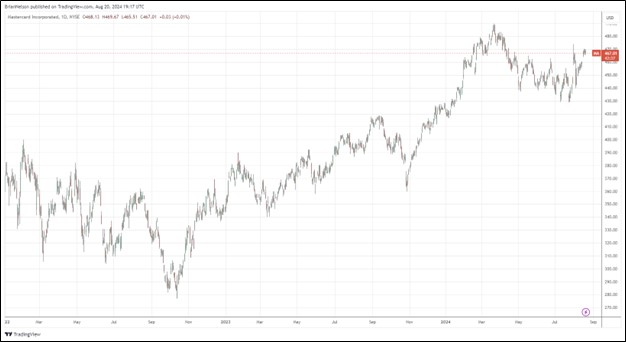

Image: Mastercard’s stock has done quite well since the beginning of 2022.

By Brian Nelson, CFA

Mastercard (MA) recently reported better than expected second quarter results with the firm’s revenue and non-GAAP earnings per share coming in higher than the consensus forecasts. Second quarter net revenue came in at $7 billion, up 11% year-over-year (13% on a currency-neutral basis) thanks to growth in its payment network and value-added services and solutions.

Operating income came in at $4 billion, up from $3.7 billion in the same period a year ago. Its adjusted operating margin was an impressive 59.4% in the quarter. On a currency-neutral basis, non-GAAP net income advanced 24%, while adjusted diluted earnings per share increased 27%, bolstered in part by a lower tax rate. Management had the following to say about the quarterly results:

We delivered another strong quarter across all aspects of our business with double-digit net revenue and earnings growth. This was supported by continued healthy consumer spending, robust cross-border volume growth of 17%, and demand for our value-added services and solutions where net revenue increased 18%, or 19% on a currency-neutral basis. These results reflect how payments and services enable each other to create differentiated value for our customers and help us realize even more of the shift to digital.

During the second quarter, Mastercard bought back $2.6 billion worth of stock (5.8 million shares), while it paid $615 million in dividends. The firm ended its second quarter with $15.6 billion in short- and long-term debt and just shy of $7 billion in cash and cash equivalents.

For the six months ended June 30, 2024, cash flow from operations increased to $4.8 billion, up from $4.6 billion in the same period last year. For the first half of 2024, capital spending increased to $272 million from $190 million in the same period a year ago. First-half 2024 free cash flow of $4.54 billion significantly exceeded cash dividends paid of $1.23 billion over the same time period.

All told, Mastercard operates a fantastic business model with huge operating and free cash flow margins. As with Visa, we’re huge fans of Mastercard’s network effect–as more consumers use Mastercard, more merchants accept their cards, which drives more consumers to use Mastercard and so on and so forth. Our fair value estimate of Mastercard is north of $480 per share.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.