Image Source: NextEra Energy

By Brian Nelson, CFA

NextEra Energy (NEE) reported mixed second quarter results July 23 with revenue coming in slightly lower than forecast, but non-GAAP earnings per share exceeding the consensus forecast. On an adjusted basis, NextEra Energy’s earnings in the quarter were $2.164 billion, or $1.05 per share, compared to $1.968 billion, or $0.96 per share in the second quarter, of 2024. Management had the following to say about the results:

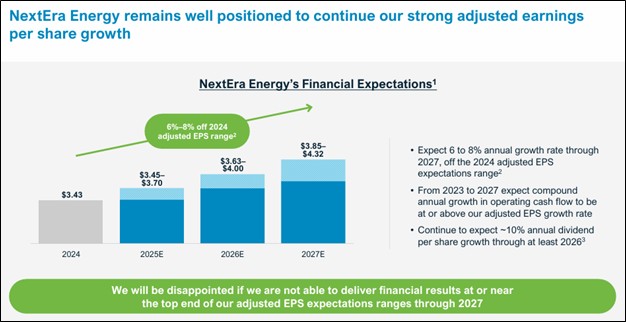

NextEra Energy delivered strong second-quarter results with adjusted earnings per share increasing by 9.4% year-over-year. We believe the continued strong financial and operational performance at both FPL and NextEra Energy Resources positions us well to meet our overall objectives for the year. During the quarter, FPL continued to invest in its business to serve Florida’s growing population while keeping reliability high and rates low. NextEra Energy Resources had a strong origination quarter, adding 3.2 gigawatts of new renewables and storage to its backlog. We believe we are well positioned to continue delivering for our customers and shareholders and will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges in each year through 2027, while maintaining our strong balance sheet and credit ratings.

NextEra’s long-term outlook remains unchanged. For 2025, NextEra Energy expects adjusted earnings per share to be in the range of $3.45-$3.70. For 2026 and 2027, NextEra expects adjusted earnings per share to be in the ranges of $3.63-$4.00 and $3.85-$4.32, respectively. The company also expects to increase its dividends per share at a roughly 10% rate per year through at least 2026, off a 2024 base. We continue to like NextEra Energy as our utility exposure and think it makes sense as a key position in the ESG Newsletter portfolio.

—–

Tickerized for holdings in the XLU.

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.