Morgan Stanley is guiding return on tangible equity to go from 12.9% this year to 13-15% in two years and to 15-17% in the longer term. Management was quite clear that they are using the assumption that the economy and markets move ahead at normal levels, meaning no severe recessions or booms. That said, if the company hits these goals, it will drive fundamentals ahead at a steady clip, requiring a reset higher in its valuation.

By Matthew Warren

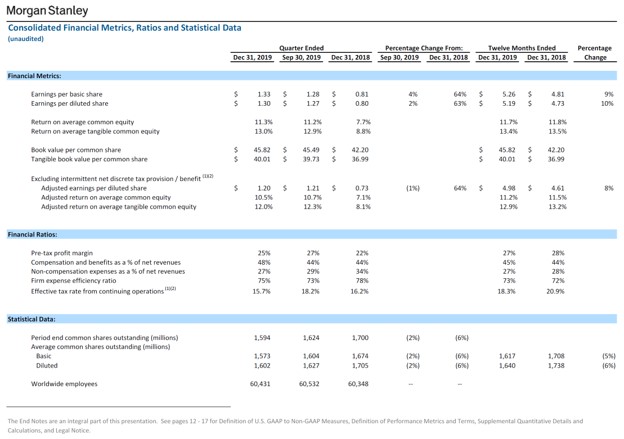

Morgan Stanley (MS) put up solid fourth-quarter results, released January 16, beating the consensus of analyst earnings-per-share forecasts by a decent margin. Net revenues advanced 8% and net income applicable to Morgan Stanley common shareholders was up a modest 1%. Adjusted return on average tangible common equity was 12% in the quarter and 12.9% for the year, as you can see in the below graphic.

Image Source: Morgan Stanley Earnings Presentation

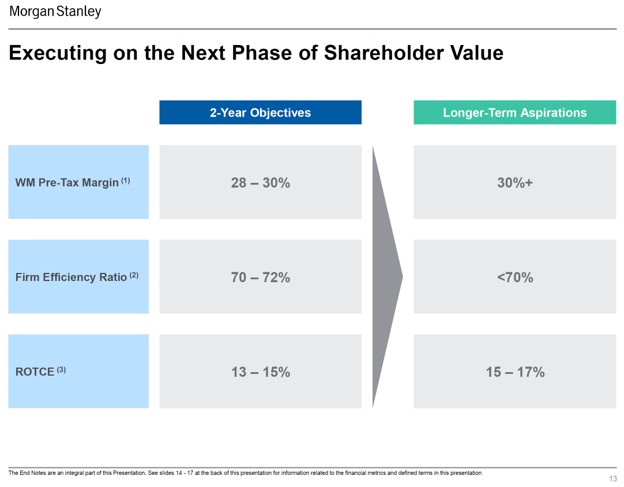

Now this is where things get interesting. Management gave a strategic update on the call, laying out expectations for two-year objectives and longer-term aspirations for Wealth Management pre-tax margin, firmwide efficiency ratio and return on tangible common equity. When comparing the above graphic to the below graphic, you can see the substantial improvement that management is now calling for.

Image Source: Morgan Stanley Strategic Update (alongside quarterly earnings)

The bottom line is that management is guiding return on tangible equity to go from 12.9% this year to 13-15% in two years and to 15-17% in the longer term. Management was quite clear that they are using the assumption that the economy and markets move ahead at normal levels, meaning no severe recessions or booms. That said, if the company hits these goals, it will drive fundamentals ahead at a steady clip, requiring a reset higher in its valuation.

Given that we are 11 years into an economic and bull market upcycle, we think these targets need to be looked at with a fair degree of skepticism. That said, we do give the firm credit for improving its financial metrics over the past few years, and most importantly return on capital steadily from low levels. If the market cooperates, Morgan Stanley is certainly levered to improving financial conditions along with self-improvement efforts to boot.

In giving partial credit for these expectations, we are raising our fair value estimate to $55 per share, pending more evidence of success regarding self-improvement efforts. [This fair value estimate change will be reflected in Goldman’s table upon the regular data update at the end of this upcoming weekend.]

—–

Goldman Hit By Charge Related to 1MDB >>

Bank of America Gaining Share >>

Citigroup Succeeding at Cross-Selling >>

Wells Fargo Remains an Inefficient Bank Despite Regulatory Overhang >>

JPMorgan’s Quarter Shows Higher Sustainable Growth Potential >>

Related: XLF, VFH, XFO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.