Image Source: Netflix

By Brian Nelson, CFA

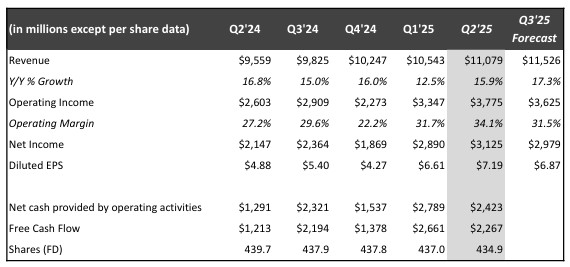

On July 17, Netflix (NFLX) reported better than expected second quarter results with revenue and GAAP earnings per share beating the consensus forecast. The company grew revenue 15.9% in the quarter on a year-over-year basis, and its operating margin was 34.1%, up roughly seven percentage points on a year-over-year basis. Both revenue and operating income came in above its guidance due to foreign exchange and the timing of certain expenses. Net income came in at $3.1 billion in the quarter, up from $2.1 billion in last year’s quarter, while diluted earnings per share came in at $7.19, up from $4.88 in the second quarter of 2024 (+47% year-over-year).

Netflix’s top line continues to benefit from more members, higher subscription pricing, and increased ad revenue. Looking to the third quarter of 2025, revenue is targeted to increase 17.3% on an operating margin of 31.5% and diluted earnings per share of $6.87, up from $5.40 per share in the third quarter of 2024. For 2025, Netflix raised its revenue forecast to the range of $44.8-$45.2 billion, up from $43.5-$44.5 billion thanks in part to the depreciation of the US dollar versus most other currencies and continued strength in member growth and ad sales. The company also raised its operating margin target for 2025 to 29.5%, up from its prior forecast of 29%.

Management is upbeat on its suite of products for the second half of the year:

We’re optimistic heading into the second half of the year, with a standout slate that includes Wednesday S2, the Stranger Things finale, the highly anticipated Canelo-Crawford live boxing match, Adam Sandler’s Happy Gilmore 2, Kathryn Bigelow’s A House of Dynamite and Guillermo del Toro’s Frankenstein.

During the second quarter, Netflix generated cash from operating activities of $2.4 billion versus $1.3 billion in the prior-year period. Free cash flow in the second quarter totaled $2.3 billion versus $1.2 billion in the year-ago period. Netflix raised its full year 2025 free cash flow forecast to the range of $8-$8.5 billion from approximately $8 billion due to continued strength in revenue and margin performance. The company ended the quarter with gross debt of $14.5 billion and cash and cash equivalents of $8.2 billion. We liked Netflix’s second quarter and outlook, but we don’t include shares in any newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.