Image: Netflix still has a lot of room for growth.

By Brian Nelson, CFA

On April 18, Netflix (NFLX) reported better than expected first quarter 2024 results. In the quarter on a year-over-year basis, the company’s revenue advanced ~15%, its operating income jumped ~54%, and its operating margin registered a roughly seven-percentage point increase, to 28%.

Netflix’s top line was driven both by membership growth and pricing, and operating income benefited in part from higher-than-expected revenue performance and the timing of its content spending. Earnings per share came in at $5.28 in the quarter versus management’s $4.49 forecast. Netflix generated free cash flow of ~$2.14 billion in the quarter.

Netflix continues to focus on building out its member base, while expanding capabilities for advertisers. During the first quarter, for example, its ads membership grew nicely, roughly 65% quarter on quarter. The company’s outlook for the second quarter of 2024 and all of 2024 was solid as well:

For Q2’24, we forecast revenue growth of 16%. This equates to 21% growth on a F/X neutral basis due primarily to price changes in Argentina and the devaluation of the local currency relative to the US dollar. We expect paid net additions to be lower in Q2’24 vs. Q1’24 due to typical seasonality. We forecast global ARM to be up year-over-year on a F/X neutral basis in Q2.

For the full year 2024, we expect healthy revenue growth of 13% to 15%, based on F/X rates at the end of Q1’24. We now expect FY24 operating margin of 25%, based on F/X rates as of January 1, 2024, up from our prior forecast of 24%. As we’ve noted in the past, while we’ve launched a F/X risk management program to reduce near term volatility, we don’t intend to be fully hedged, which is why we guide and manage to a F/X neutral operating margin target. Our goal is to increase our operating margin each year, though the rate of expansion may vary year to year.

The quarterly report and outlook were fine, but the Street didn’t like management’s decision to stop reporting quarterly membership and average revenue per membership (ARM) numbers starting next year. The rationale is that memberships have become just one component of its growth, and that its pricing has evolved to multiple tiers where paid memberships have a varying business impact. We understand management’s focus on wanting the investment community to evaluate its business on a holistic basis, but the lack of transparency with respect to membership numbers is no doubt a move in the wrong direction.

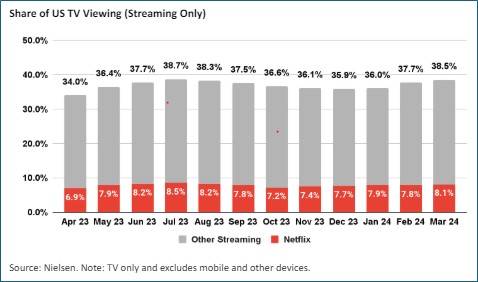

From where we stand, Netflix has won the streaming wars. Nearly 270 million households across 190+ countries subscribe to its content, and with estimates that there are more than two people per household, management emphasized that it has an audience of more than a half a billion people. Netflix has further room for growth, too, as it notes that its share of TV viewing is less than 10% in every country. Management pointed to content such as the boxing match between Jake Paul and Mike Tyson, as well as live programming such as WWE Raw as a couple examples to keep audiences entertained. We like Netflix, but we can’t get comfortable adding it to any newsletter portfolio at this time.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for NFLX, PARA, DIS

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.