Image Source: NextEra Energy

By Brian Nelson, CFA

Back on April 23, NextEra Energy (NEE) reported mixed first quarter results with non-GAAP earnings per share beating expectations, but revenue coming in light versus the consensus forecast at the time. Net income attributable to NextEra Energy on an adjusted basis came in at $0.91 per share, which was up modestly from $0.84 per share in the year-ago period.

Management had a lot to say about the quarter and outlook:

NextEra Energy delivered strong first-quarter results, growing adjusted earnings per share by approximately 8.3% year-over-year. Both FPL and NextEra Energy Resources delivered solid financial and operating performances to start off the year. FPL placed into service 1,640 megawatts of new, cost-effective solar, while NextEra Energy Resources added approximately 2,765 megawatts of new renewables and storage to its backlog, marking its second-best origination quarter ever and its best quarter for both solar and storage origination…

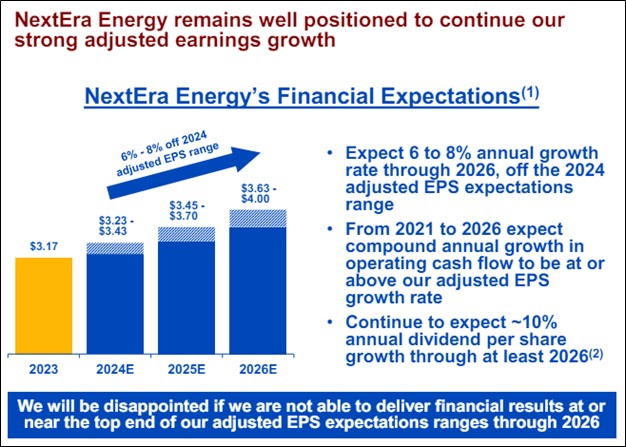

…Our two businesses are well positioned to meet future power demand with renewables, storage and transmission, while leveraging our combination of enterprise-wide scale, decades of experience and investment in technology to drive long-term value for customers and shareholders. We will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges in each year through 2026, while maintaining our strong balance sheet and credit ratings.

NextEra Energy reaffirmed its long-term outlook. For the current year, management expects adjusted diluted earnings per share in the range of $3.23-$3.43, with the measure targeted to increase to $3.45-$3.70 per share in 2025 and $3.63-$4.00 per share in 2026. The company also reiterated its expectations to grow its dividends per share at approximately a 10% clip each year through at least 2026, using 2024 as the baseline. We like the company’s expected pace of dividend growth and its position as a leading clean energy company.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.