Image Shown: Microsoft Corporation put up a solid fiscal third quarter earnings report and we continue to be big fans of the name. Image Source: Microsoft Corporation – Power Point Earnings Presentation Covering the Third Quarter of Fiscal 2022

By Callum Turcan

On April 26, Microsoft Corporation (MSFT) reported third quarter earnings for fiscal 2022 (period ended March 31, 2022) that beat both consensus top- and bottom-line estimates. Shares of MSFT jumped higher by ~4%-5% in afterhours trading on April 26 as investors cheered on the good news and its promising near term outlook. Microsoft’s cloud-oriented products and services were a bright spot in the fiscal third quarter and underpinned its impressive pricing power. The firm was able to stay ahead of inflationary pressures and maintain its strong margins while growing its revenues.

We include shares of MSFT as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Our fair value estimate for Microsoft sits at $332 per share, well above where Microsoft is trading at as of this writing, indicating that the company has substantial capital appreciation upside.

Additionally, we view Microsoft’s dividend growth trajectory quite favorably due to its rock-solid financial position, bright longer-term growth outlook that is underpinned by secular tailwinds and recent acquisition activity, its pricing power, fortress-like balance sheet, and ability to generate sizable free cash flows in almost any operating environment. Shares of MSFT yield ~0.9% as of this writing.

Earnings Update

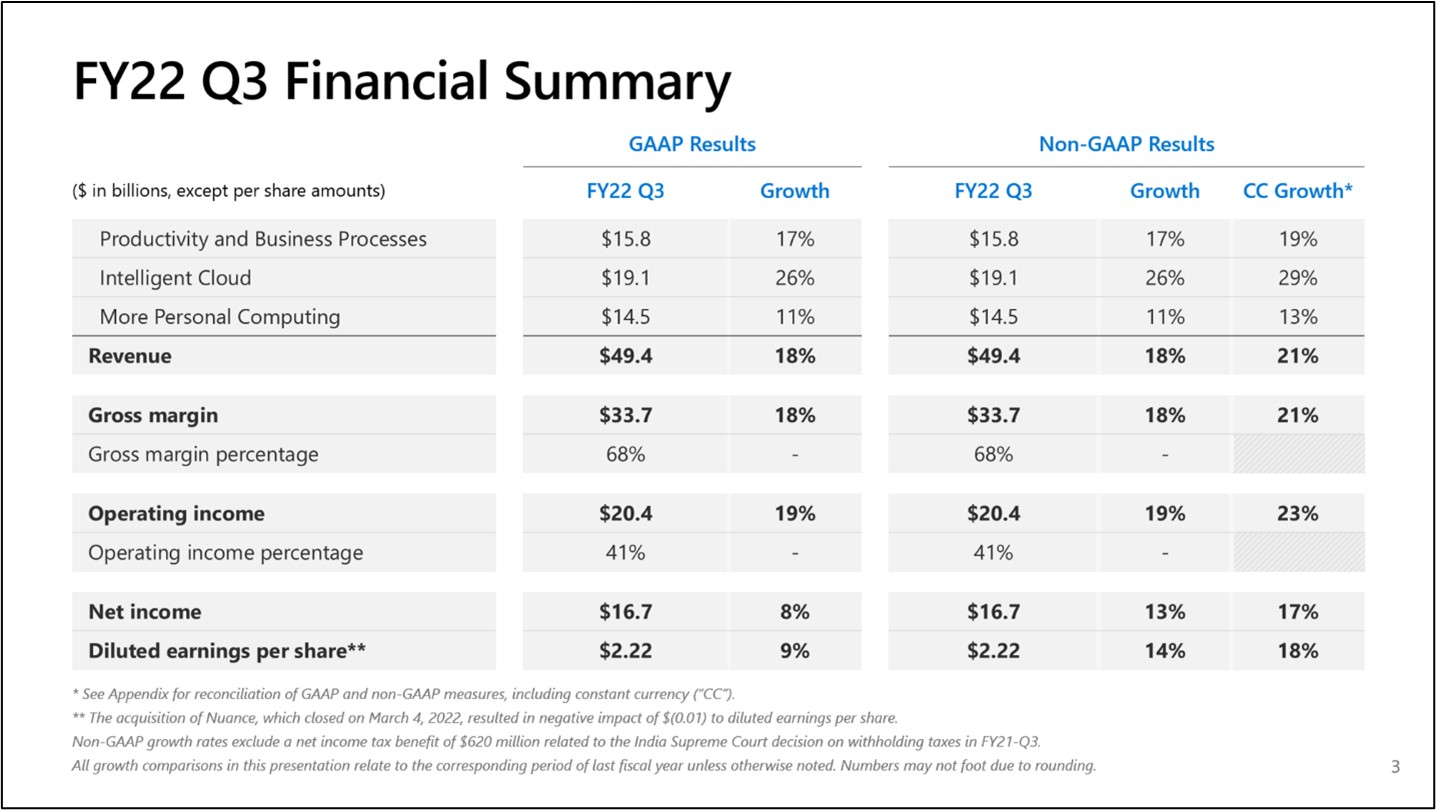

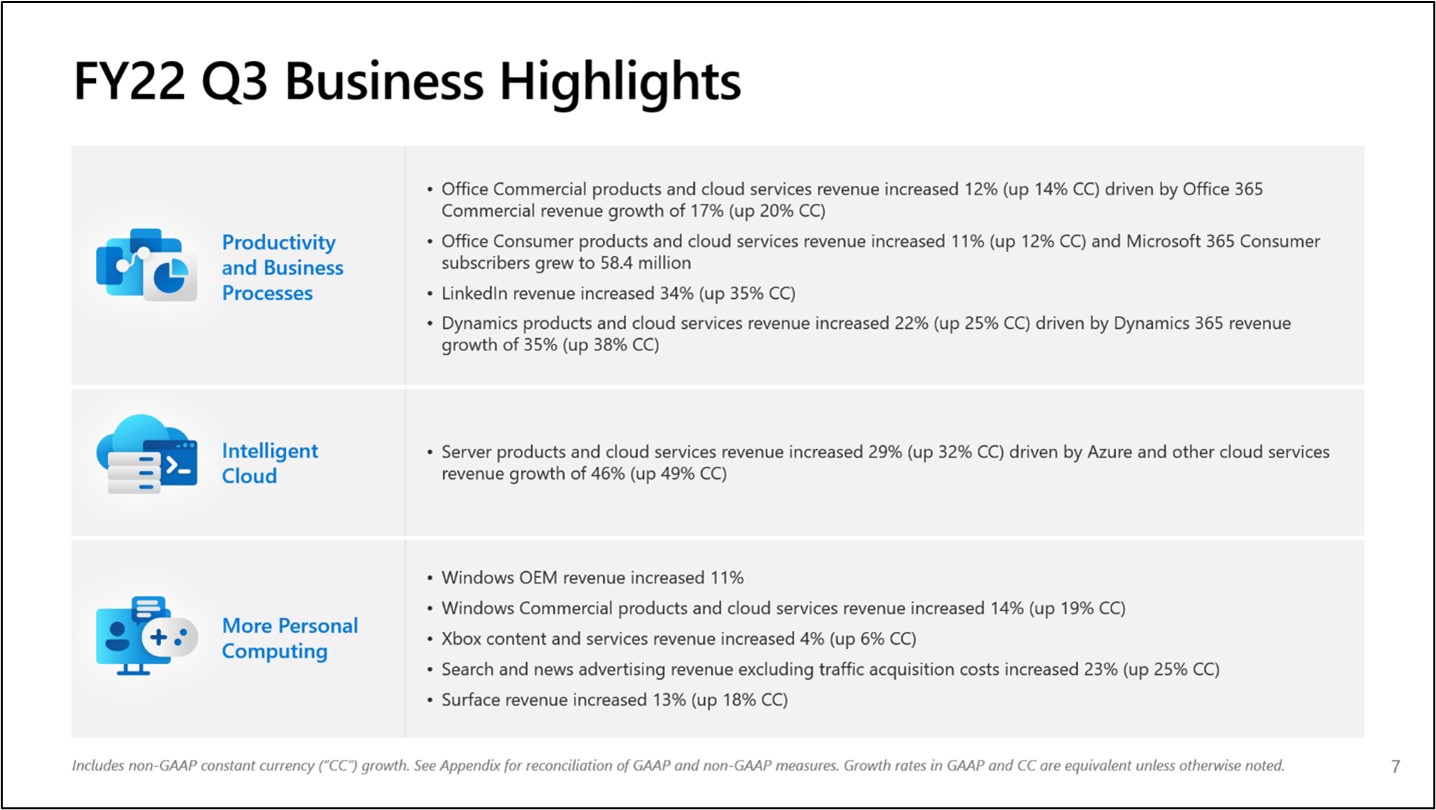

Microsoft’s GAAP revenues rose 18% year-over-year last fiscal quarter with strength witnessed across the board. In the fiscal third quarter, sales at its ‘Productivity and Business Processes’ segment grew 17% year-over-year with strong performance put up by its Office Commercial, Office Consumer, LinkedIn, and Dynamics (including Dynamics 365) operations. In August 2021, Microsoft announced significant price increases for Office 365 and Microsoft 365 offerings that were set to go into effect at the start of March 2022, though some of those increases were temporarily delayed for its reseller partners (by two weeks). Going forward, Microsoft should benefit from recent pricing increases being reflected in its financial performance on a full fiscal quarter basis.

Sales at Microsoft’s ‘Intelligent Cloud’ segment rose 26% year-over-year last fiscal quarter due to another solid quarter put up by its Azure cloud computing unit, with revenue at ‘Azure and other cloud services’ up 46% year-over-year. Finally, sales at its ‘More Personal Computing’ segment rose 11% year-over-year last fiscal quarter due to growth at its Windows OEM, Window Commercial, Surface, Xbox-related offerings, and advertising at its search and news operations. We appreciate the widespread strength in demand for Microsoft’s offerings, especially during these turbulent times.

Image Shown: Microsoft’s revenues benefited from widespread growth across its various business segments last fiscal quarter. Image Source: Microsoft – Power Point Earnings Presentation Covering the Third Quarter of Fiscal 2022

As noted previously, Microsoft was able maintain its nice margins in the face of sizable inflationary pressures, supply chain hurdles, and major geopolitical turbulence (with an eye towards the Ukraine-Russia crisis) due to its impressive pricing power and ability to get ahead of major exogenous shocks. Last fiscal quarter, Microsoft’s GAAP operating margin stood at 41.3%, up almost 40 basis points year-over-year. In the current inflationary environment, in our view it is important to stress that we at Valuentum seek out companies with stellar business models whose offerings are in high demand as these are the entities that can keep ahead of surging costs (from anything to skyrocketing power and freight expenses to rising labor/wage rates).

Revenue growth combined with nice operating margin expansion enabled Microsoft to grow its GAAP operating income 19% year-over-year in the fiscal third quarter. The company’s GAAP diluted EPS rose 9% year-over-year to reach $2.22 last fiscal quarter as Microsoft’s provision for corporate income taxes increased sharply on a year-over-year basis. Microsoft is investing heavily in its business and workforce which is driving up its operating expenses, and those investments continue to pay off in spades, which we really appreciate.

Cybersecurity and the Ukraine-Russia Crisis

In March 2022, Microsoft announced it was suspending the sales of new products and services in Russia in the wake of its invasion of Ukraine. Microsoft also committed to help the Ukrainian government and economy deal with the Russian invasion. That includes Microsoft offering cybersecurity services for Ukrainian entities (identifying weak points in Ukraine’s networks and offering to move on-premises IT operations to the cloud) and committing sizable sums towards humanitarian aid for Ukrainians. Microsoft also utilized its Skype service to assist Ukrainians with telecommunication activities when it was possible to do so. We appreciate Microsoft’s commitment here, and hope peace prevails soon.

Cybersecurity has been a big priority for Microsoft. In January 2022, Microsoft’s CEO and Chairman Satya Nadella noted that cybersecurity was a ~$15 billion annual business for the company that was growing like a weed (strong double-digit sales growth of late). Powerful secular tailwinds underpin the demand outlook for cybersecurity services as malevolent online actors, from independent groups to lone wolfs to groups backed by governments or governments themselves, are on the rise.

Financial Strength Maintained Ahead of Major Acquisition

Microsoft generated $47.4 billion in free cash flow during the first three quarters of fiscal 2022 while spending $13.5 billion covering its dividend obligations and $23.9 billion buying back its common stock. The firm exited March 2022 with $54.8 billion in net cash (inclusive of short-term debt) on hand, providing Microsoft with ample financial firepower to fund its pending acquisition of Activision Blizzard Inc (ATVI) for $95 per share in cash through a deal worth $68.7 billion.

Here is what we had to say in our January 2022 article, Microsoft Is Buying Activision On Way to Becoming Video Game Giant, covering that major acquisition (link here):

Microsoft’s purchase of Activision will see major videogame franchises including Call of Duty, Warcraft, StarCraft, World of Warcraft, Overwatch, Candy Crush, and Diablo join its stable of properties. In March 2021, Microsoft closed its $7.5 billion all-cash acquisition of ZeniMax Media, the parent company of Bethesda Softworks, which is behind hit properties including Fallout and The Elder Scrolls. Additionally, Microsoft owns the game studios behind other popular franchises including Halo and Gears of War. Microsoft is now a video game giant on both the developer and publisher side of things.

When the Activision deal closes, Microsoft will have 30 internal game developer studios along with significant publishing and e-sports operations. Microsoft is also acquiring Activision’s Major League Gaming operations as part of this deal. Back in January 2016, Activision acquired Major League Gaming to enhance its ability to capitalize on the growing e-sports industry. Activision’s Call of Duty and Overwatch franchises already have sizable e-sports communities that are supported by Activision, and Microsoft has the resources to continue growing these e-sports operations…

Microsoft intends to continue to push deeper into mobile gaming. Activision already has mobile versions of its popular games, including for Call of Duty, along with mobile-native games like Candy Crush. Making mobile versions of Halo, for example, could be used to further expand the reach of Microsoft’s gaming properties (particularly popular franchises designed for PCs and consoles that already have sizable followings). According to Microsoft, “mobile is the largest segment in gaming, with nearly 95% of all players globally enjoying games on mobile” which highlights the immense opportunity in this area.

Microsoft offers its Game Pass subscription service, which in short allows subscribers to play from a vast array of video games for a relatively low monthly fee. Additionally, its Xbox Live subscription is required to play various online versions of most video games on its Xbox console [save for certain free-to-play titles]. Microsoft sells subscriptions that bundle its Game Pass and Xbox Live offerings…

The gaming industry is worth over $200 billion, according to Microsoft, and growing briskly. Across the world, three billion people play video games, and Microsoft forecasts that figure will grow to 4.5 billion by 2030.

By adding Activision Blizzard to its portfolio, Microsoft aims to build up sizable gaming-related subscription revenue streams from its Game Pass, Xbox Live, and bundled offerings. It also intends to capitalize on the secular tailwinds driving growth in the size of the mobile gaming user base as additional households around the world get connected to the Internet for the first time, often through smartphones. Leveraging existing IP and popular titles to build mobile games that may prove to be quite popular is a core part of this strategy. Recurring revenue streams provide for stronger cash flow profiles given the highly visible nature of the future financial performance of the related operations.

This deal, given its size and the need to comply with antitrust and other regulatory concerns, is not expected to close until Microsoft’s fiscal 2023 (which starts in July 2022) after getting announced in January 2022. In our view, Microsoft is paying a reasonable price for Activision Blizzard as the top end of our fair value estimate range for ATVI sits at $105 per share, above Microsoft’s all-cash purchase price. As there are plenty of synergies to be had here, we like the acquisition and the favorable impact it should have on Microsoft’s growth runway.

Recently Closed Acquisition

Pivoting to a different acquisition, Microsoft closed on its $19.7 billion acquisition of Nuance Communications in March 2022. Nuance Communications was billed as a “a leader in conversational AI and ambient intelligence across industries including healthcare, financial services, retail and telecommunications” and represented Microsoft’s strategy of utilizing acquisitions to bulk up its existing products and services while also setting the stage of launch new offerings to further support its growth runway. In particular, the Nuance Communications deal was about growing Microsoft’s exposure to the health care sector and enabling Microsoft to help digitally transform the space. Microsoft already had an existing partnership with Nuance Communications and was well-versed in its technology.

In the April 2021 press release first announcing the acquisition, Microsoft had this to say (emphasis added):

Microsoft’s acquisition of Nuance builds upon the successful existing partnership between the companies that was announced in 2019. By augmenting the Microsoft Cloud for Healthcare with Nuance’s solutions, as well as the benefit of Nuance’s expertise and relationships with EHR [electronic health records] systems providers, Microsoft will be better able to empower healthcare providers through the power of ambient clinical intelligence and other Microsoft cloud services.

The acquisition will double Microsoft’s total addressable market (‘TAM’) in the healthcare provider space, bringing the company’s TAM in healthcare to nearly $500 billion. Nuance and Microsoft will deepen their existing commitments to the extended partner ecosystem, as well as the highest standards of data privacy, security, and compliance.

Additionally, here is what Microsoft’s March 2022 press release had to say on the combination (emphasis added):

As digital transformation accelerates, organizations in every sector across the globe can address challenges that will have a fundamental impact on their success — from reducing clinician burnout and enhancing early detection and treatment of disease in healthcare to creating personalized customer experiences and supporting employees’ productivity and well-being in financial services, retail, and telecommunications.

Microsoft and Nuance cloud-based AI solutions can help meet business goals and address organizations’ most pressing needs. In addition, Microsoft and Nuance can strengthen organizations’ ability across industries to scale their impact by offering the services consumers, patients and employees rely on, when or where they need them.

We like the deal and appreciate that Microsoft is pushing deeper into the realm of health care. Microsoft is not simply sitting still and letting its current cloud-oriented operations capitalize on existing secular tailwinds, the company is actively pursuing acquisitions in attractive areas to bulk up its longer term growth runway. The forward-thinking nature of Microsoft’s management team is one of the reasons why we are big fans of the tech giant.

Management Commentary

During Microsoft’s fiscal third quarter earnings call, management issued favorable guidance for the company’s fiscal fourth quarter performance. More importantly, Microsoft communicated to investors that its growth story should continue in earnest heading into fiscal 2023 (emphasis added):

“With that context in place, let’s turn to our Q4 outlook. In our largest quarter of the year, we expect our differentiated market position, customer demand across the solution portfolio, and consistent execution to drive another strong quarter of revenue growth. In commercial bookings, a growing Q4 expiry base, strong execution across our core annuity sales motions, and increased commitment to our platform should drive healthy growth against a strong prior year comparable…

We expect to close FY22, even in a more complex macro environment, with the same consistency we have delivered throughout the year. With strong revenue growth, share gains, and improved operating margins as we invest in the areas that are key to sustaining that growth. As we look toward FY23, our track record of delivering high value to our customers across many diverse and durable growth markets gives us confidence that we will drive continued healthy double-digit revenue and operating income growth.” — Amy Hood, CFO of Microsoft

We appreciate that Microsoft has been and expects to continue firing on all-cylinders.

Concluding Thoughts

Equity markets in the US and elsewhere have sold off aggressively of late due to a litany of factors ranging from inflationary pressures, concerns over rising interest rates (particularly in the US), supply chain hurdles, the Ukraine-Russia crisis, and the potential for parts of the global economy to slow down sharply. With that in mind, we remain bullish on US equities and the US economy at-large.

Microsoft showed that it was fully capable of continuing to grow its revenues and margins at a nice pace, even in the face of sizable exogenous shocks, while remaining a free cash flow cow last fiscal quarter. The company’s recent acquisition activity further reinforces our positive view towards Microsoft, and we continue to be huge fans of the name. Its fortress-like balance sheet is shrinking due to acquisitions, though given its stellar free cash flows, Microsoft can quickly rebuild its balance sheet strength going forward. We see room for shares of MSFT to regain their footing going forward.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for MSFT, ATVI, and holdings in HACK and GAMR.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Gro