Image Source: IDC

By Brian Nelson, CFA

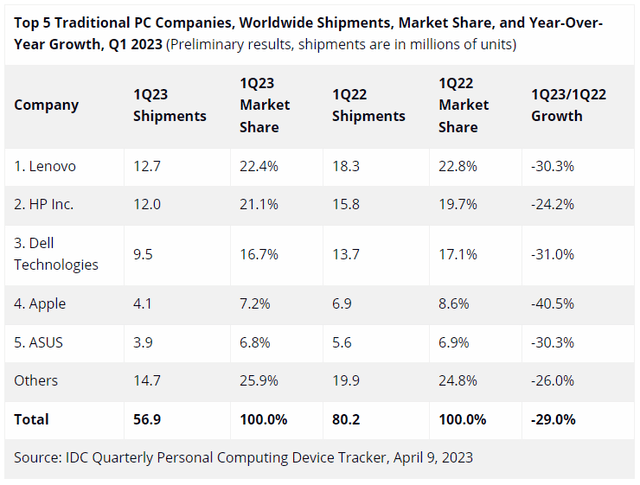

On April 9, International Data Corporation (IDC) issued preliminary findings for the first quarter of 2023 for global personal computer (PC) shipments in its Worldwide Quarterly Personal Computing Device Tracker. The results were a bit surprising, with the firm noting that “weak demand, excess inventory, and a worsening macroeconomic climate were all contributing factors for the precipitous drop in shipments of traditional PCs during the first quarter of 2023.” According to the IDC report, global PC shipments fell 29% to 56.9 million compared to the first quarter of 2022.

Apple (AAPL) experienced the biggest year-over-year percentage decline, where shipments fell more than 40%. Dell Technologies (DELL), Lenovo (LNVGY) (LNVGF) and ASUS experienced declines greater than 30%, while HP Inc. (HPQ) and a basket of other PC makers witnessed declines in the mid-20% range. Channel inventory remains elevated, and investors should expect more discounting from the PC makers, as the industry continues to optimize the supply chain amid pre-COVID and post-COVID demand dynamics.

IDC believes that “PC shipments will likely suffer in the near term with a return to growth towards the end of the year with an expected improvement in the global economy and as the installed base begins to think about upgrading to Windows (MSFT) 11.” The research firm expects the aging installed base of PCs will start to come up for a refresh in 2024 aiding demand for Chromebooks and the transition to Windows 11. However, IDC also warned that if a recession hits, “recovery could be a slog.”

Though the headline percentage declines in PC shipments during the first quarter of 2023 seem shocking, we’re not worried about it. Apple’s primary revenue driver remains its iPhone, and we’re excited about what artificial intelligence (AI) may bring for Microsoft. Lenovo, HP Inc. and Dell, which hold significantly larger share of the PC market than Apple, may witness performance suffer in the coming quarters, but given the importance of mobile, we think PC demand has become increasingly less relevant of an indicator for the health of the broader economy than it was years ago.

Though not great, we’re not sweating the news.

Tickerized for AAPL, DELL, LNVGY, LNVGF, HPQ, BBY, AAN, MSFT, SWKS, JBL, ACEYY, SONY, BB, IBM, PCRFY, SSNLF, INTC, AMD, STX, WDC, MU

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.