our discounted free cash flow models assume; however, we are assuming Nvidia’s free cash flow to the firm (‘FCFF’) grows by 29.4% CAGR over the next five full fiscal years under our “base” case scenario, and under our “bull” case scenario, that expected FCFF CAGR is significantly higher.

Furthermore, the kind of FCFF CAGR our model assumes that Nvidia will generate over the coming decades (particularly during the mid-cycle business period) would be incredibly impressive, if realized, for a company with a market capitalization north of $300 billion (as of this writing). The upcoming graphic down below highlights the key valuation assumptions used in our “base” case discounted cash flow model covering Nvidia. For additional information on our equity analysis process, please see our book Value Trap.

Image Shown: The above graphic highlights the key valuation assumptions used in our discounted free cash flow models covering Nvidia’s “base” case scenario. The market must be expecting Nvidia to put up some truly stunning growth rates over the coming fiscal years and decades, based on its generous valuation as of this writing.

We like Nvdia a lot, but at present prices, we are not interested in adding shares of Nvidia to any of our newsletter portfolios at this time. The company’s financial performance of late has been impressive, but the market has priced in long-term growth rates that, in our view, will be hard for Nvidia to live up to. On a final note, we are keeping an eye on the ongoing consolidation of the semiconductor industry.

—–

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communication Equipment Industry – CIEN SATS LHX PLT QCOM VSAT

Communications Equipment Space – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Telecom Services– CMCSA CTL DISH T TMUS VZ

Related: SFTBY, SNNLF, SCWX, SPY, VOD, CHA, CHL, CHUFF, ERIC, NLOK

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.