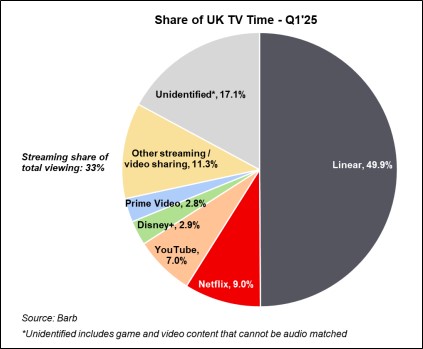

Image: Netflix has a long runway of growth given market share opportunities.

By Brian Nelson, CFA

On April 17, Netflix (NFLX) reported strong first quarter results with revenue and GAAP earnings coming in ahead of the consensus estimates. Revenue and operating income advanced 12.5% (16% on a foreign exchange neutral basis) and 27.1% on a year-over-year basis, respectively. Netflix’s operating margin increased to 31.7% from 28.1% in the year-ago period, while net income leapt to $2.89 billion from $2.33 billion in last year’s quarter. Diluted earnings per share increased 25.2% to $6.61 from $5.28 in the same period last year. Netflix’s performance was in part propelled by membership growth and higher pricing.

Management continues to execute on its 2025 priorities:

(It) delivered a solid slate in Q1 with one series (Adolescence) and three films (Back in Action, Ad Vitam and Counterattack) all breaking into (its) all-time most popular lists.

On April 1, (it) successfully launched (its) ad tech platform in the US and (is) on track to roll it out in (its) remaining ads countries in the coming months.

(It’s) building out (its) live offering with (its) Q1 launch of WWE RAW, which has been on (its) global Top 10 list every week. (It) also announced Taylor vs. Serrano 3, a historic women’s boxing rematch that will stream on July 11, and opted into a second NFL game for Christmas Day 2025.

Looking to the second quarter, Netflix expects revenue growth of 15.4% (17% on a foreign exchange neutral basis) as the company benefits from recent price changes and ongoing strength in membership and advertising sales. The company expects an operating margin of 33.3% in the quarter, roughly 6 percentage points better on a year-over-year basis. Netflix continues to expect 2025 revenue in the range of $43.5-$44.5 billion and an operating margin of 29% based on foreign exchange rate levels at the start of the year. We like Netflx’s market share growth opportunities and view shares as relatively immune to tariff pressures and broader macroeconomic uncertainty. Our fair value estimate stands at $1,060 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.